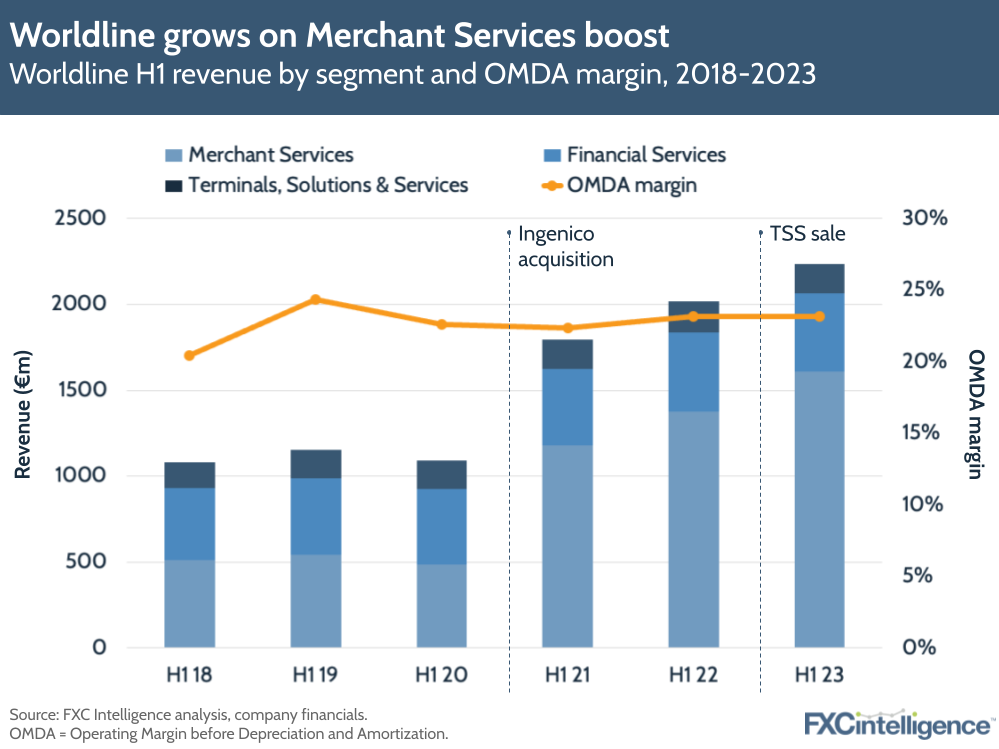

French payment processor Worldline has reported its H1 2023 results, with the company reporting what CEO Gilles Grapinet described as “very satisfactory” organic revenue growth of 9.3% YoY to €2.2bn for the half, or 9.4% YoY to €1.2bn for Q2 2023.

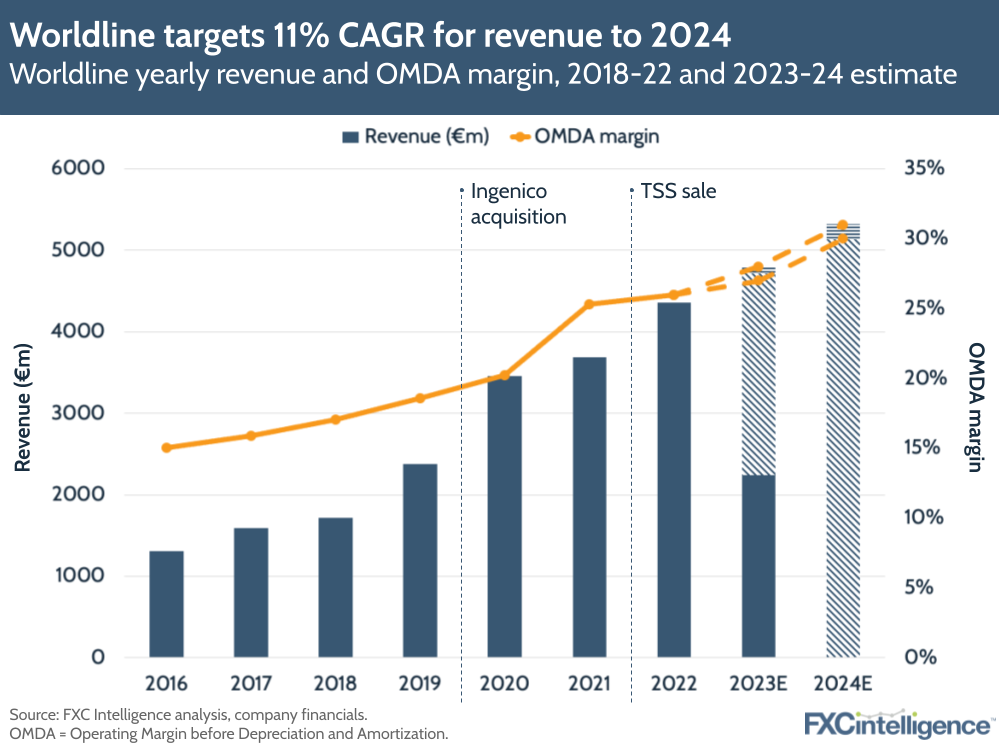

It has also outlined plans to realise 9-11% CAGR revenue growth to 2024, including a joint venture with Crédit Agricole that is designed to create a leading payments player in the French market.

Merchant Services drives solid H1 2023 results for Worldline

Worldline’s solid H1 performance included a 13.4% improvement in operating margin before depreciation and amortisation (OMDA), the metric Worldline reports instead of EBITDA, to $519m for the half. The results have been met with a positive response from investors, with shares rising on the announcement.

