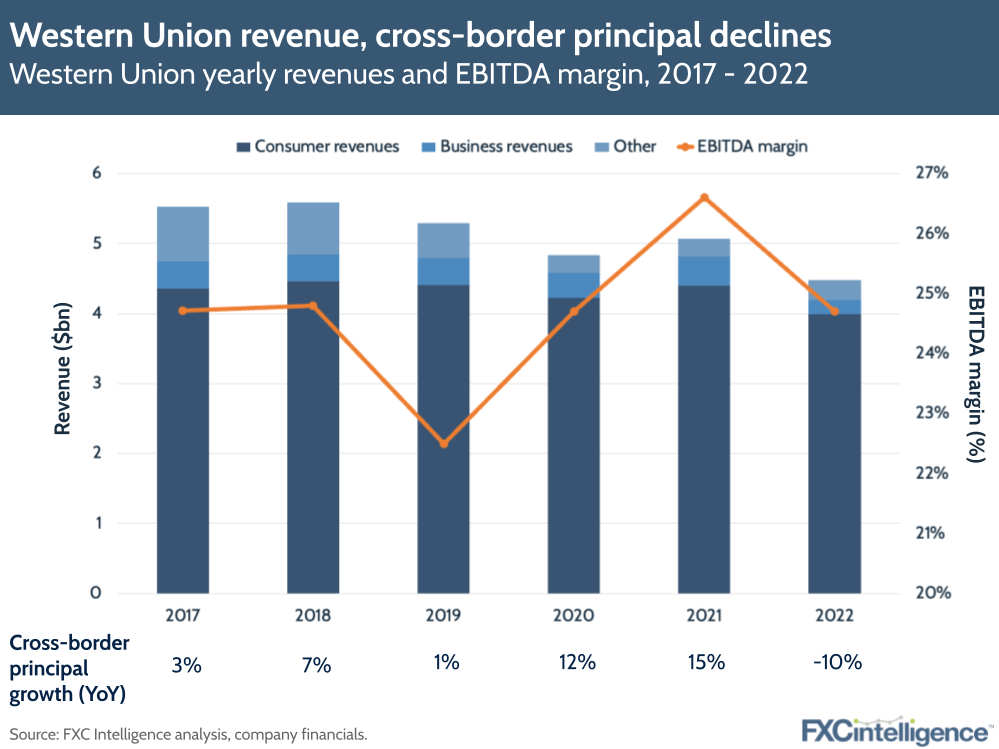

Western Union’s Q4 revenues declined 15% YoY to $1.1bn in 2022 (or 6% on a constant currency basis). The company’s stock price has declined by more than 20% since this time last year, but it is early in its three-year strategy to become a gateway for omnichannel financial services and return to growth.

Full year revenues declined 12% to $4.5bn, including an approximated two percentage point hit from suspended operations in Russia and Belarus. On an adjusted basis, EBITDA declined by 21% to $1.06bn, while adjusted EBITDA margin fell by 190 bps to 24.7%. Other key results:

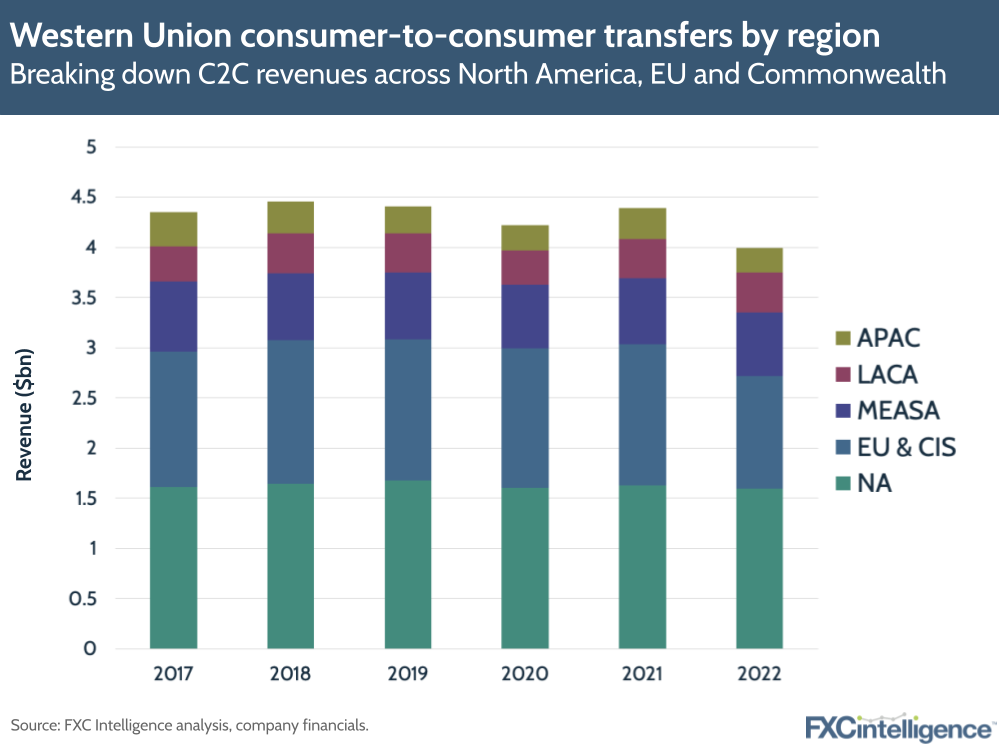

- Consumer revenues decreased 11% over the quarter, driven by macroeconomic challenges in Europe and retail softness across regions, amongst other factors.

- Revenues declined across North America (-7%); EU & Commonwealth States (-23%); the Middle East, Africa and South Asia (-9%); and Asia-Pacific (-20%), but grew 11% in Latin America and the Caribbean.

- Though it didn’t comment on digital transfer numbers specifically, Western Union did update on its ‘Branded Digital’ marketing strategy, which spans transactions carried out through online channels. Branded Digital saw revenues decline 8%. However, competitive pricing saw digital transactions rise by 2% and new customers grow by 14%, driven by a 30% rise in US outbound customers.

- Western Union launched its digital bank in Italy, having already brought this offering to Germany, Romania and Poland earlier in 2022. It aims to bring its digital wallet to more countries in 2023.

- The company is still in the process of selling its Business Solutions segment to Convera, with the third and final closing expected in Q2 2023.

The company reaffirmed its 2023 adjusted full year financial outlook provided in October: a -4% to -2% loss on adjusted revenue, with a 19-21% increase on its adjusted operating margin. With digital competition intense globally, it will be interesting to see how the broader product and omnichannel strategy allows Western Union to compete.

Which corridors in the remittance market are growing fastest?