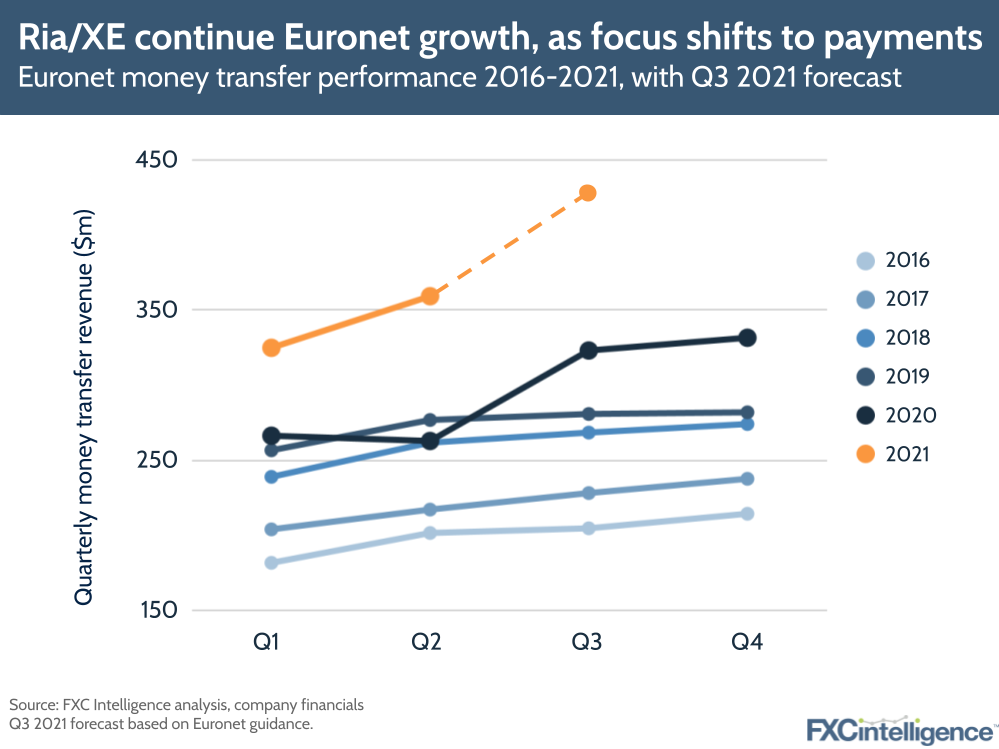

Euronet’s Q1 2021 results continued the positive run for the company. The Money Transfer segment results, which includes Ria and XE, helped to produce overall Euronet revenue growth of 35% to $715m. This is compared to the pandemic-hit Q2 2020, however the company is also up on its 2019 numbers despite travel remaining muted, and is now looking beyond remittances in its money transfers segment for future growth.

Our main takeaways:

- Money transfers, which saw a 37% climb in revenue, reported record results across all areas, including a 36% increase in US outbound transactions and 44% growth in overall outbound transactions.

- Digital channels in particular saw strong growth of 74% year-over year, while bank deposit transactions saw an acceleration of adoption, increasing by 61%, while deposit volume grew by 70%. This was helped by the launch of Ria’s app in Chile, and an overall expansion of the Euronet network, which now reaches 3.6 billion bank accounts and 220 million wallet accounts, many of which now support real-time payments.

- Euronet is re-framing its money transfers TAM (addressable market). The company is now setting its sights on the wider payments industry, combining XE and Ria to morph its money transfer business “into an international payments business” and moving its core TAM from the World Bank $700bn number to the trillion-dollar global payment market.

- This move will see it add support for multiple use cases beyond remittances (which XE has already been doing), including C2B payments.

- Part of this will see the extension of current relationships it has with money transfer players such as Xoom and Remitly, to companies beyond the sector. This will include direct relationships with companies, partnerships and private label agreements that will see it compete directly with fintechs and provide a “faster alternative to Swift”.

- The company expects overall revenues to have recovered to 2019 levels in Q3, with double-digital compounded annualised growth rates in its money transfer segment.

Euronet plans to go into more detail about these plans in future quarters, so stay tuned.