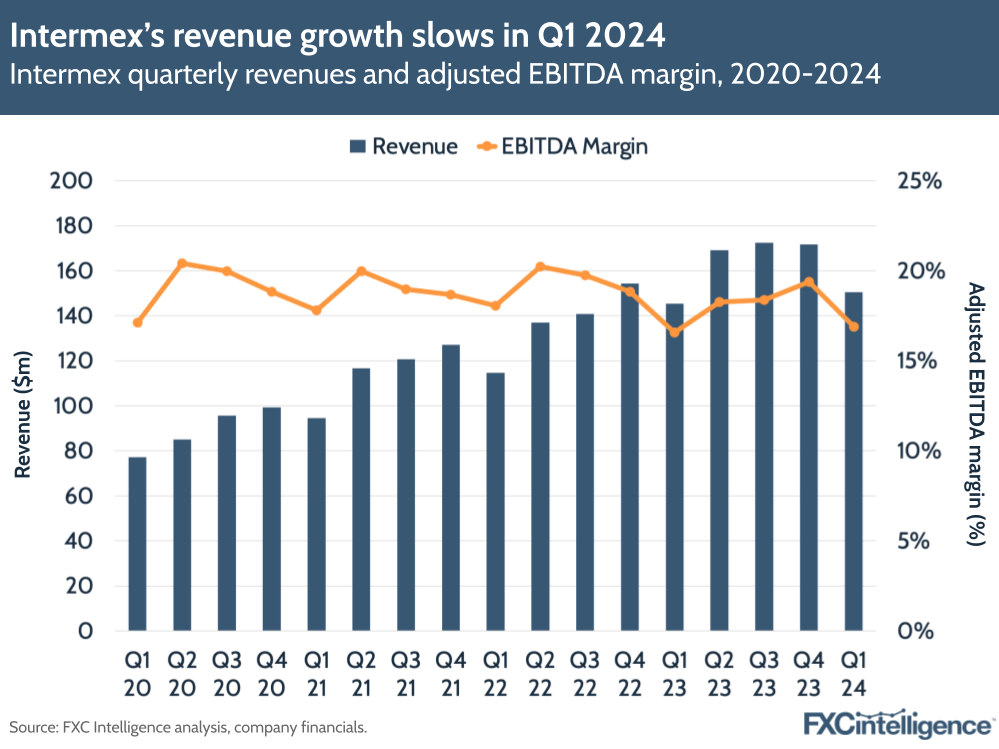

US-based remittances player Intermex saw revenues rise 3.5% to $150.4m in Q1 2024, meeting the lower end of expectations as the company reported softness across the the US-Mexico corridor. However, the company saw digital revenues rise 59.1% as it continues to expand its presence outside its core markets.

Intermex’s adjusted EBITDA rose by 5.5% to $25.4m, which gave the company an adjusted EBITDA margin of 16.9%. The company pointed out it has achieved this despite costs from the consolidation of Spanish remittances provider i-Transfer, which the company acquired in April 2023 alongside La Nacional, another LatAm-focused remittances player.

Intermex also noted that its recent integration of La Nacional had resulted in a four times increase in EBITDA, and that it had achieved revenue highs in ten countries.

