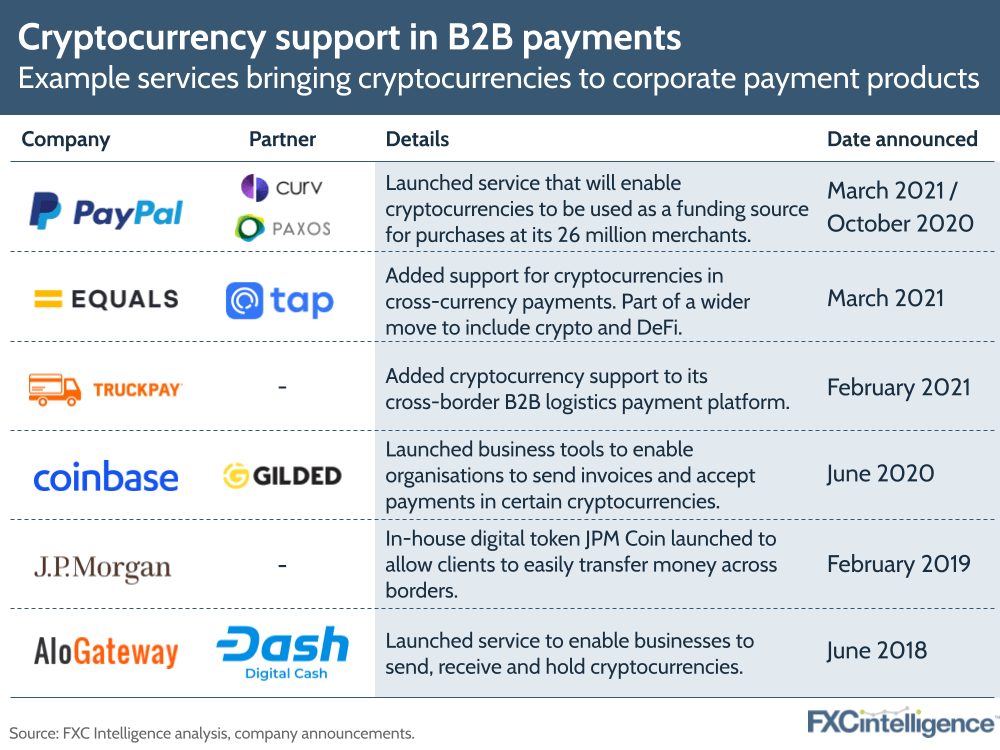

Last week, PayPal confirmed that it was acquiring digital asset security firm Curv as part of a wider initiative to support cryptocurrency payments that began in the US in October. This came shortly after a partnership between Equals Group and Tap.Global, which will see the former provide cryptocurrency exchange services to both B2B and B2C customers.

They’re the latest in a number of announcements that are seeing cryptocurrencies increasingly enter the B2B payments space – but how far could the development go?

Cryptocurrencies are beginning to be embraced by the wider business world, with headline-grabbing highlights including the $1.5bn bitcoin purchase by Tesla. But in payments, particularly in the B2B space, they remain a fringe option.

While blockchain – the technology that underpins cryptocurrencies – has been tested by a host of leading payments and banks, cryptocurrencies have been less widely used over concerns surrounding regulation, stability and corporate/banking partner constraints.

Some organisations, most notably J.P. Morgan, have embraced the technology on their own terms with in-house tokens, but a small but growing number now appear to be responding to corporate demand for payments in well-known cryptocurrencies.

A surge of corporate support for cryptocurrencies has been predicted for some time, and so far, we’ve not seen the enthusiastic swell some have suggested. But with top-tier payments companies such as PayPal now supporting digital currencies, the tide may finally be turning. We’ll be watching developments in the space carefully, so keep reading for future updates.