The company’s Merchant Services division was the main driver of Worldline’s performance this quarter, growing 13.5% YoY to €849m for Q2 2023. Merchant Services OMDA also grew 17.6% YoY for H1 2023 – to €399m.

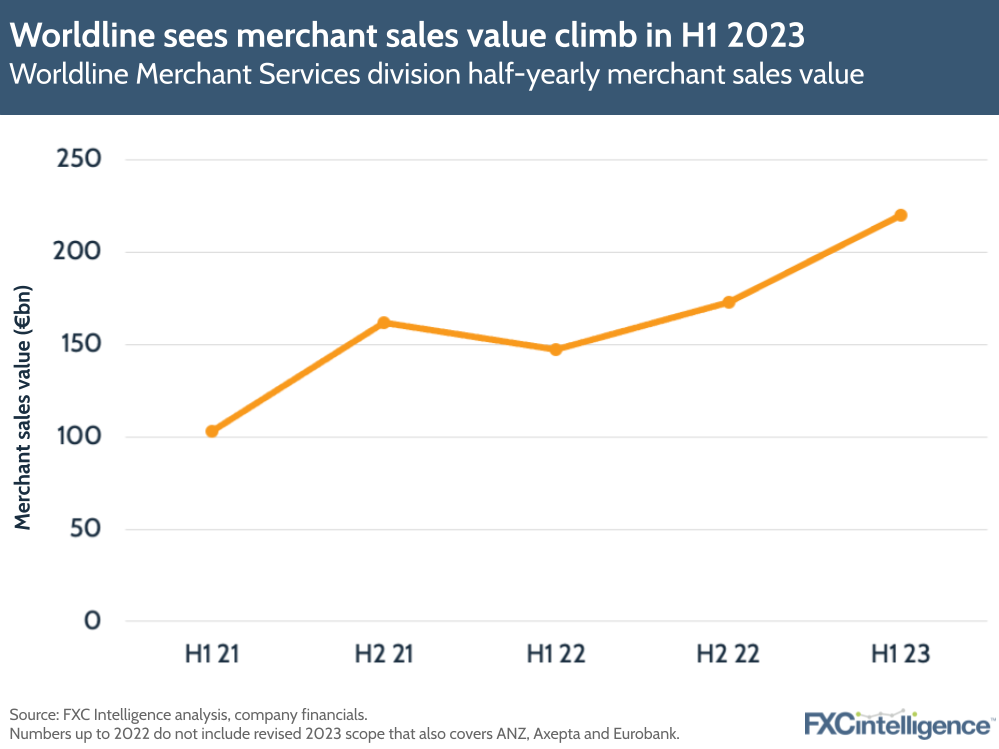

Acquiring merchant sales value, the volume of sales handled by the division, also grew to €120bn, bringing the total for the half to around €220bn – an almost 50% increase on previously reported numbers for H1 2022 and 10% on revised numbers, which include ANZ, Axepta and Eurobank. This growth is the result of strong online acquiring, as well as a number of key new clients. In Q2, Worldline added or extended its commercial acquiring and payment acceptance services for several companies, including international game brands Blizzard and Valve.

Within Merchant Services, Commercial Acquiring saw double-digit growth with Benelux, Switzerland and Germany performing particularly strongly, while Payment Acceptance was aided both by new customers and the ongoing recovery of travel boosting omnichannel solutions across most of the company’s markets.

Worldline provides digital euro project update

Meanwhile, Worldline’s other divisions performed less strongly, although in line with expectations. Mobility & e-Transactional Services saw stable revenue of €87m for Q2 2023, as the re-insourcing of a telco contract continues to offset growth. However, e-Ticketing did see double-digital growth, while the company signed a key education contract in France.

Financial Services saw a 0.2% increase in Q2 2023 to €236m, with highlights including APAC-based card payment processing and increased digital banking volumes in France, Belgium and Switzerland.

The company also provided an update on the delivery of a front-end prototype for a digital euro, which it delivered in collaboration with the European Central Bank. Here, Worldline developed a solution for a P2P payment use case where the user was fully offline, enabling digital euro payments to be made without network access. The company says that the success of the prototype confirms that the technology is feasible and scalable for offline use, and can contribute to “a more resilient payment system”.

Worldline, Crédit Agricole target french payments market

The company restated its expectation of 8-10% organic revenue growth for FY 2023, and said that it was targeting a revenue CAGR of 9-11% between 2022-2024. As part of its efforts to achieve this, the company has been taking significant steps to manage debt maturity, including buying back bonds maturing in 2024 for €385m.

It is also taking steps to grow its presence in a number of key markets through strategic initiatives, including the completion of the acquisition of the merchant acquiring arm of Banco Desio, which will boost the company’s presence in Italy.

Most notable, however, is a joint venture with Crédit Agricole that will see the two companies create a “major player” in French payments. Combining Worldline’s vertical knowledge and processing power, as well as the market presence and distribution networks of Crédit Agricole, this is intended to provide innovative, market-specific products to French merchants.

Set to be majority owned by Worldline through a 50% capital-plus-one-share structure, the joint venture is intended to begin generating revenue and OMDA from early 2025. At present, the companies are in exclusive discussions, which they first entered in April, and plan to fully sign in Q3 2023 with transaction close in Q4 2023.

What are the key market size opportunities in cross-border payments?