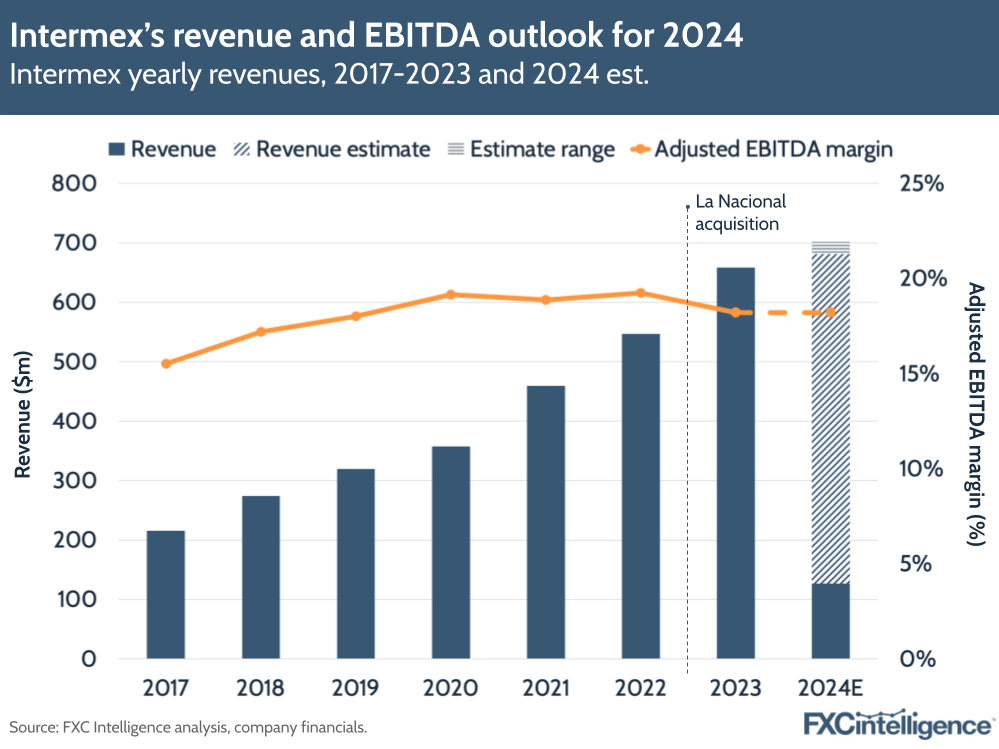

Intermex has reiterated its relatively conservative guidance for FY 2024, for which it expects revenues to rise by 3-7% to $681-701.8m, and an adjusted EBITDA of $124-127.7m, which would give an adjusted EBITDA margin of around 18.2%.

Meanwhile, for Q2, the company is expecting revenues to rise by 1.4-2.5% to $171.5-176.8m, and an adjusted EBITDA of $31.7-32.7m, which would give an EBITDA margin of 18.5%.

Intermex revenue growth drivers in Q1 2024

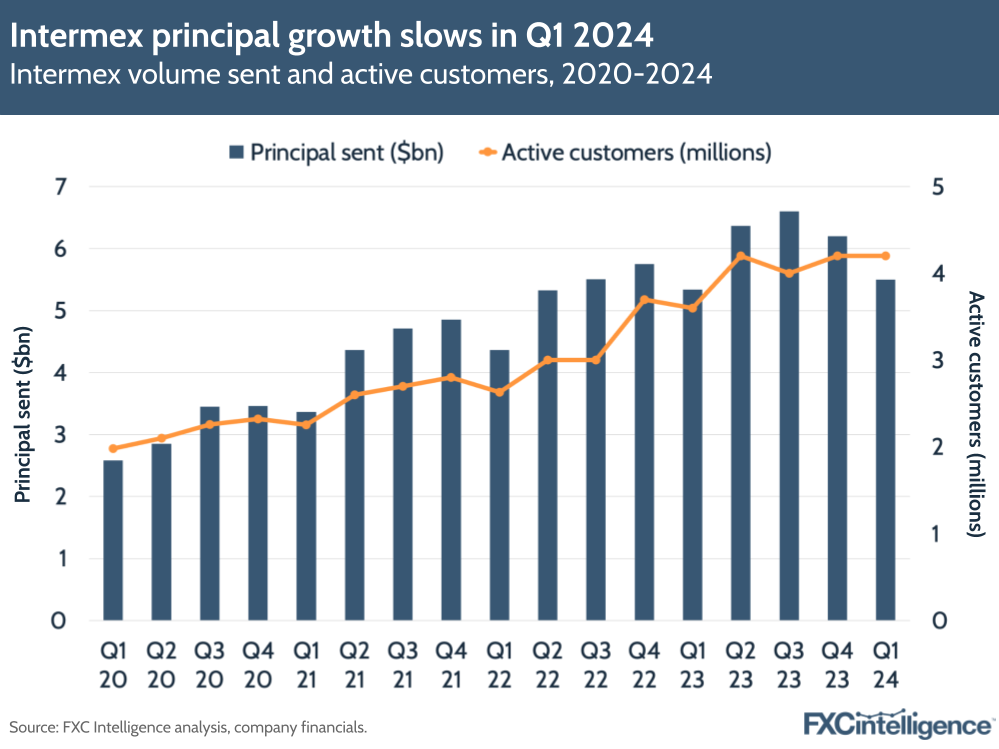

Intermex’s revenues continue to be bolstered by its recent acquisitions, particularly i-Transfer in Europe. It also mentioned a 3% rise in unique, active customers to 4.2 million. This helped increase the number of money transfer transactions by 4.8% to 13.5 million, which in turn drove a 2.6% increase in principal transferred to $5.5bn.

While positive, these growth percentages are significantly lower than previous quarters. For example, in Q1 2023 Intermex’s number of transactions grew by 28.6%, while principal transferred grew by 22.4%. It is worth noting that the Q1 2023 figures were bolstered by the new addition of La Nacional’s business in the US.

