Payments processor Stripe has announced that its valuation has climbed to $95bn – three times what it was worth a year ago – as a result of a Series H funding round in which it raised $600m.

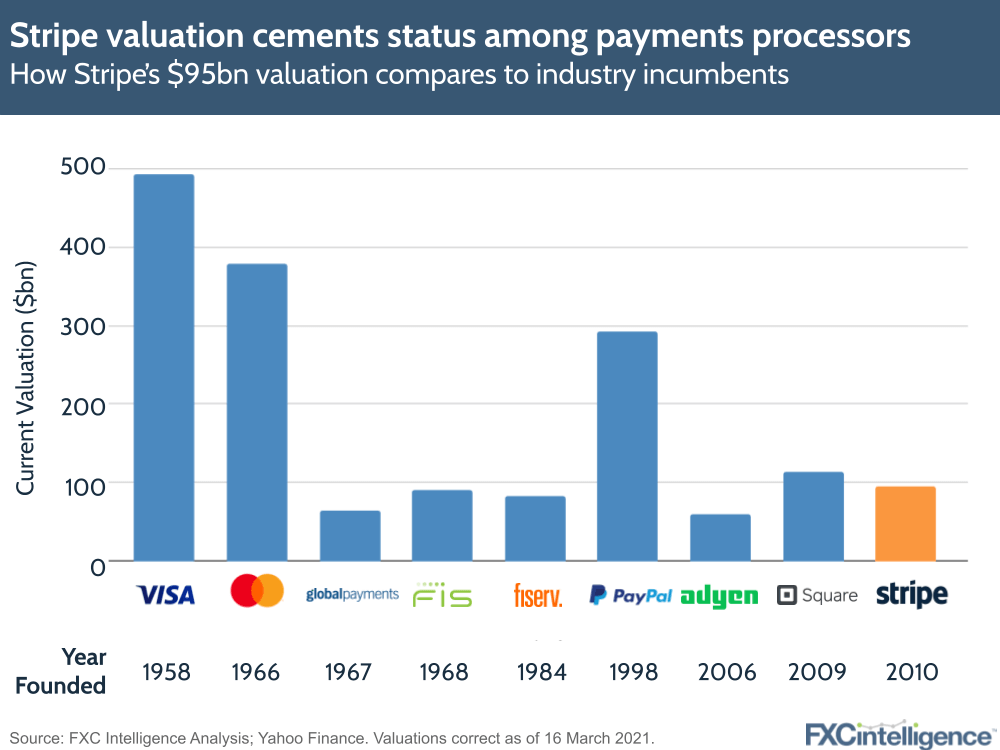

The raise sees Stripe earn the title of the US’s most valuable startup, but it also establishes it as a firm competitor in terms of value within the wider payments processor space.

The 11-year-old company is now worth more than 2006-founded Adyen, as well as Fiserv, FIS and Global Payments, who are all decades old. Its surging value also puts it on a course not dissimilar to PayPal, which rapidly became an incumbent after its founding in 1998.

So how does Stripe plan to keep the growth going? For now, the answer lies in Europe, where it plans to spend much of its new funding, including with a significant expansion of its Dublin headquarters. The reason? “Surging demand” in the continent’s digital economy, which is home to 31 of the 42 markets it currently serves.

We’ll be covering future developments at Stripe and in the wider payments processing space, so stay tuned.

Sign up to our newsletter to stay up to date on industry developments