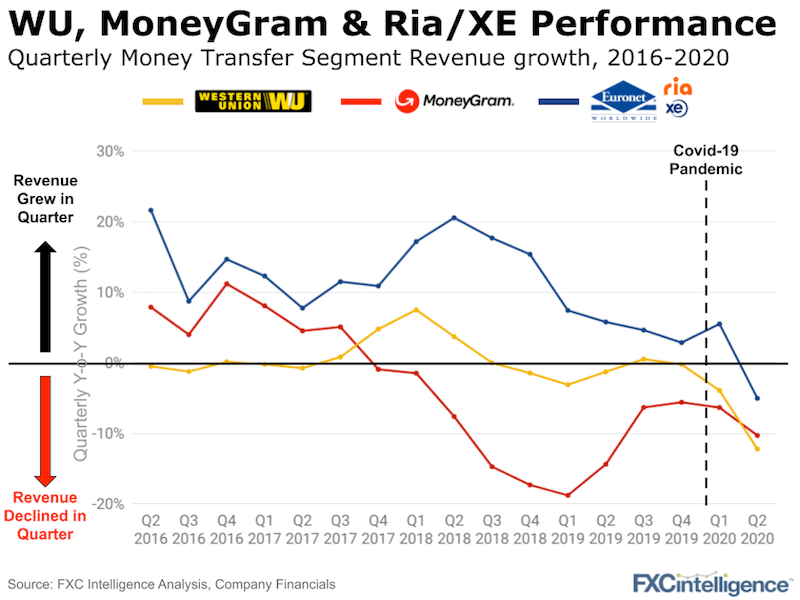

Q2 has been one of the toughest quarters on record for many remittance companies in the sector. Western Union, MoneyGram and Ria all saw their overall businesses decline.

It’s worth adding that there are three different numbers often used interchangeably to describe top line performance but they are not perfectly correlated to each other:

– Total FX volume (e.g. the World Bank number in $m)

– Company revenue ($m)

– Company transactions (a count)

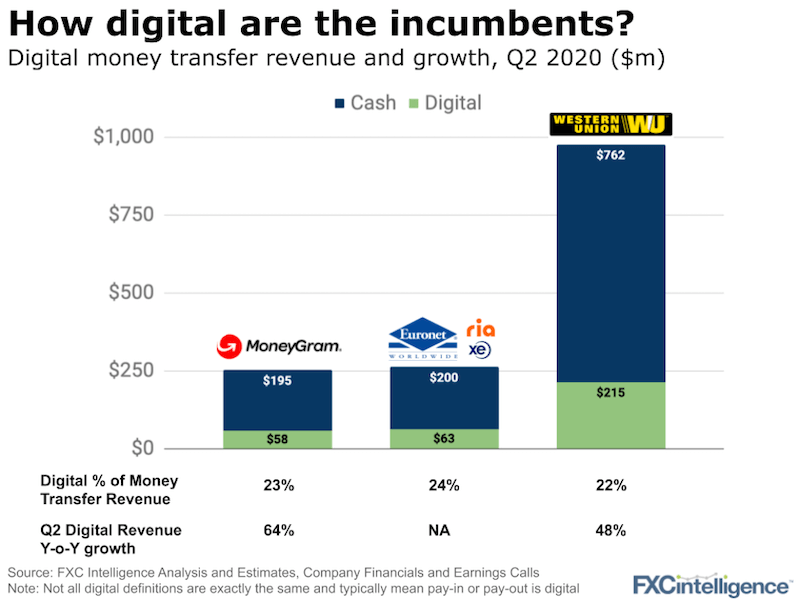

Western Union, MoneyGram and Euronet provide different levels of detail on each. Plus the definitions of digital do not all align. We’ve tried to tie it all together for you.

The main takeaways:

Western Union shows signs of rebound

- Consumer-to-consumer (C2C) revenue declined 12% in Q2 year-on-year. All geographies around the world felt the hit of Covid-19, though to different degrees, with LatAm reporting a 45% drop in revenue. As restrictions of movement were eased and people started travelling across countries, C2C transactions volume rebounded from declines of 21% (year-on-year) in April and a 7% decline in May, growing 6% in June and 10% in July, helped by some improvement in the travel industry.

