Ant Financial, the financial arm of Chinese ecommerce giant Alibaba, bought payments company WorldFirst at the turn of the year (deal analysis here). Now backed by one of the largest company’s globally, WorldFirst can really focus on growth.

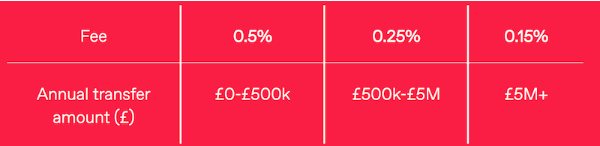

This can be most clearly seen by its very recent change in its pricing (screenshot from the WorldFirst website):

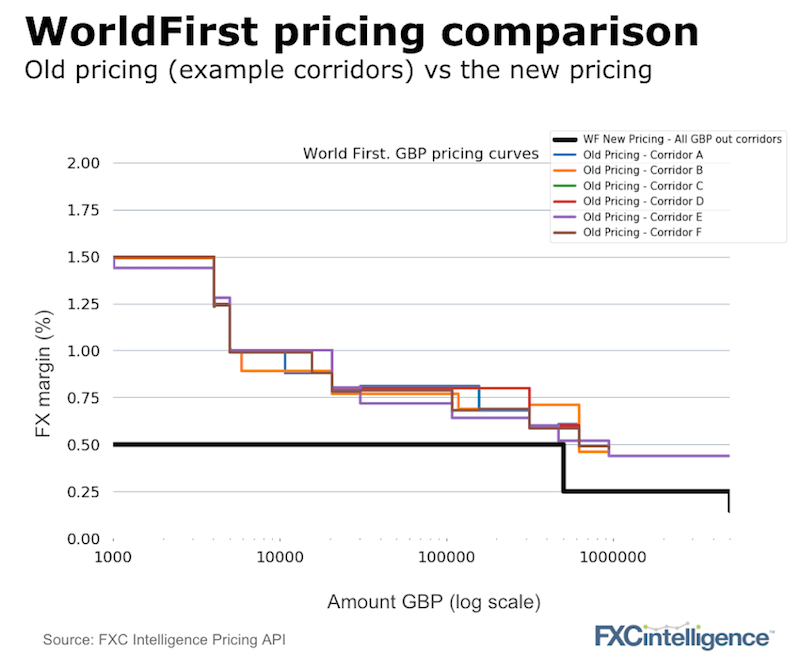

This pricing model compares to the more traditional pricing curve that WorldFirst used to operate:

What are the implications:

- With the support of Ant Financial, WorldFirst can focus on growing market share.

- The new pricing structure is one that also supports a faster scaling of the business. Quoting prices over the phone requires a different customer journey to a simple one size fits all price structure.

- WorldFirst is following the transparency and technology models of players like TransferWise but WorldFirst’s pricing is even simpler as it is not differentiated by currency corridor.

- The one interesting nuance in WorldFirst’s new pricing model is that it is based on total annual flows rather than a single transfer. This requires taking a small leap of faith with a new customer but will also help encourage commitment of ongoing business.

This is a bold move by WorldFirst. We’ll be able to assess the impact of this price change over the coming year once we see the response from customers and the change in market share. Given the reduction in price and simpler model, we certainly expect it to be positive.

To track the pricing of all the leading players globally, get in touch.

[fxci_space class=”tailor-63330875a5026″][/fxci_space]