Visa and Mastercard recently reported their latest quarterly earnings. Whilst their share prices are nearly back to where they were pre-Covid, their revenue is still playing catchup.

The big points:

- Net revenue overall was down 17% April to June at both companies. Operating expenses were only cut 5% at Mastercard for example, not enough to offset the loss in revenue.

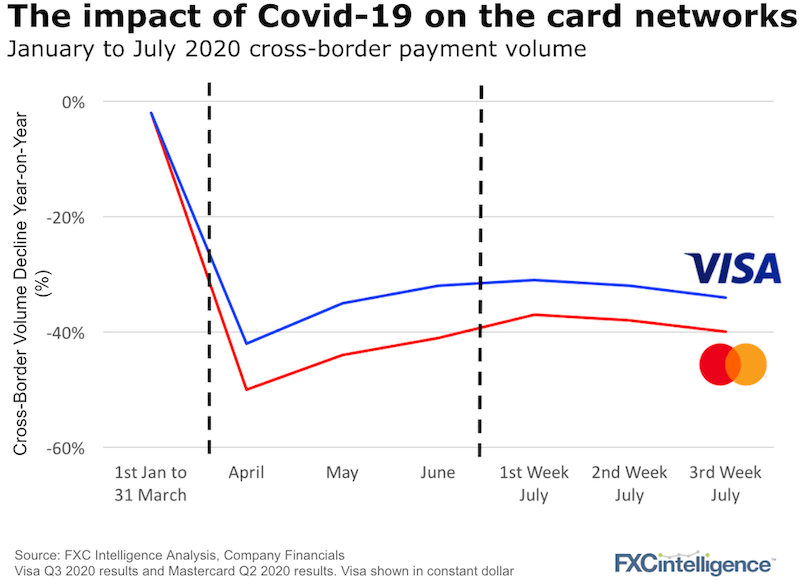

- International transaction revenues declines were much more substantial for the quarter – Visa declined 44% year-on-year to $1.1bn and Mastercard fell 54% to $637m.

- On the growth front, digital and contactless payments continue to see increases across the board plus

- Mastercard talked up its partnership with the Bank of Shanghai to help enable its entry into the Chinese market.

- Visa continues to push its B2B product and expects by the end of the year to processing transactions in 40 markets across the globe.

Visa and Mastercard continue to maintain their market dominance globally in the card space, highlighted by investors pushing their stocks back up to near normal level and seemingly out of sync with the overall global economy. But wallets and local payment methods are fast taking market share, especially in emerging markets and we’d expect both companies to have to respond in some way, likely via further acquisitions.