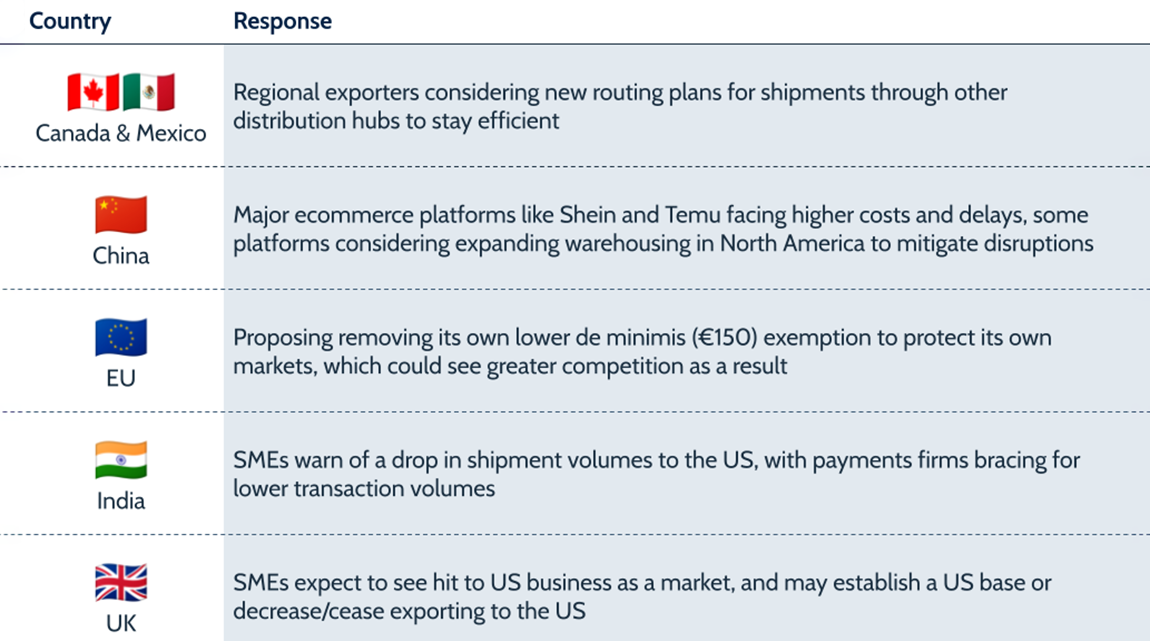

In the closing days of 2021, Australian cross-border payments major OFX announced that it would be acquiring Canadian foreign exchange service provider Firma for A$98m ($70.5m). At around 2x revenue and EPS accretive, this was a well received transaction by the market with OFX share price rising on announcement of the deal.

