In our latest weekly Forbes column, we look at the issues around Western Union’s reported possible acquisition of MoneyGram. The economics of the deal look good for both parties but could antitrust issues stop the deal?

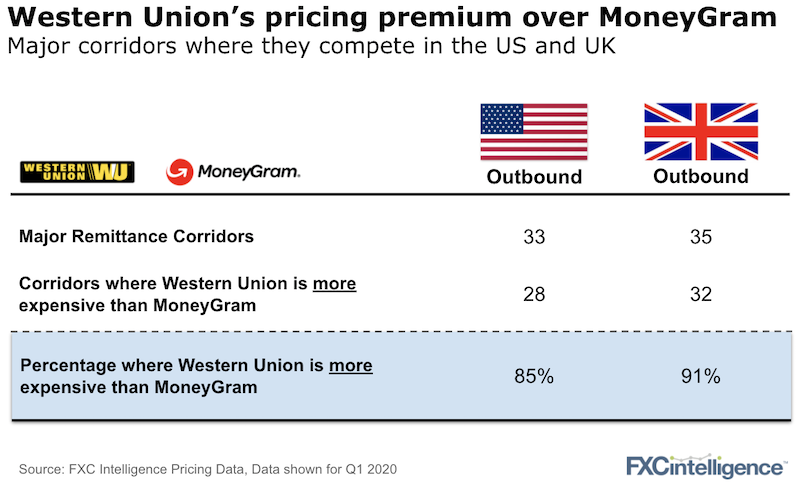

One clear area of opportunity, but also potentially a deal blocker, is the pricing power Western Union may obtain along key corridors and into key markets.

With such a significant proportion of currency corridors where Western Union prices above MoneyGram, a deal would provide Western Union with several interesting options:

- Remove MoneyGram as a competitor in a corridor to either further protect its current pricing or even increase it.

- Continue to run MoneyGram as a lower-cost brand and maintain a price premium for Western Union.

Especially in parts of the cash-to-cash market, both Western Union and MoneyGram often dominate the market. Would this be enough to rouse the antitrust bodies or is there still enough competition from the new digital players? Dig into this in our column…

What next for Finablr’s brands?

Travelex

Finablr issued a statement this week that no acceptable offers were received for Travelex. For a brand that has been around for 40 years, this is a sad state of affairs. Travelex currently has considerable debt. For now, the debt-holders have given it an additional window until 2 July to come up with a solution to move forward. Travelex owes €360m in debt to bondholders and has a revolving credit facility of €90m.

UAE Exchange

The remittance arm of Finablr appears to be emerging from some of the recent difficulties. Reports have emerged of some customer refunds being made and the company has started to offer pricing on its online transactions again. The company still remains under the control of the UAE Central Bank and firms such as TransferWise, who have recently launched in the market, will be benefitting from the market incumbent running far under capacity.