- Digital continues its rapid growth. Average monthly active users of westernunion.com went up 45% compared to Q2 last year, and 80% of these customers were new to Western Union. We saw some significant compression in pricing in the period, especially in Europe and the Middle East.

- Western Union managed to squeeze up its operating margin to 19.9% in the quarter as a result of a cost structure that is 55-60% variable and a continued cost cutting programme.

Sign up to our weekly newsletter, the most read in the international payments sector globally

MoneyGram and its impressive digital growth

- MoneyGram’s money transfer revenue declined 10% year-on-year in Q2 2020 due to the negative performance of transactions in April (-17%), which the positive turnaround in June (up by 10%) could not fully make up for. While the walk-in business started improving as agents around the world reopened, the US market continues to decline.

- Digital transactions grew 106% year on year during the quarter, with a corresponding increase in revenue of 64%. MoneyGram is mostly acquiring new customers through its digital channels, who are increasingly embracing new payout methods such as account deposits and wallet payments. (Note definitions are important – in 2020, MoneyGram removed its store Kiosk’s from its reported digital numbers, reducing previous year numbers and increasing the growth rate.)

- The outlook for Q3 is more positive, with EBITDA expected to grow over last year. The high growth in digital and the rebound of walk-in services will help the company to grow its profitability.

Also of note, neither Western Union nor MoneyGram were asked about or talked about the reported acquisition talks in the earnings call. For now there may be nothing more to say.

Ria’s playing catchup plus its focus on agent locations

- Digital transactions initiated through the website or mobile app grew 98% in the quarter, facilitated by the launch of Ria’s Money Transfer app across Europe in May (Note – Ria has its own definition of digital, which includes transfers that are either initiated or terminated in the digital or physical channels through methods other than cash). However, Ria continued to focus on agent locations, which rose 13% to 435,000 in this quarter. The shelter-in-place restrictions undermined the profitability of such investments, with a negative effect on operating income and EBITDA.

- For Ria, North America experienced 20% year-on-year transactions growth in the month of June, while the Europe and Africa’s business grew over 25% in the same month. Euronet expects Ria to achieve double-digit revenue growth and a lift in EBITDA in Q3.

- Euronet also wrote down its investment in XE by $82.7m, a sizeable proportion of the undisclosed amount it paid back in June 2015 citing Brexit and Covid-19. In truth, Euronet has yet to be able to fully translate the hundreds of millions of users of XE.com searching for currency rates to money transfer customers.

Overall, it is not yet clear if the rebounds seen in June and July plus the uptick in digital are here to stay. That is more a reflection on predicting the future of the pandemic, rather than the underlying companies.

Access the best remittances pricing data across 7,000 corridors

Remitly reaches unicorn status

We talked this week with Matt Oppenheimer, Co-Founder and CEO of Remitly and Laurent Le Moal, CEO of major fintech investor PayU who led the latest round.

Matt on what’s driven the recent validation of a unicorn valuation:

- Remitly has now served three million customers and its customer growth went up 200% between May 2019 and May 2020.

- Remitly has branched out its product offering bringing its immigrant bank account to the US (including a partnership with Greendot to facilitate cash pay ins). This product extension redefines its total addressable market (it’s TAM in venture capital speak) above and beyond remittances.

- And Matt’s focus now – “I used to think it was about speed, I used to think it was about price. While those things matter, it’s all about trust.”

Laurent on why PayU led the round:

As context, PayU’s focus is on high growth markets – namely India, Africa, Latin America and Central Europe, many of which Remitly’s customers send money to.

- “Remitly is a reflection of Matt and [Co-Founder] Josh. It’s as simple as that. That’s why we have one bet, and it’s a bet on the team.”

- On the product side – Laurent highlighted how the nuances of Remitly’s product around price, speed and usability have supported its high retention rates

With plenty of positives, there are some challenges Remitly will have to face:

1) Competition. The incumbents, as outlined above, have really focused on their own digital plays having previously neglected the segment. The leading fintechs are also gaining scale and corridor specialists are also emerging. Competitive pricing and similar products will continue to add pressure to growth.

2) Lower barriers to entry. Whilst Remitly’s push into digital banking expands its offering, the emergence of banking as a service (which we’ve covered in depth) means the barrier to entry for competitors to launch a similar product is greatly reducing.