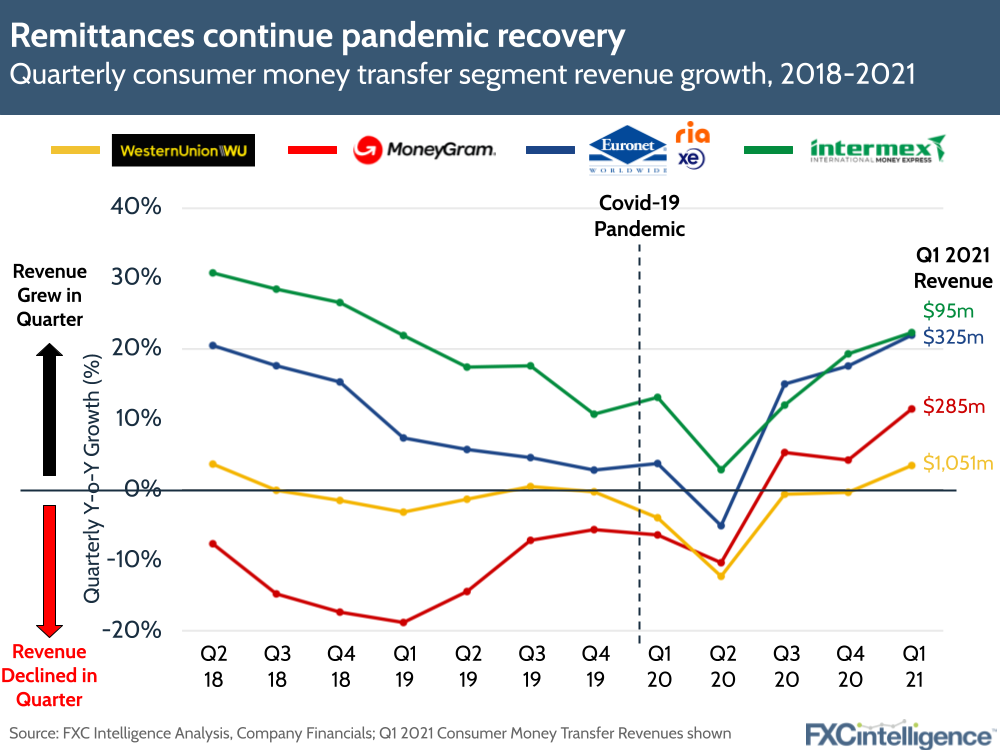

Recently the World Bank updated its data on remittance flows in the pandemic, confirming what we already knew: that remittances proved more resilient in 2020 than many predicted, at 1.6% below the 2019 total. Meanwhile, the latest earnings releases show that all the major remittance companies are showing strong signs of recovery.

We now have enough perspective to compare how the biggest four publicly listed groups – Western Union, MoneyGram, Euronet (which owns Ria and XE) and Intermex – performed. And while there are similar patterns across all of them, there are also notable differences.

All four took a hit in Q2 2020, when the majority of the world was in strict lockdowns and some of the most severe impacts of the pandemic were being felt. However, the bounceback was relatively quick, particularly for Intermex and Euronet.

Intermex was notable for being the only one of the four not to fall into negative revenue growth at any point during the pandemic – something CEO Bob Lisy attributes to the company’s core customers being essential workers who largely continued working throughout the year (Intermex is also a tenth of the size of Western Union and US outbound focused so scale plays a part). MoneyGram and Western Union, meanwhile, took a bigger initial hit and have seen a slower recovery, although both are now seeing their best growth rates in years.

As we begin a potentially slow road to full recovery in a market that has seen permanent changes since the pre-pandemic days, we would expect all four companies to continue to grow through 2021. We’ll be covering all the developments as they happen.