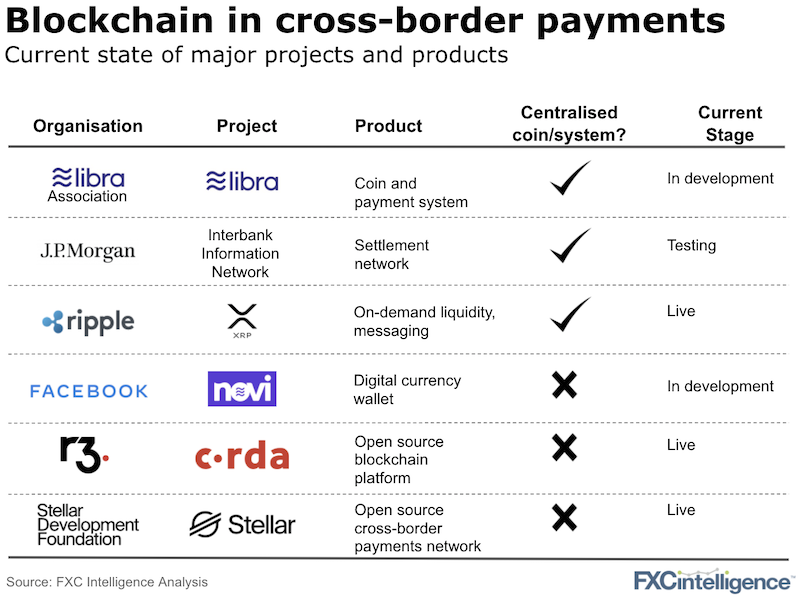

It’s been a few months since we last updated you on blockchain and the cross-border payments industry – most organisations have just had their heads down. Off the back of Calibra rebranding as Novi, we thought we’d take look at how crypto currencies and blockchain-based offerings are evolving in the sector.

Whilst these players above are at various stages and some like R3 have been providing blockchain technology to Nasdaq and Mastercard, private players and foundations are not the only ones bringing new products into the market.

Central banks around the world have also been actively developing their central bank digital currencies (CBDC). Although a survey by the Bank of International Settlement found out that there are no CBDC projects with an explicit focus on retail cross-border payments, some Central Banks are exploring the CBDC application to wholesale payments.

Project Inthanon-LionRock by The Hong Kong Monetary Authority in collaboration with the Bank of Thailand, and the ECB and Bank of Japan’s Project Stella have been testing cross-border exchanges of digital currency. Despite the significant gains in terms of speed and settlement efficiency, privacy issues are still a concern.

Overall, no blockchain projects have yet reached scale. Ripple is without doubt furthest along and now faces the challenging task of moving towards a more wide-scale adoption. Is the market ready? We’ll see.