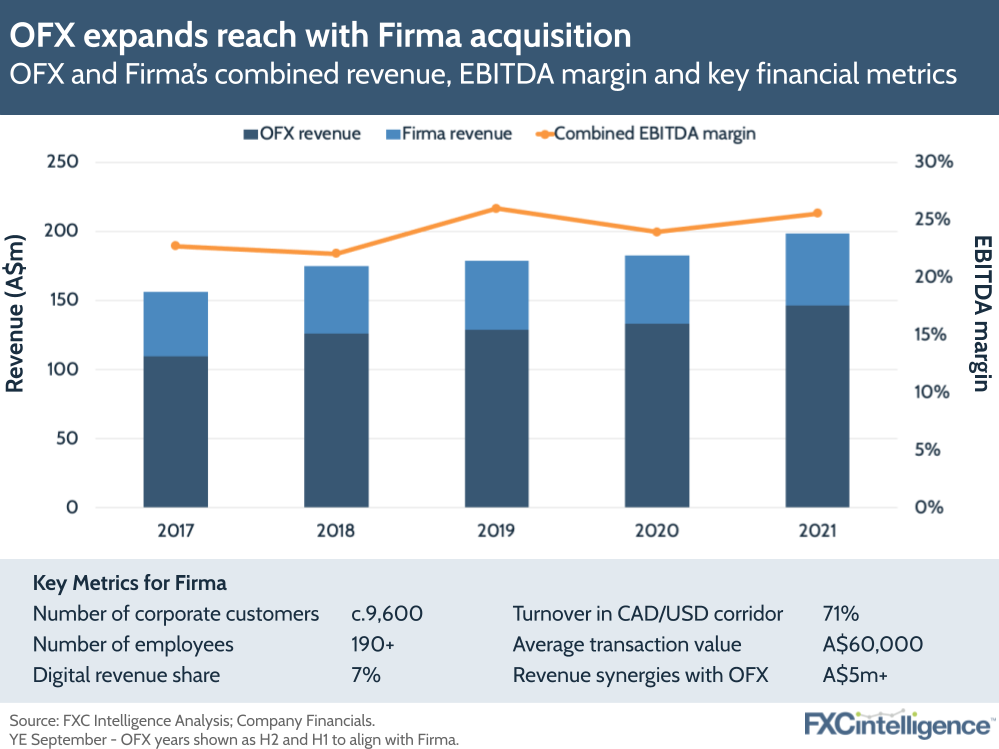

In a call with investors shortly after the announcement, CEO Skander Malcolm explained that the acquisition would bring significant strength to its North American revenue, providing a 121% boost. It is also expected to enhance OFX’s increasingly strong corporate segment, with Firma’s 95% corporate client base projected to bring 93% growth to OFX’s corporate segment.

Expected to complete in the first quarter of OFX’s FY 2023 (calendar Q2 2022), the acquisition is designed to accelerate OFX’s growth trajectory. But beyond the headline benefits, how does OFX see Firma enhancing its offering and operations, and how does the acquisition play into OFX’s overall strategy? I caught up with CEO Skander Malcolm to find out.

Inside OFX’s acquisition of Firma

Daniel Webber: Let’s start with the main questions: why Firma and why now?

Skander Malcolm:

There’s quite a few things we like about Firma. Obviously they’re playing in the space that we have outlined in our strategy as being where we want to grow, corporate, and also in the region that we really want to grow, North America. That’s obviously a big tick.

