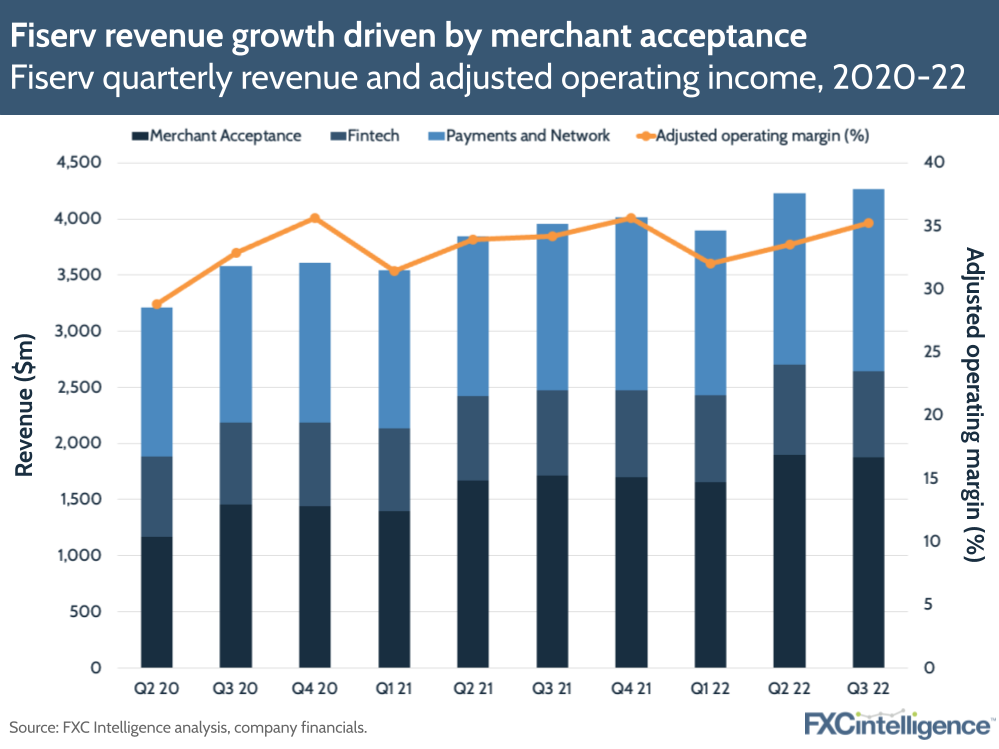

Payment processor Fiserv reaped the benefits of growing merchant acceptance and payments opportunities in Q3 2022, with its adjusted revenue increasing 8% to $4.27bn.

Adjusted revenue increased 9% to $12.41bn over the first nine months of the year. Meanwhile, organic revenue growth was 11% in Q3, led by 14% growth in Fiserv’s acceptance segment, 11% growth in its payments segment and 1% growth in its fintech segment. The company is well on the way to reaching its FY 22 expectations, and is now expecting organic revenue growth of 11% for the full year.

Fiserv’s payments and network segment saw notable growth, with its adjusted operating margin increasing 1.9% to 45.9% YoY. The revenue increase was spurred by 18% credit active account growth in North America, as well as its US money transfer product Zelle, which saw 34% growth in transactions and a 48% increase in number of clients. The company cited a number of trends boosting its payments arm, including a growing addressable market from healthcare, education and government organisations.

Meanwhile, Fiserv’s merchant acceptance business saw 10% and 5% growth across merchant volume and transaction growth respectively. Its point-of-sale offering Clover saw 19% revenue growth, while its omnichannel commerce system Carat saw growth of 18%.

During the earnings call, the company said that an uncertain macro environment was driving merchants towards full-service providers such as Fiserv, as opposed to single-issue specialists. However, it said that FX volatility did have an impact across the company’s revenues, with Clover being an example of this.

How does Fiserv’s pricing compare to other ecommerce players?