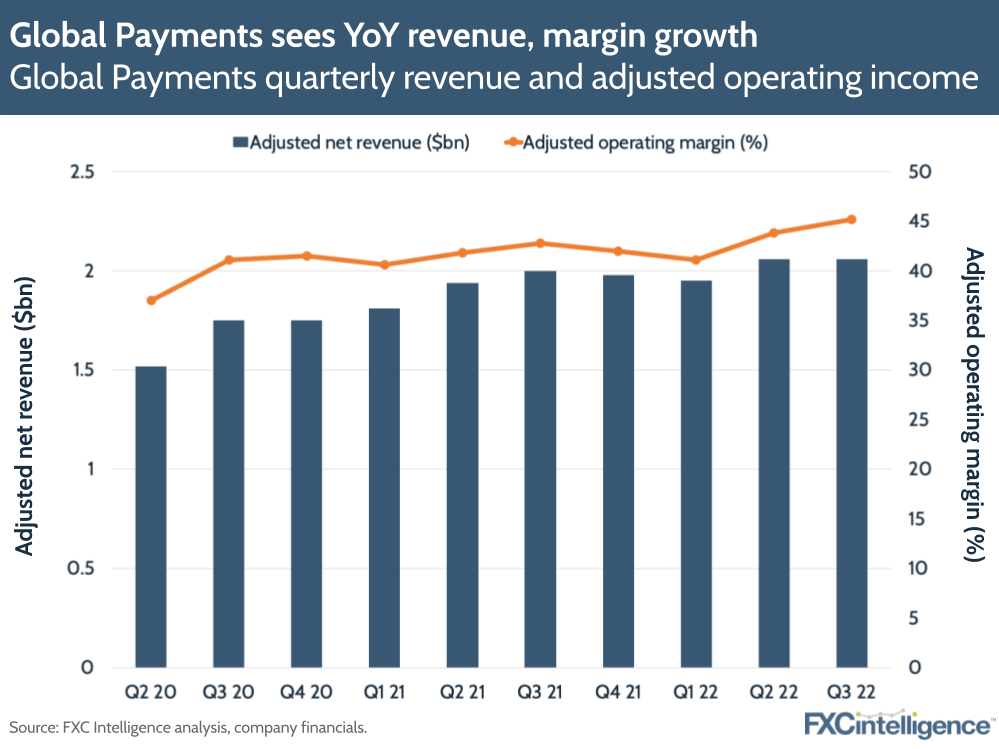

Payments processor Global Payments saw its adjusted revenues rise 3% YoY to $2.06bn in Q3 2022, while its adjusted operating margin grew 240 bps to 45.2%. Growth was offset by the company’s exit from Russia and the sale of card provider Netspend’s consumer assets, but the company continues to forecast revenue growth for FY22.

Adjusted net revenue growth would have been 6% on a constant currency basis, and 9% excluding the impact of exiting Russia and the $1bn sale of Netspend’s consumer business. The merchant solutions segment saw an adjusted revenue increase of 6.8%, while issuer solutions saw 1.7% growth. On the other hand, its consumer solutions segment saw a 22% decline, likely influenced by the Netspend sale.

Following the sale of Netspend’s consumer business and its $4bn acquisition of rival EVO Payments, Global Payments expects merchant solutions to represent approximately 75% of adjusted net revenue, while issuer solutions (including B2B) will comprise the remaining 25%.

Both the sale and acquisition are expected to close in Q1 2023 (subject to approvals). The company has taken steps to finance the EVO acquisition, including launching a $2.5bn debt capital raise and closing its $1.5bn strategic investment with private equity company Silver Lake.

Looking forward, Global Payments expects net revenue growth of 10-11% over 2021, excluding dispositions and on a constant currency basis. It also expects its operating margin to increase by up to 170 bps, higher than 150 bps stated previously. However, this growth presumes continued recovery from the pandemic and a stable macroeconomic environment throughout the remainder of the calendar year.

How does Global Payments’ pricing compare to other ecommerce players?