With the launch of our Buyer’s Guide: Stablecoin Payment Infrastructure product (learn more about purchasing a subscription or read the executive summary), we’re continuing to explore the many facets of stablecoin payments infrastructure. And this week we’re looking at incentives and their role in companies’ stablecoin infrastructure choices.

While there are a number of costs associated with stablecoin infrastructure, many stablecoins and blockchains also rely on incentives to encourage their use – and which companies moving money can in some cases make use of to their advantage. These incentives exist because while the market is still seeing significant growth, the majority of stablecoins and blockchains are still comparatively small.

At the time of writing, 82% of the stablecoin market was held in just two stablecoins, with USDT accounting for 59% and USDC accounting for 23%. However, multi-chain issuance means the availability of a stablecoin on different blockchains is also important. 47% of USDT and 66% of USDC is held in Ethereum, while a further 42% of USDT is held on Tron. This means that almost a third of all stablecoin value is held in a single stablecoin on a single blockchain, and more than two-thirds is held across two stablecoins on two blockchains.

This matters because it impacts the liquidity of each stablecoin and blockchain combination in each market. More demand for a stablecoin/blockchain combination means it will be easier to off-ramp from, so for stablecoins and blockchains outside of the big two, incentives are a valuable tool to help increase use and grow adoption.

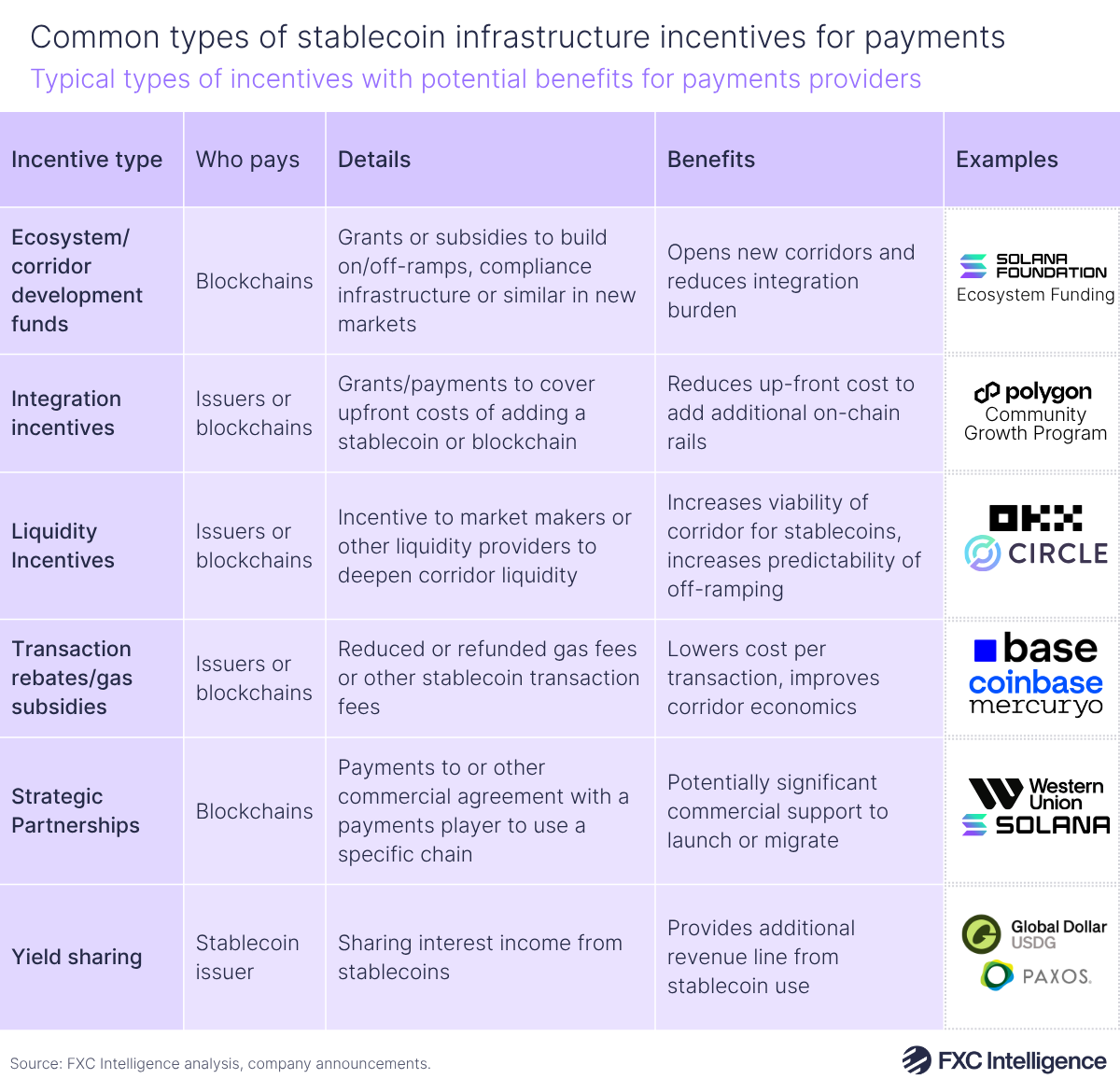

There are many different ways that incentives are deployed, but they are typically designed to either increase adoption directly or make the stablecoin/blockchain combination more appealing or easier to use, increasing adoption indirectly. Many blockchains offer grants or other programmes to support nascent companies as they are developing in return for those companies building on the blockchain’s infrastructure, with Solana, Polygon and Stellar all having some form of this incentive type. Similarly, companies also offer grants and other development funds to build solutions that build out the wider ecosystem, such as improved on-ramping and off-ramping.

Others will offer rebates or discounts on the cost of transacting with a particular stablecoin/blockchain combination, typically for a limited period to drive up adoption. For example, Coinbase and Mercuryo are currently running one such offer with USDC on the Base blockchain. There are also some stablecoins that share their yield with the companies that use them for services such as money movement, as opposed to retaining that yield as a key revenue line, as in the case of Circle. Paxos’ Global Dollar Coin, for example, uses this revenue sharing strategy, which has led some stablecoin payment providers to question why the practice is not more widespread.

Meanwhile, there are also larger partnerships that drive greater adoption. For example, blockchains and stablecoin issuers use incentives to improve their liquidity in specific markets and so make that market more viable for cross-border payments. This is achieved by offering incentives to market makers and other liquidity providers to increase their coverage there, either in the form of formal long-term partnerships or shorter term ad-hoc incentives.

However, while all of these approaches are typically one part of a broader strategy, with each adding incremental gains, there are also larger partnerships that attract specific companies to adopt specific stablecoins or blockchains. Western Union’s planned USDPT stablecoin, for example, is being launched on Solana, a move that is thought to have come with a payment to Western Union.

Next week, we’ll be continuing our exploration of the technical side of stablecoins with a look at Layer-2 blockchains. And if you’re looking to add stablecoins to your own company’s technology stack, learn more about how FXC Buyer’s Guide: Stablecoin Payments Infrastructure can help increase your market understanding and support you in identifying the right providers for your needs.