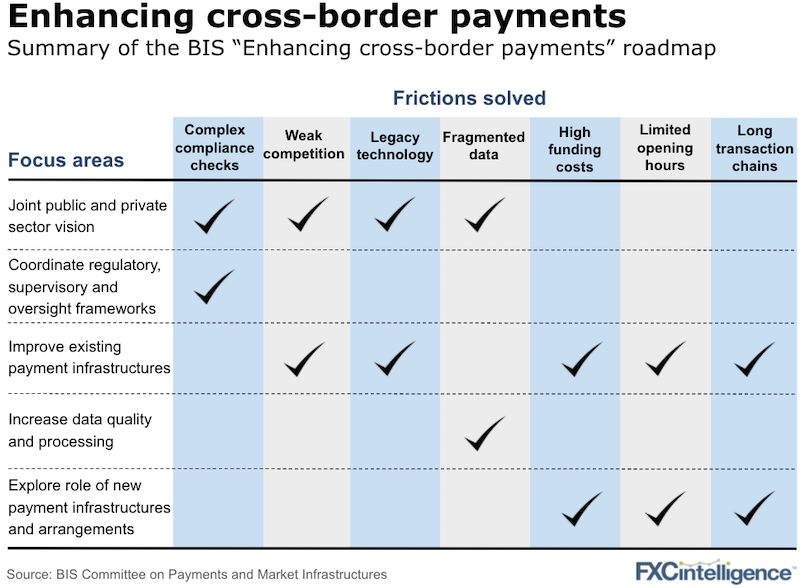

This week, the Committee on Payments and Market Infrastructure (CPMI) of the Bank of International Settlements published a report highlighting the building blocks of a roadmap to enhance cross-border payments.

The “to-do list” – the list of focus areas is no small set of tasks and none of these are new. Corralling large numbers of central banks, government agencies and regulators all to one common cause (each with their own goals) helps explain why much of this moves at a snail’s pace.

In October 2020, the roadmap will be delivered to G20 finance ministers and central bank governors to start an implementation phase. The aim of the project is to make cross-border payments “cheaper, faster, more transparent and more inclusive” – a set of goals we’ve heard many times (and sounds very similar to that of many fintechs) – but any improvements to the list above will be welcomed.

Reducing rather than removing these frictions seems the most attainable outcome for now. And remember, it’s these very frictions that enable so many businesses to offer cross-border payment services in the first place so be careful what you wish for.

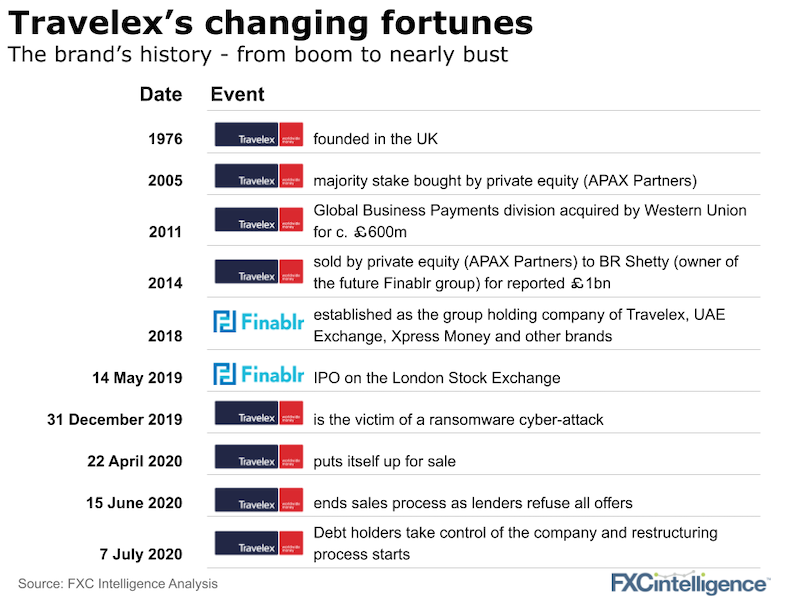

The decline of a market leader

Since last December, life hasn’t been easy at Travelex. After a cyber attack forced the company to cease operations at the turn of the year, the covid pandemic then came along crushing most of Travelex’s travel money business. And just when every travel payments company needs cash to survive, Travelex’s owner Finablr, faces bankruptcy after uncovering $1bn in hidden debt.

Having failed to find a buyer, Travelex has now been taken over by its debt holders and the business will go through a painful restructuring process.

As the brand’s stock continues to decline, will there be enough juice left to give it another run or might this be the beginning of the end of one of the once leading brands in cross-border payments?