PayPal has posted its Q3 2021 results and was in part a victim of its own recent success. Investors knocked around 10% of its share price as it forecast a dampened outlook for 2022.

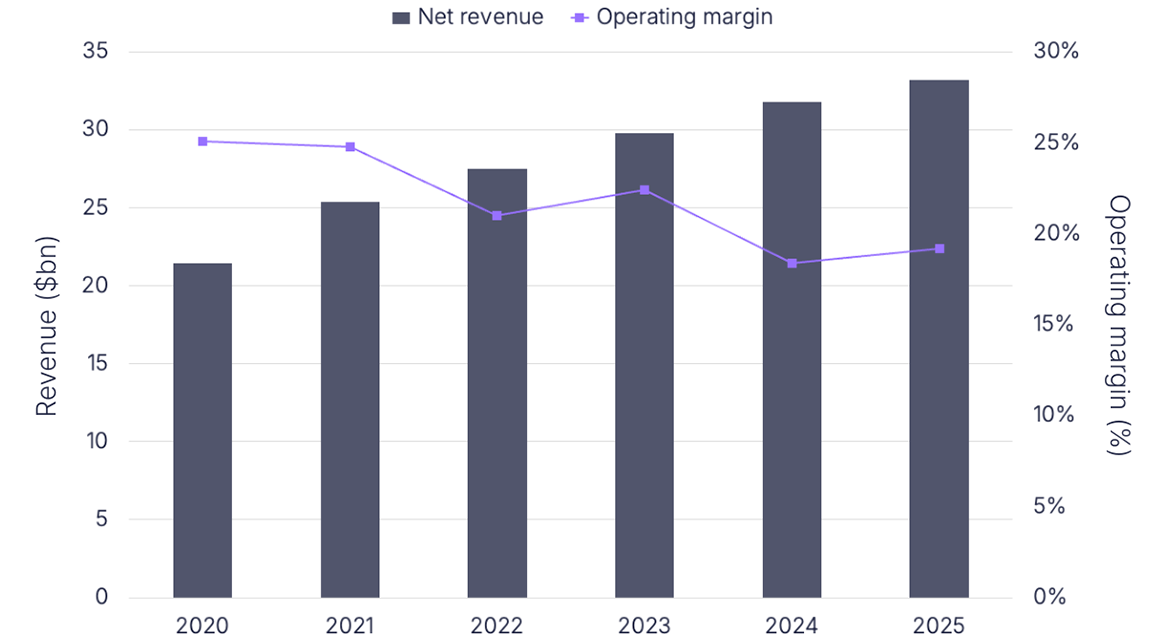

Net revenue was slightly weaker than expectations at $6.18bn – just under Q2’s record $6.24bn. This represents a 13% year-on-year increase – a climb that many companies would be proud of, but for PayPal is the lowest increase it has seen since Q1 2020. PayPal attributes this to weaker-than-expected back to school and travel sales – arguably the result of Covid-19 impacts continuing for longer than many hoped. Other highlights from the earnings call:

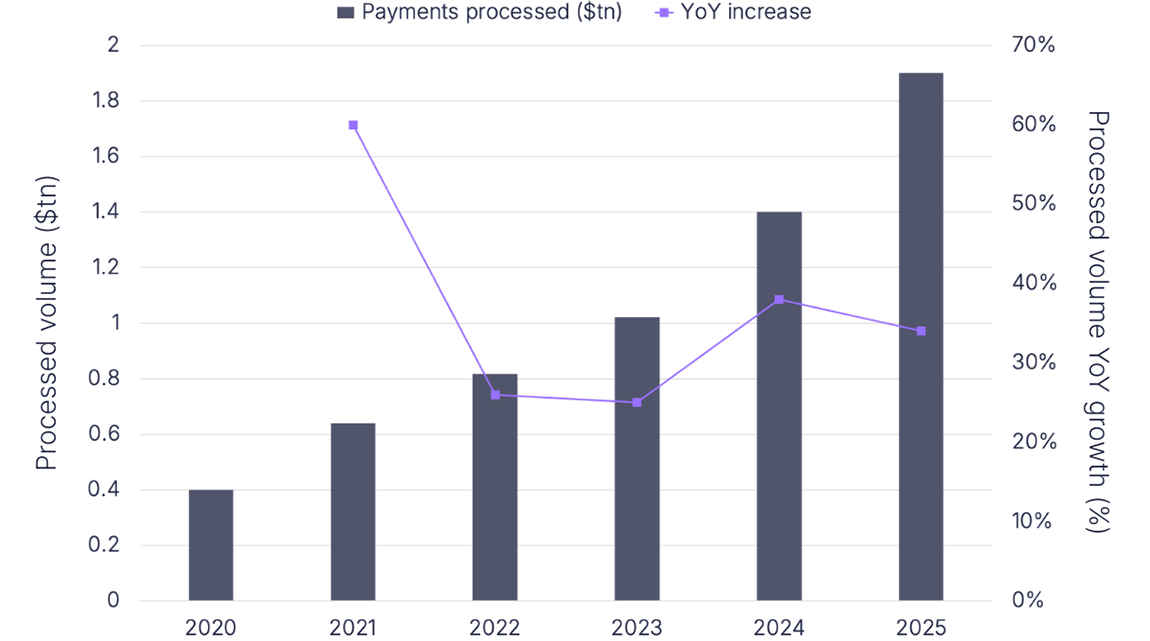

- Total payments volume (TPV) grew 26% on a spot basis to $310bn, despite 45% decline in eBay TPV. eBay now represents just 3% of PayPal’s overall TPV.

- Volumes grew 31% on a spot basis, with annualised run rate reaching $1.2tn.

- Active accounts, meanwhile, have increased 15% year-on-year to 416 million, while the number of merchants tops 33 million.

- PayPal made several key account gains, including Walmart and GoFundMe. The company also announced a partnership with Amazon to enable US customers to pay with Venmo at checkout.

- BNPL continued to grow, with over 950,000 merchants having added the service, and over 9.5 million customers using it. The company now plans to expand this in H1 22 to add longer-term instalment plans for higher value purchases, a service already available in Germany and seeing “great initial success”.

- PayPal has also completed its acquisition of Japanese BNPL provider Paidy, which it sees as vital to increasing its presence in Japan, one of the world’s biggest ecommerce markets.

- The company’s app, meanwhile, had a complete redesign this quarter and has seen 100% increase in use, which PayPal says is driving crypto adoption. The company saw a 15% increase in first-time crypto users this quarter.

Looking ahead, while the company says Q4 has had a “solid start”, it warns that growth rates remain below expectations. This, combined with ongoing supply chain and labour shortage issues, has led the company to reduce its projections for the year to 18% revenue growth with 430 million+ active accounts – prompting a 6% drop in share price.

PayPal has set very strong expectations during the pandemic, but it will need to find new ways to keep investors happy as it faces some new headwinds.