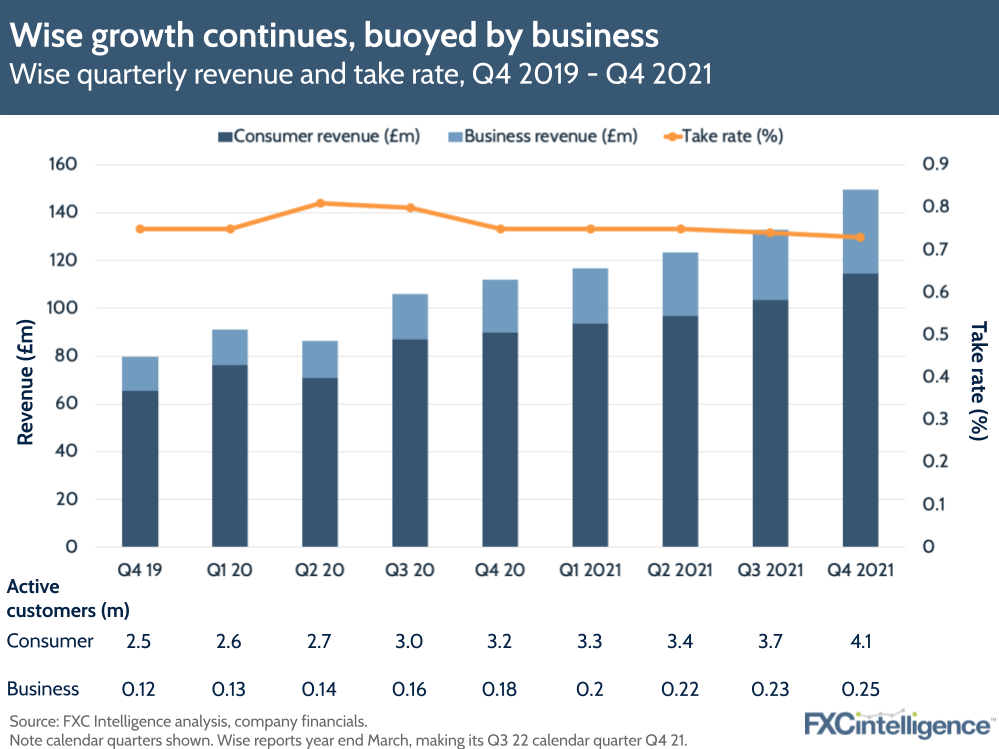

Wise has released its Q3 for FY22 results (Q4 2021 in calendar time, which is how we’ll refer to it from now on), and it’s another successful quarter in terms of growth, particularly for the company’s business segment.

While both consumer and business segments have seen a climb in revenue, business has seen a 59% year-on-year increase, compared to 28% for consumer. Take rate, meanwhile, has dipped slightly compared to the last four quarters, dropping to 0.73%. Wise attributes this to price drops which it says are key to its ongoing strategy.

Notably, Wise’s business segment has achieved much of its revenue growth through an increase in the volume per customer, which has climbed 13% y-o-y compared to consumer’s increase of 6%. Wise does note that the strong numbers here are partly seasonal, but the year-on-year improvements are a positive sign. This is particularly key for the company’s business offering, as it remains at a far lower volume per customer than many of its competitors due to its focus on small business clients.

Looking forward, while Wise anticipates the drop in take rate to continue into the next quarter, it does now expect revenue growth in the region of 30% for its financial year 2022. This is a significant jump on the high twenties it projected in December, which were themselves an increase on a projection earlier in the year. We analysed Wise’s growth rates in detail last week and the link to that article is at the bottom of this letter).

However, this guidance hasn’t been enough to fully placate investors. While still recovering from Citi’s Sell guidance the previous week, the share price dropped slightly on the publication of the results and remains like many other payments stocks well below the highs of 2021.