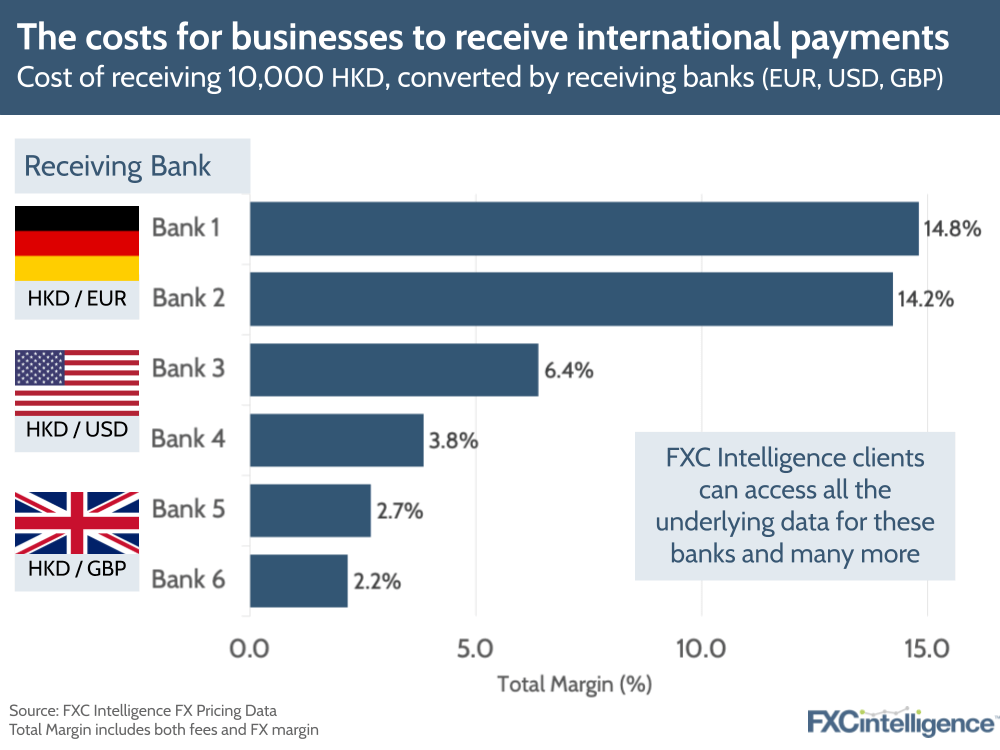

Last week we launched a new dataset showing what banks charge for converting foreign currency payments into local currency. This represents the cost a business faces when it is paid or receives foreign currency, such as a UK business receiving a USD payment into their GBP account.

Whilst much of the cross-border payments world is focused on the costs to the sender, the costs of converting payments by recipients is much more opaque and can be significant. The recipient often has no choice in the matter if a foreign currency lands in their domestic bank account, as it is automatically converted to their home currency.

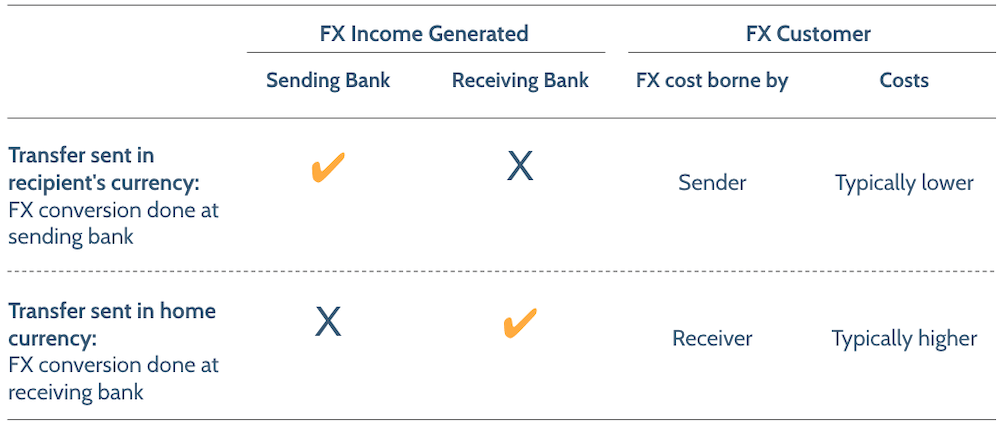

In our example above, in order to transfer 10,000 HKD from a bank account in Hong Kong to a UK bank account in GBP, the business or consumer in Hong Kong has a choice. They can either convert the money to GBP and incur a FX costs on the send side, or send the money in HKD, in which case the receiver’s UK bank will automatically convert the transfer to GBP and charge various fees and an FX margin.

This data has many use cases. Given how high rates are on the receiving side, there is considerable opportunity for banks and payment companies to help customers lower overall costs, for example by:

- Minimising FX costs within corporate group.

- Renegotiating invoicing currency (from sender currency to recipient currency).

- Convincing the sender to do the FX themselves.

Discover how you can use our FX pricing data to help your business