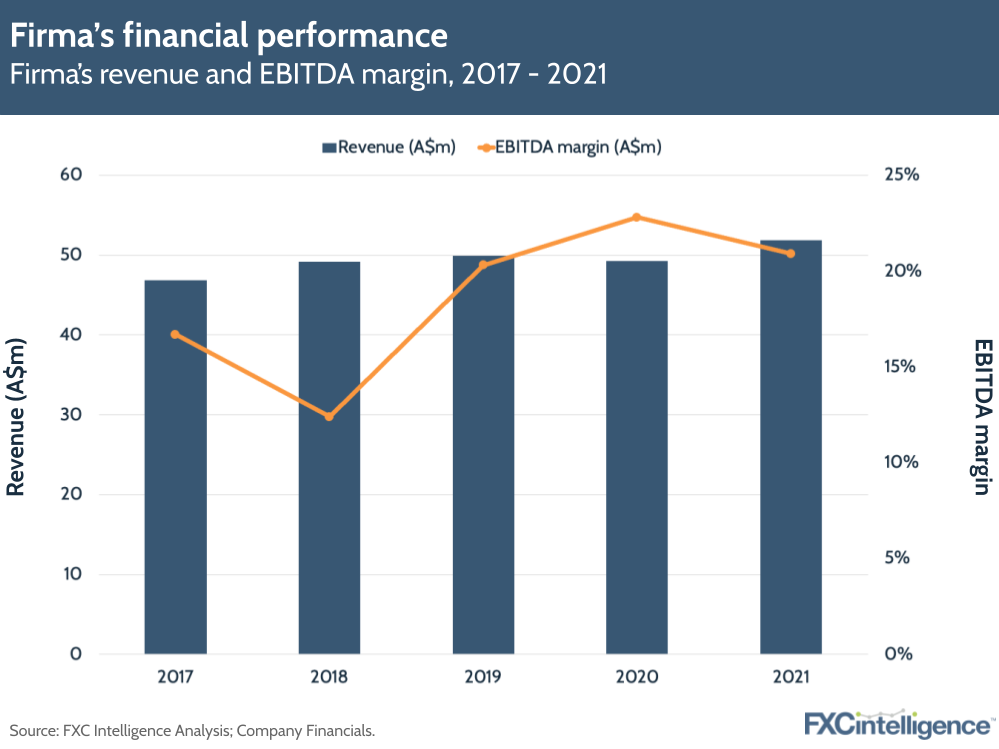

Second of all, we like their profitability, because they’ve demonstrated through the cycle that they are a company that can retain clients, generate a return and improve their business. That’s obviously very similar to the whole OFX way of doing business.

The third thing is, Dave [Dominy, CEO of Firma] and I have been in touch for 4 or 5 years. We’ve kept dialogue as they’ve thought about ways in which they’re growing the company and that relationship.

Plus, the relationship that Selena [Verth, CFO of OFX] has with their CFO has helped get us comfortable about their culture and specifically around things like risk management, client centricity. Those are the types of things that are very, very fundamental to any business that we are thinking about acquiring.

Put all that together and that is why Firma.

In terms of why now, it’s pretty straightforward. They had previously indicated to us that if there was a time that they were thinking of selling that they would talk to us. We had been in touch and then they said, “Look, there is a process that we are going to enter into. If you’d like to join, then these are the terms,” which we were very happy to accept.

It’s a great time for OFX. Genuinely when you think about transaction, we generate a lot of cash, so we could use cash. We think about the size of the transaction. It’s a great time for us to be using debt in association without cash.

The vendor was very motivated. And frankly, because it was a single vendor, for them, certainty was really, really important – and obviously for us as well – and we could bring certainty. So the why now was a willing vendor; a strategic buyer that could provide that certainty and generate a better future for their staff; a good shareholder return. It came together very well.

The future of Firma at OFX

Daniel Webber: Firma has built a good business – what opportunities do you see for OFX to build it out and develop it after the acquisition?

Skander Malcolm:

Obviously we’ve said to the market that we expect to generate significant EPS accretion – more than 20% in year one – and we also see significant synergies through fiscal year 25. The reason we say those things is because of the opportunities that Firma bring to the table to frankly grow faster and be more efficient.

Firma has, I think, strong expertise and client management. You look at the clients they had, the retention rates, the expertise that they provide to their clients. If you look at their bad debt and so forth, there’s a disciplined approach to the way their relationships are managed. And we think we can help by adding products and licenses to that.

If you think about a business like Firma which is largely CAD/US that doesn’t have US licenses, by definition they hit challenges growing with their clients if they can’t offer the US legs, even from a receivables perspective.

They’ve got a nice little business in the UK and here in Australia and New Zealand, which all create opportunity as well. But I think particularly for their Canadian clients, adding all those US licenses, adding that product and technology means that you can take that strong client-centricity and expertise, and really grow the share that those clients give to Firma and therefore generate real growth.

OFX’s future acquisition plans

Daniel Webber: Should we expect more acquisitions on the horizon? What would be the criteria for another acquisition?

Skander Malcolm:

We have been very consistent about our criteria and there’s three different ways we look at opportunities – three categories.

Category one is what we call middle of the fairway, where it’s a company that’s like us, where we can generate EPS accretion quite quickly through either faster growth or more cost synergies, and Firma’s a perfect example. There are still plenty of those companies that are in our pipeline that we’re in conversation with, therefore those opportunities continue to be out there.

The second category is what we would call a product adjacency. We have product road maps going out over the next three to four years and by segment. We don’t have to build all of that ourselves. Sometimes we find companies that have built these products or have deployed technology to do that job for clients. Our TreasurUp investment is the perfect example of that, and there are others like that that we are looking at.

