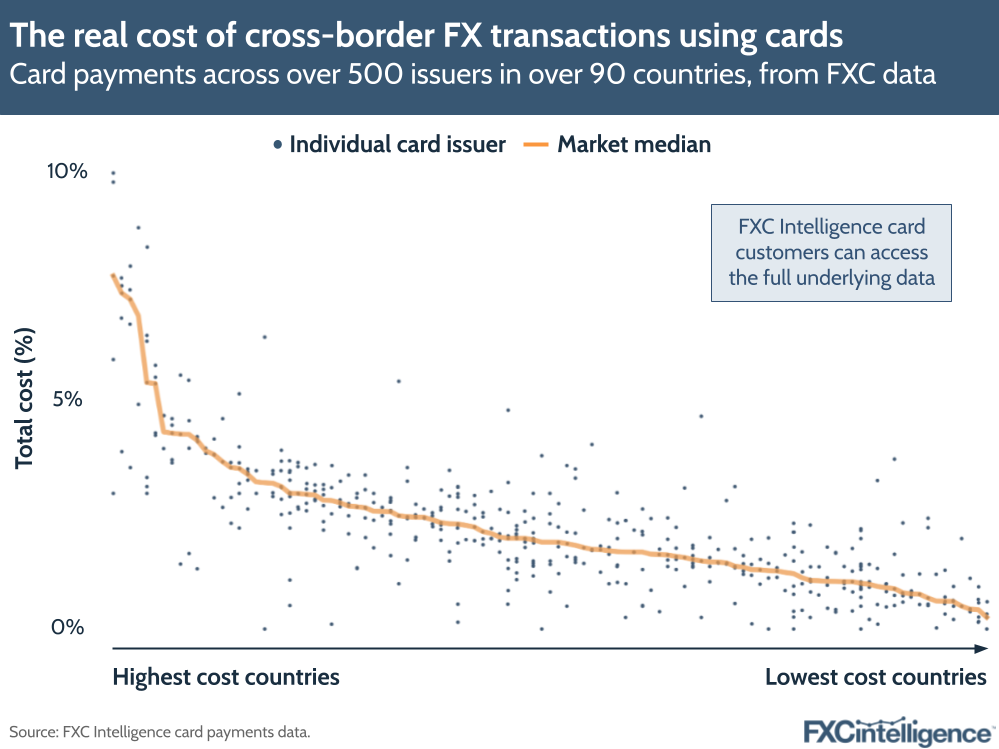

Whether for online purchases or in-person transactions, cards remain popular means of making cross-border payments. However, the foreign exchange fee and costs that are typically applied to the end user vary wildly – and our data shows that costs can vary significantly depending on both the location and the card in question.

Our proprietary cards dataset, built over many years, focuses on the full cross-border charges applied by issuers to a card holder, by issuers and card programmes for each data point. Segmented by fees for both FX and home-currency cross-border transactions, it is used by some of the world’s largest marketplaces to support direct currency conversion (DCC) and multicurrency pricing (MCP) products, as well as forming part of the benchmarking data for the G20’s Roadmap for Enhancing Cross-Border Payments.

Analysis of the dataset shows that there are often significant discrepancies between published fees and charges and the true charges a cardholder incurs when they use their card for a cross-border transaction. It also shows that there can be significant discrepancies between FX charges and home-currency charges. While some providers in some markets will apply the same fee for both, in others the FX fee can come with a very significant additional charge, in some cases upwards of 4-5% of the cost of the transaction.

While stablecoins are increasingly being explored by some players as a means to avoid interchange fees, there is also increased scrutiny of the fees themselves from some regulators. Gaining insights into the cost of card transactions at an individual card level can therefore be invaluable for issuers and networks benchmarking, internal monitoring and price setting, as well as providing a vital underpinning for DCC or MCP solutions tailored to individual customers.