Expanding into new markets

In the Q1 2024 call, Intermex CEO Bob Lisy spoke about how the company is continuing to see softness in the Mexico market, which has historically been one of the major Latin America and the Caribbean (LAC) markets served by Intermex, along with Guatemala, the Dominican Republic, Honduras and El Salvador.

Intermex had mentioned in previous earnings calls that the changing value of the Mexican peso has led to pricing pressures from other services to Mexico, which has in turn affected the number of transfers being sent on the US-Mexico corridor (the world’s largest remittances corridor).

The company reports having around 20% of the market share in the top five LAC markets (Mexico, Guatemala, Dominican Republic, El Salvador and Honduras), which it says have a market size of around $96bn. However, Intermex also outlined how the company is looking to expand beyond these core LAC markets.

The company said that recent alliances have opened up a $250bn market opportunity in other markets and also highlighted that i-Transfer is currently active across an $81bn European market for outbound remittances (currently spanning Spain, Italy and Germany). Intermex said that it could also open up an additional $62bn market in other euro-using countries.

Intermex is still aiming to penetrate LatAm markets, particularly through its La Nacional acquisition, and also drive efficiency through in-process restructuring, which it believes can generate more than $5m in annual deal synergies.

Digital grows share of transactions

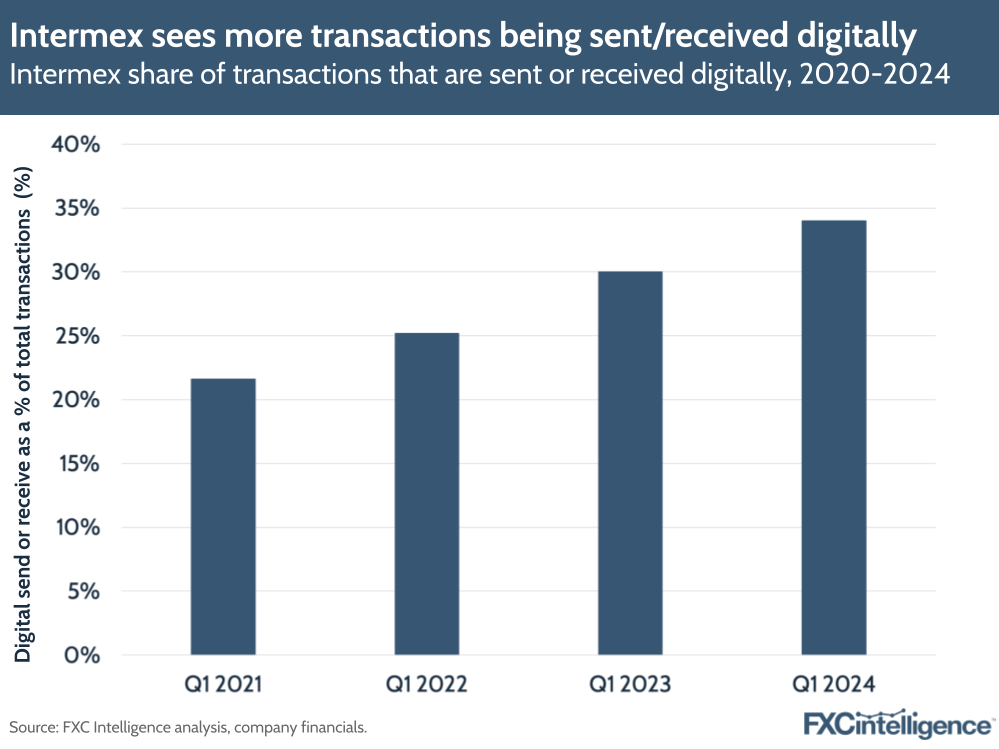

While softness in Mexico is affecting Intermex, the company is continuing to drive up digital transactions, which continue to take a growing share of the overall transactions sent and received through the company. In Q1 2024, 34% of transactions were sent or received digitally, compared to 30% in Q1 2023 and 25% in Q1 2022.

Intermex has also been forging more alliances to help expand its digital footprint. For example, in April the company announced a partnership with digital remittances provider Félix Pago to launch a new service allowing users to transfer money via messenger platform WhatsApp, while in March it partnered with labour management company Picktrace to enable remittances through its app.

The move to grow European markets is aligned with Intermex’s digital growth strategy, but the company is still keen to express the importance of an omnichannel approach, particularly in the US, where Intermex claims the US to LatAm retail market is estimated to be 3-4 times the size of the digital market.

With regards to Mexico, Lisy said that the company expects the market to get better as the year goes on, but the company has not reflected that expectation in its projections, given the volatility of the dollar and the peso. Either way, the company has made clear its aspirations to grow its presence in other markets and expand its digital offering, which could help it diversify its customer base.