Payments processor FIS has announced its Q2 2023 results, which are above the top end of the company’s previous expectations for the quarter as its Future Forward cost-cutting initiative begins to bear fruit.

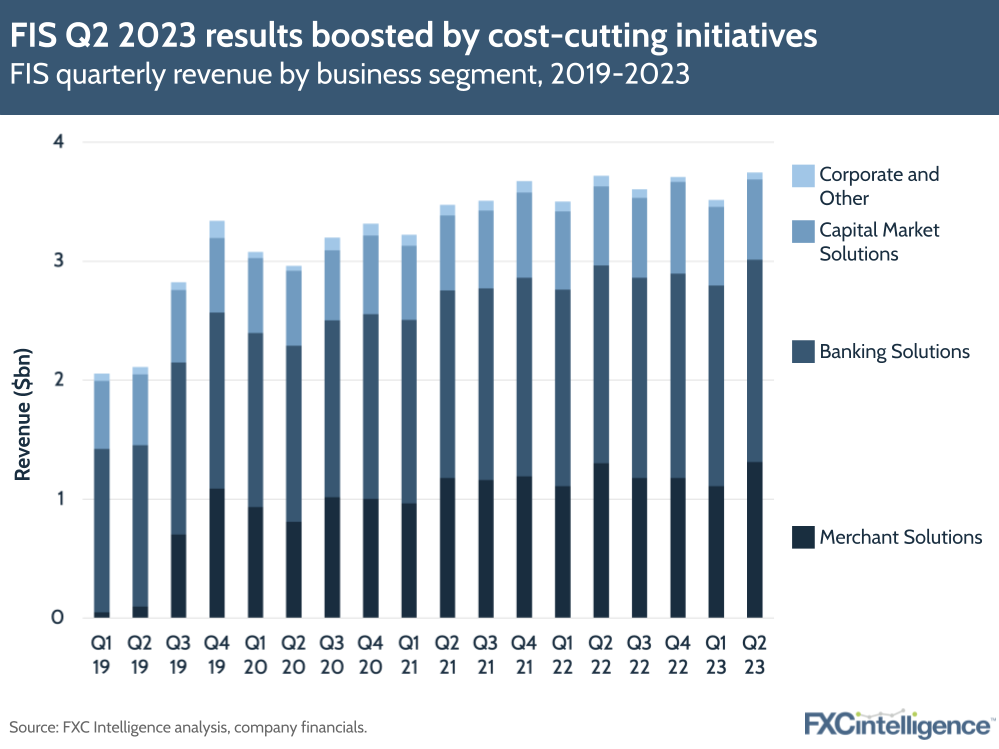

FIS reported a consolidated revenue YoY increase of 1% on a GAAP basis to $3.7bn, or 2% on an organic basis, although adjusted EBITDA reduced by 3% YoY to $1.6bn. This resulted in a 160bps cut to the company’s adjusted EBITDA margin.

However, FIS did report a net loss of $6.6bn in the quarter, compared to net earnings of $0.3bn in Q2 2022. This was the result of a $6.8bn non-cash goodwill impairment charge related to its Merchant Services division, which a month ago the company announced it was spinning back out into standalone company Worldpay, via the sale of a majority stake to private equity player GTCR. Today’s announcement includes an update on the performance of the division, which is now valued at almost half what FIS paid for it in 2019.

Shares in FIS were up at market opening following the publication of the Q2 2023 results, however dropped sharply shortly after.

Cost-cutting measures help drive revenue gains for FIS in Q2 2023

FIS has been undertaking extensive cost-cutting measures under its Future Forward initiative, which under the helm of CEO Stephanie Ferris has sought to reposition the company for growth while improving both the efficiency and effectiveness of the business’ core operations.

This drove the spinout of Worldpay, but has also reached an annualised run rate of cash savings of over $315m as of the end of Q2 2023. This includes $175m in operational expense savings and $140m capital expense savings. With the Worldpay spinout now underway, FIS expects cash savings by the end of 2024 to reach $1bn – down from the previous projection of $1.25bn.

Looking to FIS’s individual operating segments, growth in recurring revenue from processing volumes and professional services drove a 1% YoY increase, on a GAAP basis, in the Banking Solutions segment to $1.7bn – 2% on an organic basis. However, the division’s adjusted EBITDA margin dropped 200bps to 42.5% as a result of changes in revenue mix.

Meanwhile, Capital Market Solutions saw the strongest growth, at 6% on a GAAP basis or 7% on an organic basis, to $672m. The segment’s adjusted EBITDA margin also increased by 100bps to 50.2%. This was attributed to strong growth in recurring revenue.

However, Corporate and Other saw a 43% decrease to $60m as a result of the divestitures of non-strategic businesses, resulting in an adjusted EBITDA loss of $143m.

Worldpay/FIS Merchant Solutions sees volume growth

FIS’s Merchant Solutions division, which will be spun back out to become Worldpay, also saw modest growth, with revenue increasing 1% on both a GAAP and organic basis to $1.3bn. This is a positive sign given that FIS had projected a YoY retraction for the segment in 2023, and is partly the result of ongoing strength in ecommerce.

