Western Union has reported its Q4 and full year 2021 results, beating estimates to achieve a modest year-on-year revenue increase of 5% for the full year to $5.1bn and 1% for Q4 to $1.3bn. However, as the first earnings call with CEO Devin McGranahan at the helm, who joined a month and a half ago, this was a somewhat transitional quarter that provides us with our first insights into the company’s future direction.

On Q4 and the company’s full year performance, it wasn’t the strongest quarter although there a number of positives and its worth remembering Western Union is still a highly cash generative company:

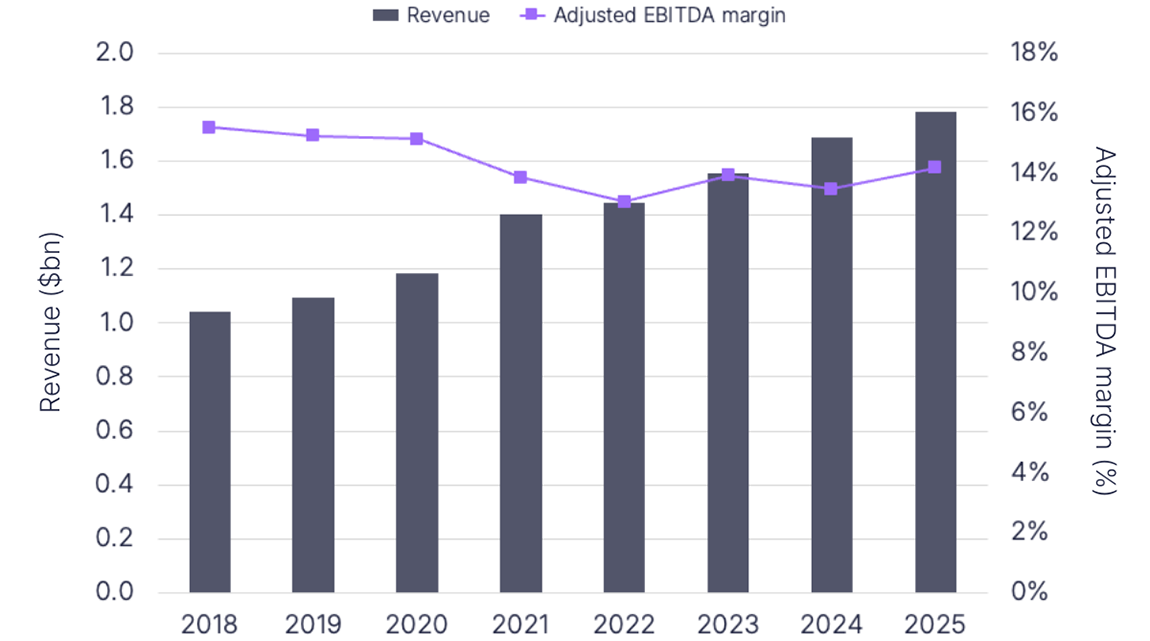

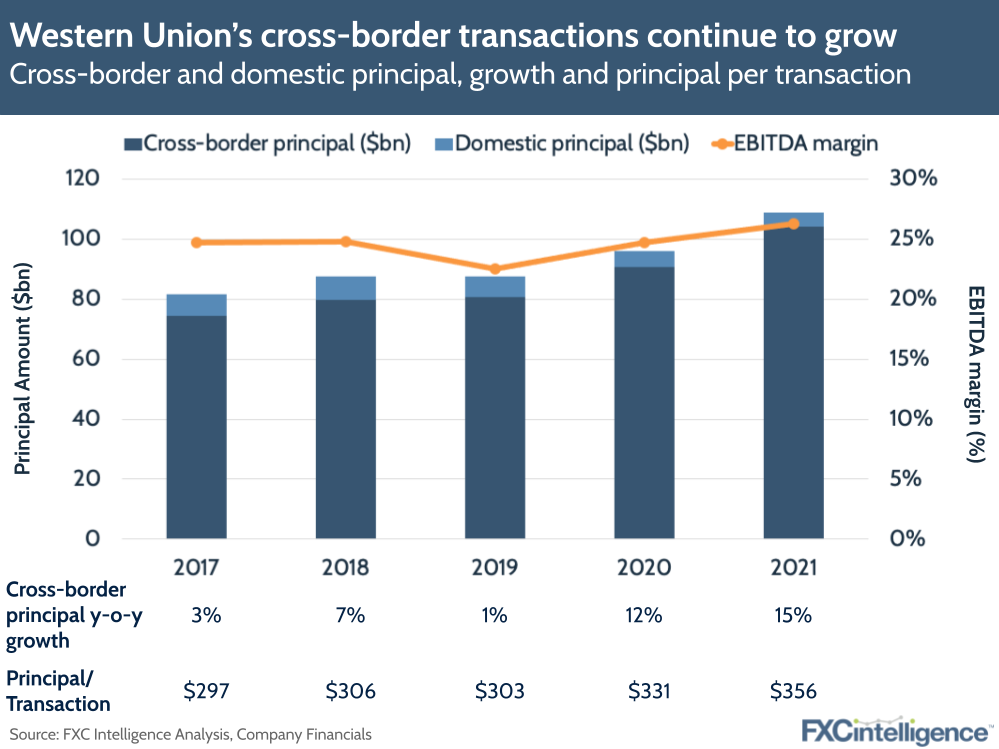

- While the company saw an overall revenue increase for the year, it did see a slowing of top-line growth throughout 2021, which are expected to continue into 2022. While C2C revenues increased 4% for the year, they dropped from 0% increase in Q3 to -1% in Q4.

