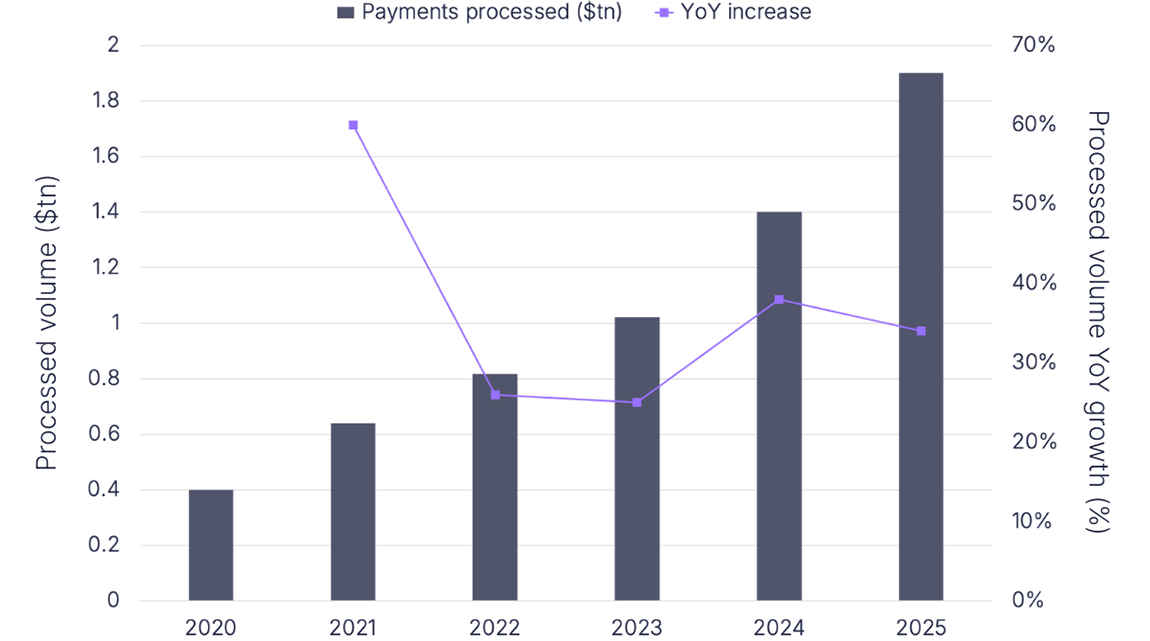

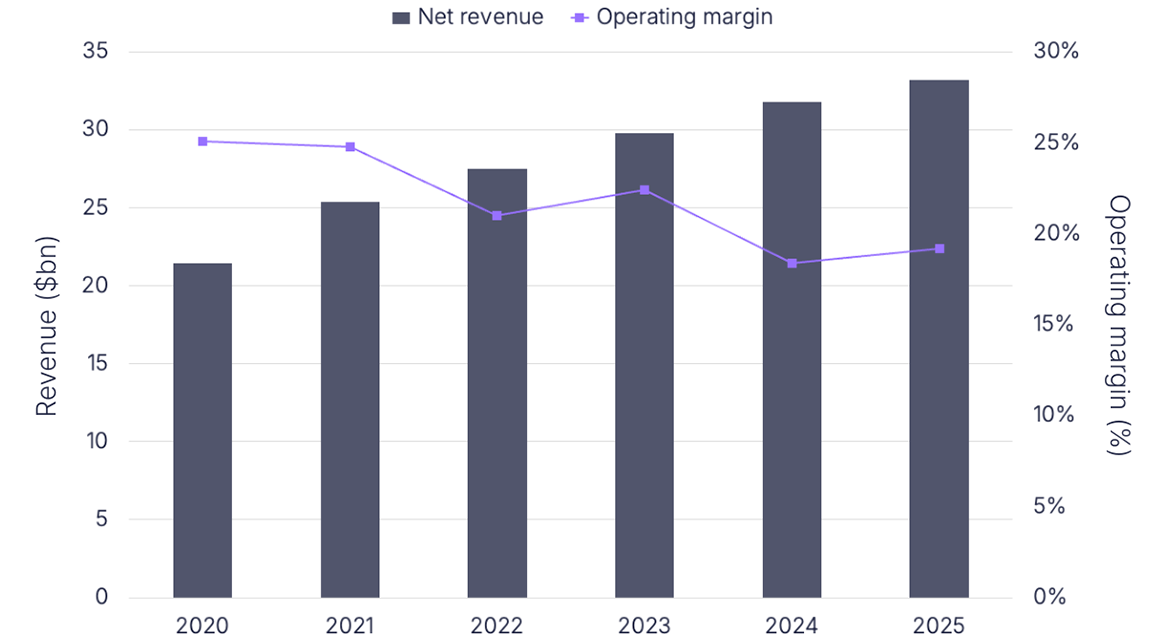

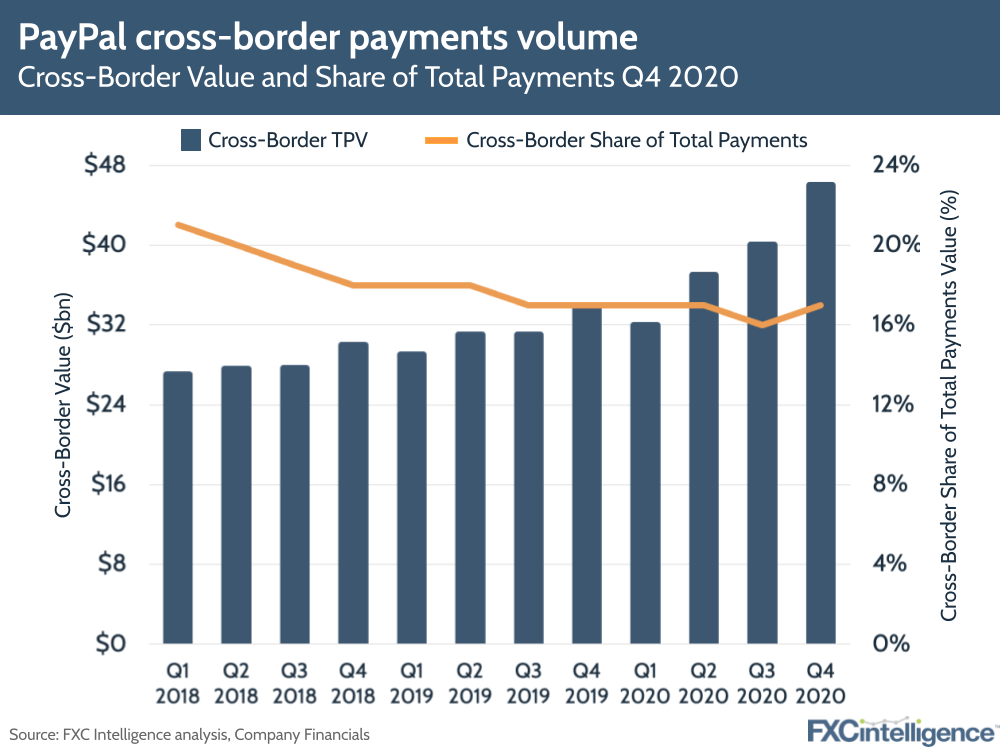

PayPal released its Q4 and full year 2020 results last week and they make for happy shareholder reading (PayPal’s share price has doubled over the past year from its pre-pandemic levels). With net revenue for the quarter of $21.5bn, up 22% from last year, and Total Payment Value surging by 39% to $277bn, PayPal experienced considerable growth in the uncertain year that was 2020.

Although the rise in ecommerce and the need for digital payments played a key role, new product launches also helped the company to gain 72.7m new active users, bringing the total number of active accounts to 377m.

Our main takeaways:

Cross-border payments continue to grow

- Cross-border payments volume rose 36% year-on-year and its share of total payments rebounded. The recovery in key intra-European corridors and in outbound flows from the UK and US helped this growth.

- Xoom continued to expand in terms of geographic coverage and pay-out capabilities. The money transfer service has been added to wallets in 12 key markets across Africa – with a focus on the unbanked population – and expansion will continue in 2021. The ability to send direct transfers paid out to bank accounts and debit cards was also added in November 2020.

Paving the way for wider crypto-currency adoptions

- Crypto and digital currencies gained increasing attention in 2020, but their use in retail domestic and cross-border payments remains limited. PayPal launched the ability to buy, sell and hold cryptocurrencies in its wallets in the US in October 2020 with Venmo and more in international markets to follow this year.

Growing a profitable customer base

- PayPal acquired 72.7m new active users in 2020 and expects to add an additional 50m this year. Although customer acquisition is expected to slow down, the introduction of new products such as cryptocurrencies and the Buy Now Pay Later products helped boost engagement and reduce churn.

China will provide a platform for cross-border flows growth

- In January, PayPal completed the acquisition of GoPay, a Chinese payments gateway specialising in ecommerce and cross-border payments. PayPal is planning to leverage its cross-border expertise to connect Chinese merchants to PayPal’s international customer base and also allow Chinese customers to shop from abroad. Although still in the early stages, we can expect this initiative to boost cross-border flows for the company.

Sign up to our newsletter to stay up to date on industry developments