Then the third one is more of a customer adjacency where we see companies that have clients that are very similar to ours, where they’re doing a slightly different job than us. Maybe it’s a joint venture. Maybe it’s an acquisition where if we bring them together, we can generate faster growth because we can just make the customer more productive, to be blunt.

We’ve got a very experienced board in M&A. We’ve got an experienced management team in M&A. We have a lot of ambition and we have very supportive shareholders. So I wouldn’t expect this to be the last transaction seen from OFX and we’re certainly excited to get this one closed in April.

Headcount benefits

Daniel Webber: Great, anything else you want to add on OFX’s acquisition of Firma?

Skander Malcolm:

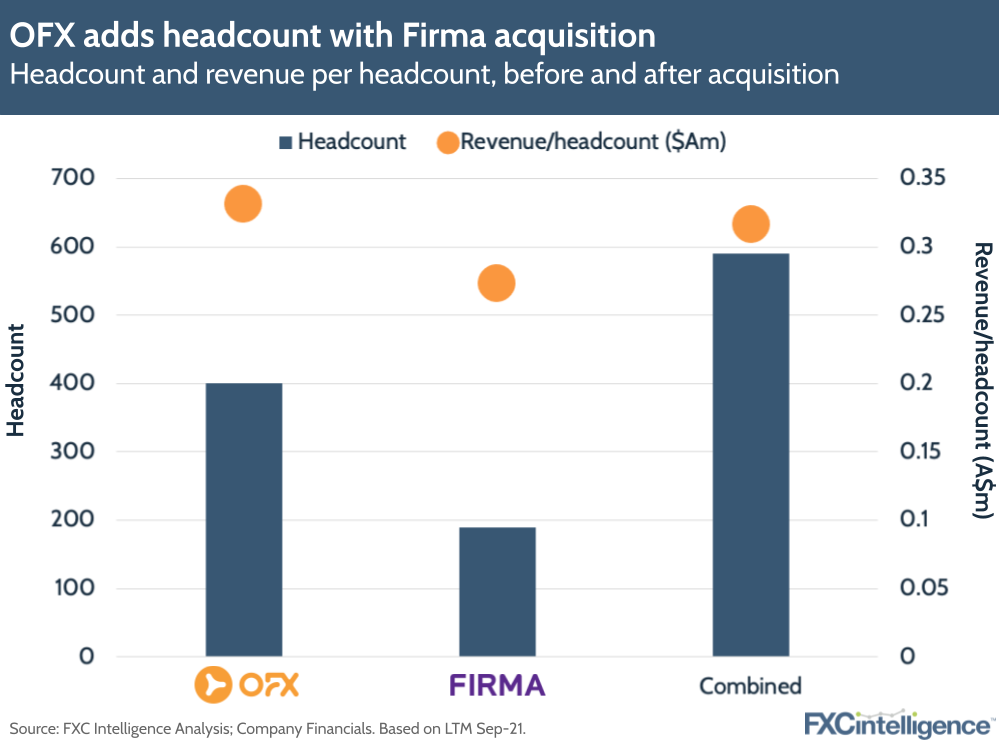

The last thing that I would add, which often gets missed when you’re looking at it from a more financial or strategic perspective, is what we’re really excited about also is you’ve got over 190 staff in Firma and I don’t know the single CEO that’s running it better than a minimum of 10% under staffed right now. The vacancy rates are high, it’s very challenging to recruit.

What we also love about this opportunity is it brings us 190-plus people who are specialists in the industry, who love customers, who have a good risk culture in one go. We think that is very, very valuable at a time like this. Obviously for our us, it’s about giving them a good career trajectory and more opportunities to be as good as they can be. So that’s probably the final point that I think gets missed a fair bit.

Daniel Webber: Skander, well done on the acquisition. Thanks for your time.

Skander Malcolm:

Thank you.