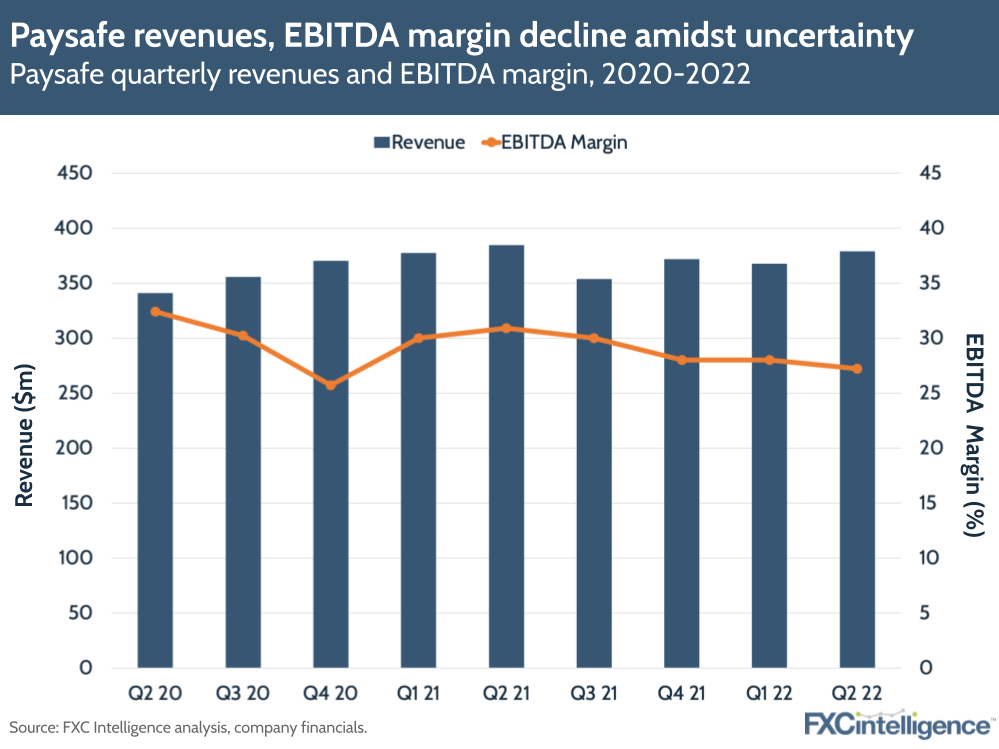

Online payments company Paysafe felt the effects of European headwinds in Q2 22, with a 1% decline to $379m, as well as a 13% decrease in adjusted EBITDA – down to $103m. These figures met expectations for the company, which reported solid gains in its US acquiring business, but it also saw a sizable net income loss of $631.5m in Q2 (although this included a non-cash impairment charge of $676.5m).

Paysafe sees growth in merchant acquiring offset by digital commerce decline in Q2 22

Volume increased by 3%, to $33.4bn, driven by US-based retail SMBs, Paysafe’s iGaming division and Latin America. However, this was offset by weakness in Europe due to changing gambling regulations, the Russia-Ukraine war and softer activity in financial/crypto markets.

Strong growth from the company’s US merchant acquiring business, which increased 14%, was offset by declines in its digital commerce segment. Digital commerce revenue decreased by 4%, primarily reflecting the aforementioned changes in gambling regulations in Europe and the Russia-Ukraine war. This change in the mix resulted in a lower EBITDA margin than last year – 27.2% compared to 30.9% in Q2 21 – as well as reducing its take rate from 1.2% to 1.1%.

On the positive side, headwinds were partially offset by new acquisitions (including LatAm-focused payments platforms SafetyPay and PagoEfectivo) and Paysafe’s embedded finance product. After joining in May, new CEO Bruce Lowthers wants to introduce new operational efficiencies to the business, reduce silos and put more investment into funding sales and product innovation.

Paysafe now expects Q3 revenue to be $350m-$365m and adjusted EBITDA to be $90m-$95m. To reflect anticipated FX headwinds and macroeconomic uncertainty, it has updated its FY22 revenue outlook to $1.47bn-$1.49bn (previously $1.53bn-$1.58bn) and adjusted EBITDA outlook to $400m-$415m.