Few segments of the cross-border payments industry have been worse-hit than travel money, with the sector all but vanishing when the world went into lockdown. However, while some companies have not survived the upheaval, others are rising from the ashes as travel begins to pick up.

Some of the biggest upheavals have occurred out of the Gulf region, where the pandemic has led to a consolidation trend, forcing struggling businesses to sell, often at minimal prices.

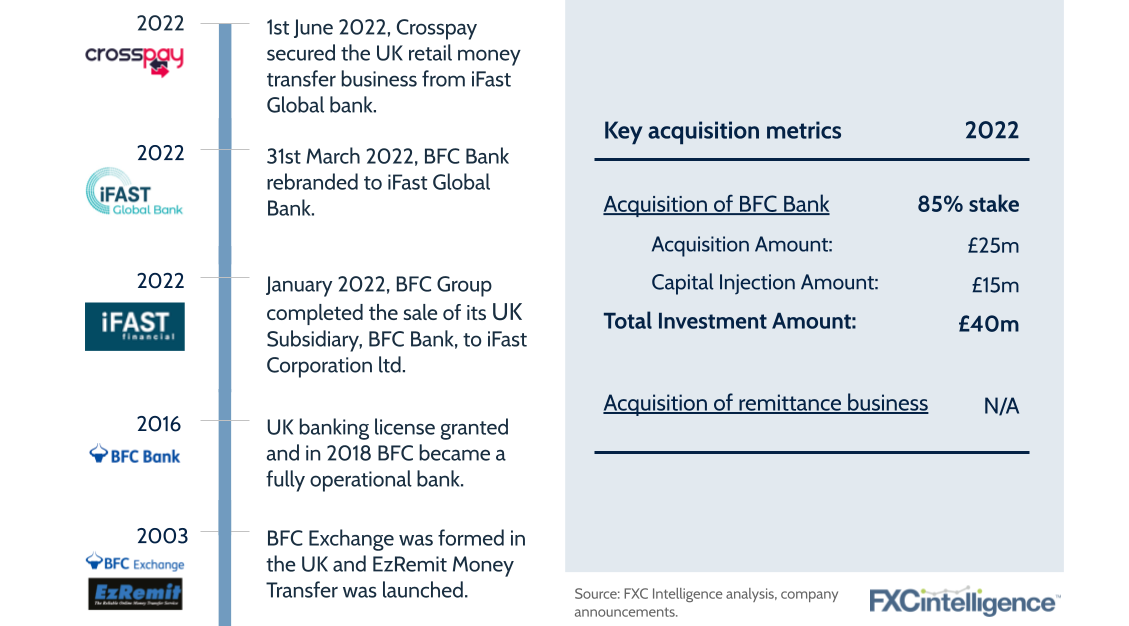

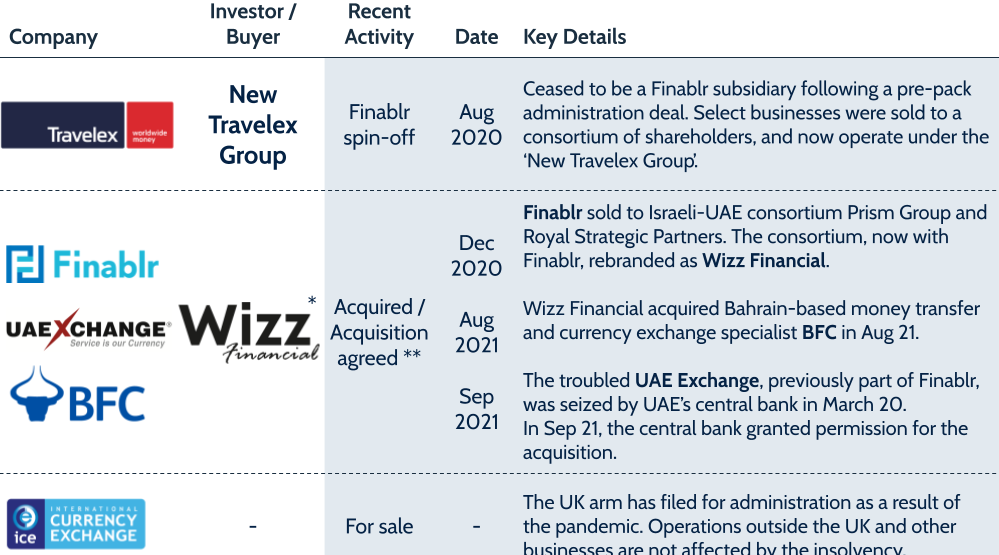

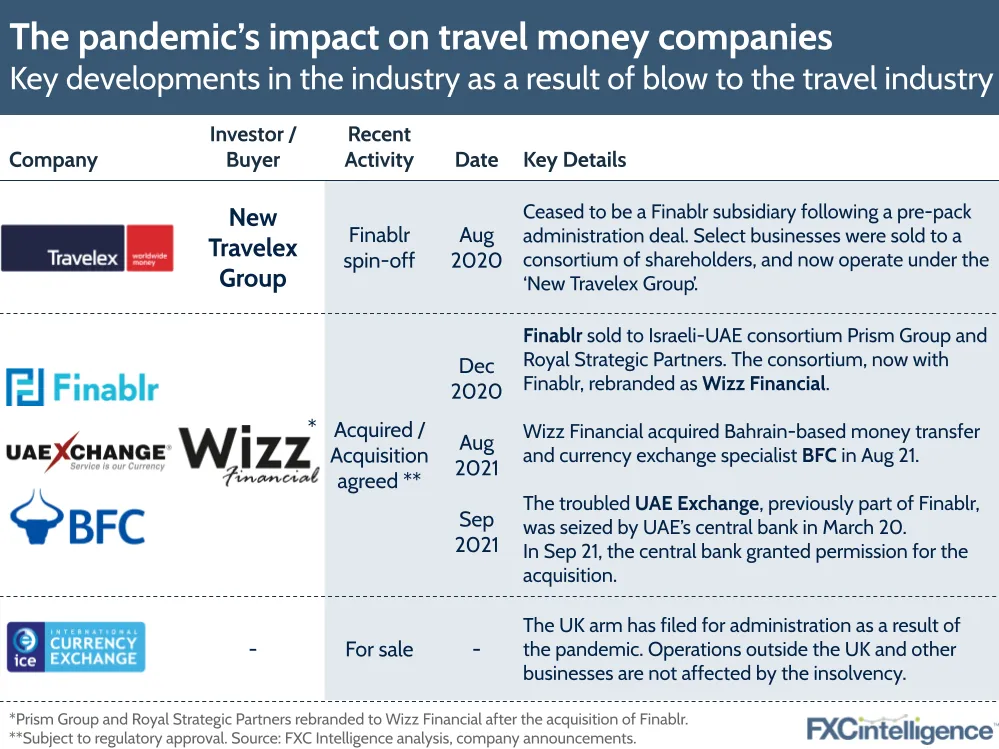

This began with the collapse of Travelex’s parent company Finablr early in the pandemic, which initially saw UAE Exchange being separated off as its own entity, before both it and its parent company were acquired by a consortium now known as Wizz Financial. Wizz has also acquired BFC, the holdings group for, among others, Bahrain Financing Company, Bahrain Exchange Company and BFC Forex & Financial Services in India. This is one of the oldest exchanges in the Middle East, with branches across Bahrain, Kuwait and India, making this a key addition for the consolidated company.

Notably, this is not the end of Wizz’s acquisition plans. The company has stated that it plans to acquire additional companies, including remittance providers and alternative financial institutions to form a sprawling payments platform for the region.

Away from the Middle East, inevitably some providers haven’t survived the severe hit of the pandemic. International Currency Exchange (ICE), one of Britain’s most prominent bureau de change chains, recently ceased all operations.

Of course, neobanks such as Revolut which Monzo have made great inroads into the travel money segment too picking up share from the traditional players.

While travel is seeing increasing volume, there remains some way to go before it returns to pre-pandemic levels, and we are likely to see more change as the industry responds to the evolving situation.