It is not often that stock markets greet a bid by an incumbent for a smaller competitor so positively. But that’s just what happened here. Once news of a bid surfaced early this week, Western Union’s stock price rose 10% and MoneyGram’s jumped over 30%. Why so happy?

Let’s go through what the deal might mean at a high level.

The upside

When two of the biggest players in the market combine, it is usually a good thing for shareholders.

- Removing a big competitor often allows for price increases. Our analysis of Western Union and MoneyGram pricing through 2020 shows that Western Union is more expensive than MoneyGram in the vast majority of corridors. In some corridors, these companies are the only two meaningful options for a customer. Removing MoneyGram and its lower pricing offers upside pricing for Western Union.

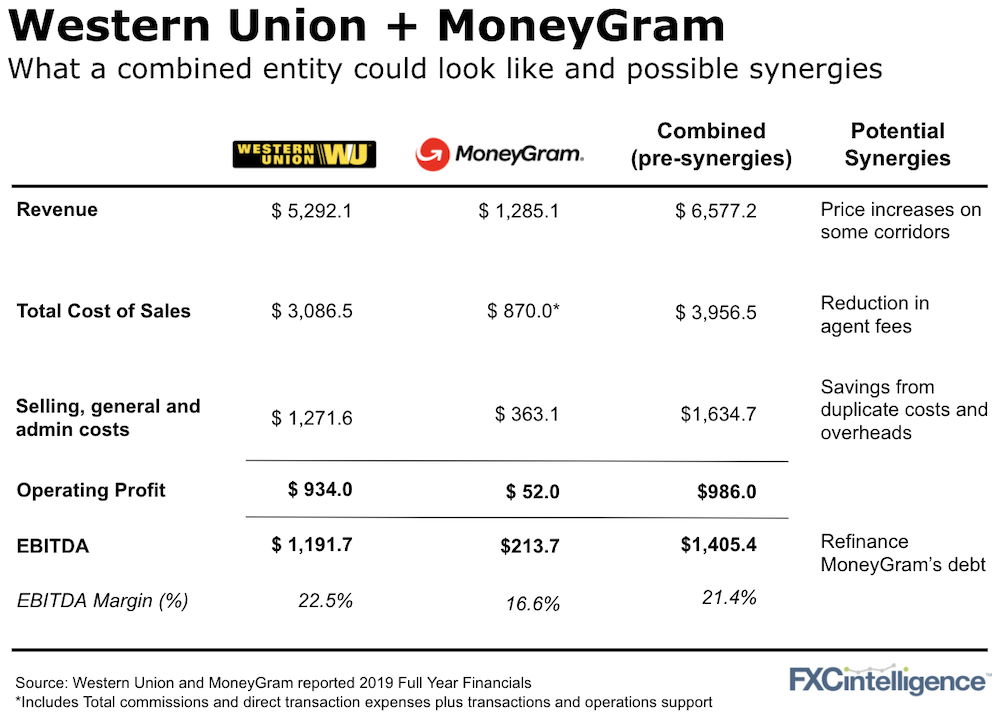

- Cost savings. There look to be plenty. MoneyGram’s agent costs run at around 70% of its total cost of sales while Western Union’s sit at 60%. Bringing this percentage into line would amount to around $100m of savings alone. In addition, combining shared functions in operations, treasury and head office should take another big chunk out of more than $1.6bn of total selling, general and administrative costs. Plus renegotiating MoneyGram’s relatively expensive debt.

The price

Western Union is currently worth around $9.4bn. MoneyGram’s equity value is just under $200m, it has around $880m of long-term debt and around $130m of cash putting its enterprise value (debt plus equity) somewhere around $1bn.

Western Union trades at around an 8x equity/EBITDA multiple, which means if it can find $125m of synergies (we think it probably can), then the deal pays for itself. Western Union also just added around $900m to its own equity value from the market’s own positive view of the acquisition. If anti-trust and regulators allow the deal, it will be pretty much a no-brainer for the acquiring company.

The risks

Competition authorities don’t often like two of the biggest players in a market combining. But the nuance comes as to how you define the market. If authorities focus on cash pay-in corridors to the developing world, Western Union and MoneyGram are the two major players and, in some regions like Africa or in outlets like Post Offices, they are extremely dominant and only have a few other competitors.

In the remittances market overall, Western Union and MoneyGram cumulatively have around $110bn in cross-border payments flow compared to the World Bank’s $600-700bn market size number. This accounts for less than 20% of the market. Including even more of the C2C market takes the market size up to potentially $2bn and the share of flows down to 5%. Anti-trust is a big topic, we’ll continue to investigate it if the deal develops.

Who else could bid?

Ant Financial tried to buy MoneyGram and failed a few years back. We all know that story. Euronet’s Ria launched an alternative bid. Would they be willing to have another try? Euronet’s stock is depressed by around a third right now due to the pandemic. However, a Western Union owned MoneyGram would really make them a very small second place player.

Outside of that, PayPal (who owns Xoom) has the means but not necessarily the desire to enter the cash pay-in market, with PayPal being very much a digital player. Finablr could have been an option but they are now broadly out the market.

What next?

Nothing formal yet has been confirmed by either company. We’ll be watching it and analysing it for you. Stay tuned.