- This is attributed to ongoing challenges in Western Union’s retail business, which continues to be impacted by Covid-19 due to labour force participation still being below pre-pandemic levels (not to mention the obvious sector-wide shift to digital).

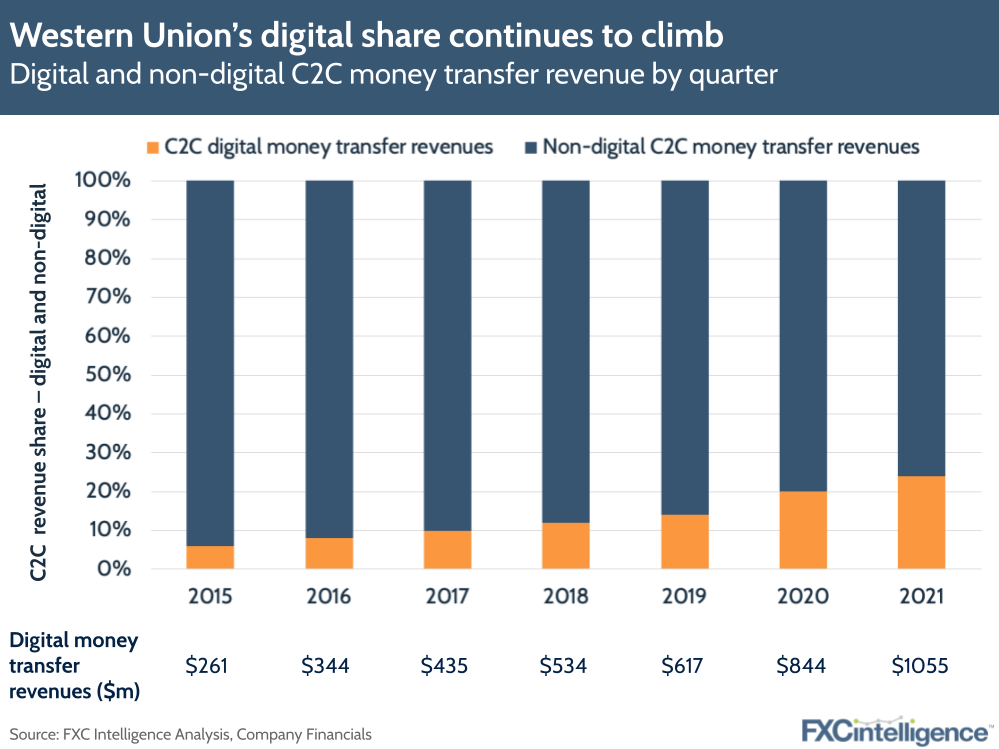

- Digital has been a sharp contrast to retail, however, with digital money transfer revenues increasing 22% for FY 2021, while Westernunion.com revenues grew by 18% over the same period.

- Looking regionally, while revenue grew in a number of regions, including North America (2%); Middle East, Africa and South Asia (2%) and Latin America and the Caribbean (8%), it declined in Europe by 8%.

- The company announced a number of successful renewals, including with Russia’s Sber, which is one of its largest digital partners. Its multicurrency card and banking platform pilot in Germany and Romania is now fully live too.

Western Union’s future strategy according to CEO Devin McGranahan

Despite only being 45 days into the job at the time of the call, Devin also provided some initial thoughts on where he plans to take Western Union in the future:

- Devin highlighted the “hard-to-replicate” foundational assets, including a historic, trusted global brand and strong infrastructure, regulatory compliance and risk management, which together he sees as providing a springboard for value creation.

- He highlighted the potential to use the company’s assets to expand its addressable markets, focusing on areas that have strong underlying growth potential to build “better long-term growth”.

- He also identified opportunities beyond cross-border remittance as a key area of opportunity, citing the commercial launch of the company’s multicurrency wallet and digital bank as “the right direction” and indicating he planned to accelerate the rollout to other countries. Other products such as early wage access could be offered too

- Devin pointed to crypto as an area of opportunity that the company needed to “prioritise”, pointing to omnichannel; on and off ramps, KYC and retail distribution as areas of focus.

- On the operational side, he argued that the company could improve its core operations and would be focusing on delivering performance improvements and enhanced investment capacity. He said that this may include the growth of its digital and omnichannel customer base; increasing returning customers “significantly” and improving retail competitiveness.

Devin has said he expects to have an investor day in September or October of this year. By that time, expect a new multi-year strategy to be laid out. We’ll start to frame our more detailed thoughts on Western Union’s future strategy over the coming months.