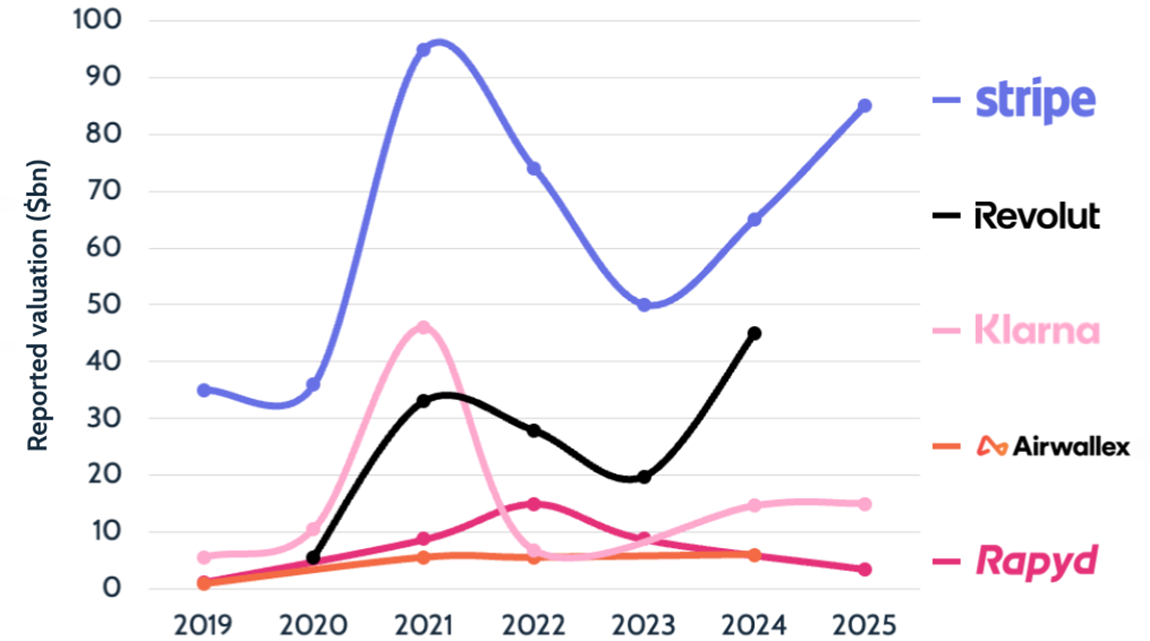

The stock markets have had a challenging 2022, with the majority of companies across all sectors seeing a downturn amid wider supply chain issues and rising costs of living. Unfortunately this has also impacted global payments, with most publicly traded companies in the space also taking a hit.

While most companies in the space are currently sitting at a lower market cap than they were a year ago, there are insights to be gleaned from those still in green – as well as those further down the table.

Some companies have seen a bigger drop in part due to arguably inflated valuations in the sectors they operate in. Coinbase and Block, both of which largely focus on crypto, are the most obvious example of this as the cryptocurrency space has seen a dramatic drop over the past six months or so. However, those that are very tech leaning have also seen similar impacts, as retail investors that were previously enamoured by technology and fintech reduce their holdings.

Meanwhile, ecommerce has taken a hit from reduced consumer spending after the pandemic and a slowdown in ecommerce, with PayPal, dLocal and Payoneer among those who are impacted.

By contrast, the sector that seems to have been hit the least is B2B payments – a market that has not seen a notable hit from the wider economic landscape – with Equals and OFX (both with meaningful corporate segments) topping the board and Alpha close behind. Traditional cash-led remittances are also showing their resilience, most notably with Intermex.

Valuations are inherently a subjective view of the market and it remains unclear whether we are at the bottom and a rebound is coming (in which case, what would drive that rebound?) or if there are further reductions to come. We’ll share more insights as companies begin to report their Q2 earnings next month.