Santander splashed out £350m for a majority stake in Ebury, one of the leading cross-border payments providers to small and medium sized businesses (SMEs). I spoke at length to Juan Lobato, co-CEO of Ebury to get into the details. Is this the future of banking and fintech partnerships?

The future of banking partnerships

Unless you’ve spent the last year on the International Space Station, you’ll know the world has changed and banks and fintechs are partnering more than ever. This was a big theme at the Money20/20 conference last week too (our key takeaways here).

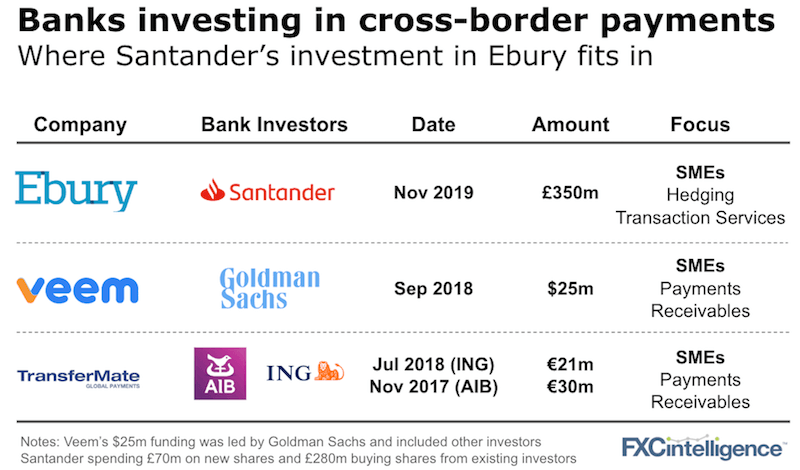

Less commonplace though have been direct investments by banks into cross-border fintechs. We count only three major ones, all of which have focused on the SME segment.

Santander’s investment is notable as it is far larger than previous investments made in the sector. Absent are banks investing into consumer cross-border fintechs. Unlike the retail side, where the banks have the customers (and revenue) and already offer the payment products most consumers need, transactions services for cross-border SMEs is much more complex.

Why was Ebury so attractive Santander?

The complexities of cross-border SMEs

My conversation with Juan, Ebury’s co-CEO, can be summed up into this key question:

What makes SME cross-border payments and trade complex enough that a bank would rather buy versus build? (Santander has one of the largest SME footprints of any global bank)

Emerging markets are key

In SME banking in emerging markets, everything has to be built since banking is much less mature. This provides an opportunity to build new services from the ground up. Santander is heavily focused on Latin America. Expect to see more from Ebury in markets such as Brazil and Mexico – markets of the future (our recent Mexico analysis here) – and Ebury can now leverage Santander’s market experience.

Choosing a banking investor rather than private equity money

Ebury had the choice of who take funding from. As Juan told me, the downside of private equity for him is that it fits into strict cycles (usually five to seven years), often forcing an exit before a business may be ready. Santander provides patient capital with no requirement for exit.

What Ebury has that Santander wanted

Santander is at its heart a transaction bank focused on SMEs. It is especially strong in Latin America and Southern Europe and has continued to operate in 10 core countries while many other banks pulled back their global ambitions post-Great Recession. Ebury offers several things:

- Regulated operations in 21 countries. For most banks, it’s simply too costly to get regulated outside their core markets.

- A deep product set for SMEs around cross-border trade, FX hedging, trade finance and in-country accounts. This complements both Santander’s current offering and other similar sized and smaller banks.

- A platform (see that word again) for more banking partnerships, especially for Tier 2 and regional banks.

Ebury will continue to operate independently from Santander, which means expect more bank deals, both from Ebury and the sector more broadly. We’re only half way through Juan’s plan (another 10 years to go) and when I asked him how he celebrated the Santander deal, he simply had a glass of Spanish wine called Ebury.

Looking for partnership ideas in cross-border payments or need help narrowing your partner search – get in touch.

[fxci_space class=”tailor-63330f15f0f0g”][/fxci_space]