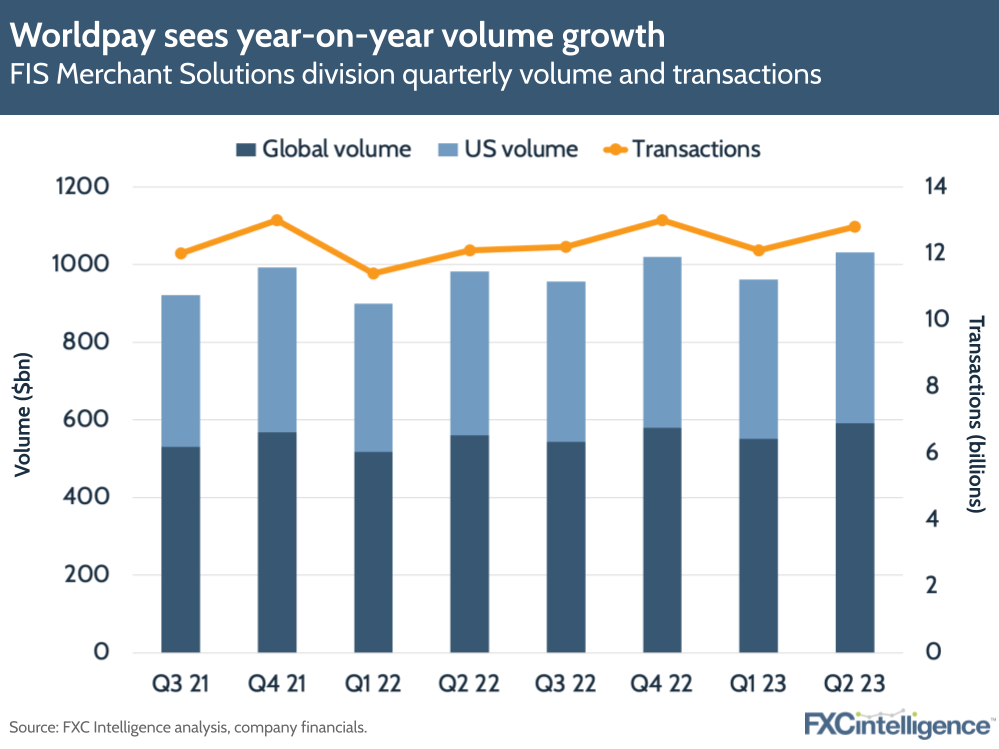

Merchant Solutions in particular saw positive growth in terms of volume, with global volume increasing 6% YoY on both a reported and constant currency basis to $591bn. Meanwhile, US volume grew 5% on a reported and constant currency basis to $441bn.

Transactions are also the highest they have been for this quarter, and only slightly below the holiday season-driven highs of Q4 22, at 12.8 billion.

FIS raises FY 2023 projections

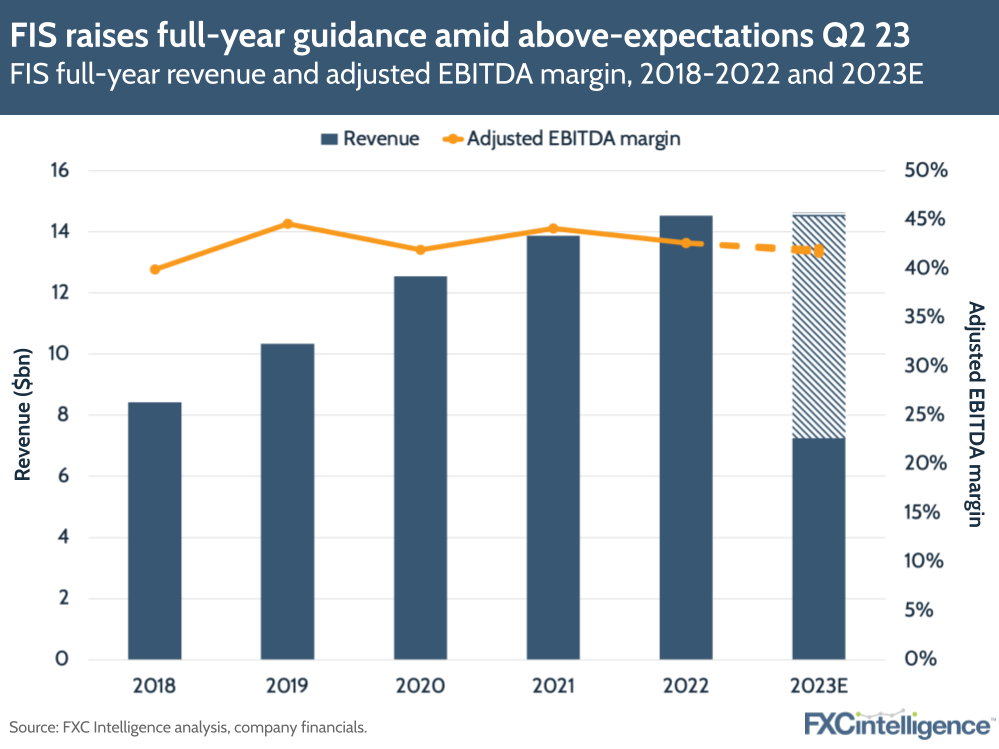

The results have prompted FIS to increase its projections for FY 2023 to $14.5bn-14.6bn, from its Q1 2023 projection of $14.3bn-14.5bn. The company now also anticipates a FY 2023 adjusted EBITDA margin of 41.6-42%.

From Q3 2023, FIS will also change how it reports the Worldpay Merchant Solutions business revenue. From next quarter, this will be shown as part of ‘Discontinued operations, net of tax’ and no longer shown as part of the main FIS revenue.