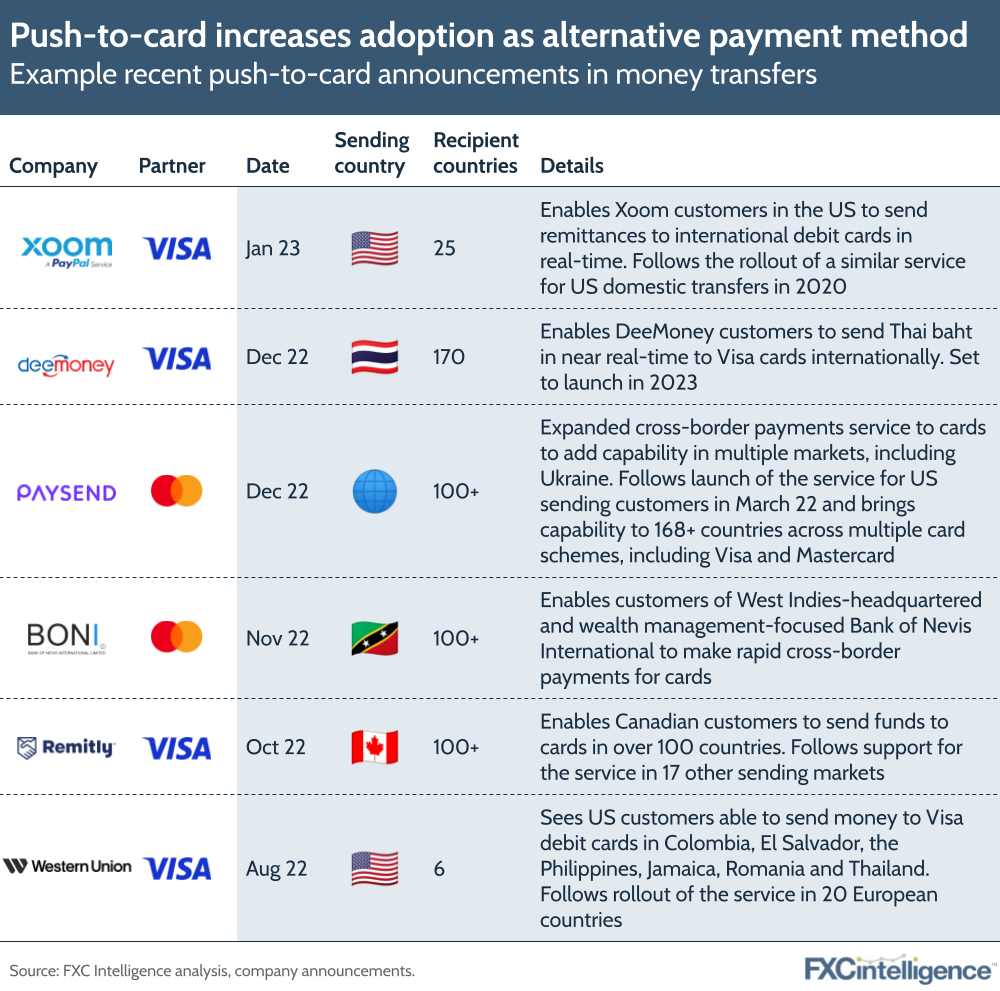

Alternative payment methods are seeing growing adoption in money transfers, and while digital wallets are getting much of the attention, push-to-card is also seeing significant growth. Over the last few months, there have been a number of key partnerships between money transfer providers and both Visa and Mastercard.

Push-to-card enables money transfers and other cross-border payments to be sent to an international card using just the 16-digit card number. In many cases, the service spans the card issuer’s entire network and reaching as much as 90% of the global population.

Significantly, the push to card is 24/7, without restrictions on weekends, and in many regions can be delivered in real-time.

Both Visa and Mastercard have been offering the service for some time, but its adoption and use is growing. For money transfer companies, many of whom have been adding the capabilities on some or all of their corridors, the service is an extra pay-out solution alongside bank accounts, digital wallets and, in some cases, cash.

As digitisation continues to develop in 2023, expect support of push-to-card to continue to grow as money transfer players increasingly diversify their digital support in response to the complex and changing needs of the market.

Which corridors have seen the most growth in push-to-card adoption?