Since Bitcoin’s introduction to the market in 2009, the debate as to how blockchain, distributed ledger technology (DLT) and cryptocurrency (“blockchain”) can change the payments world has been raging on.

This week, we’re taking a detailed look at the blockchain players focused on changing the international payments industry.

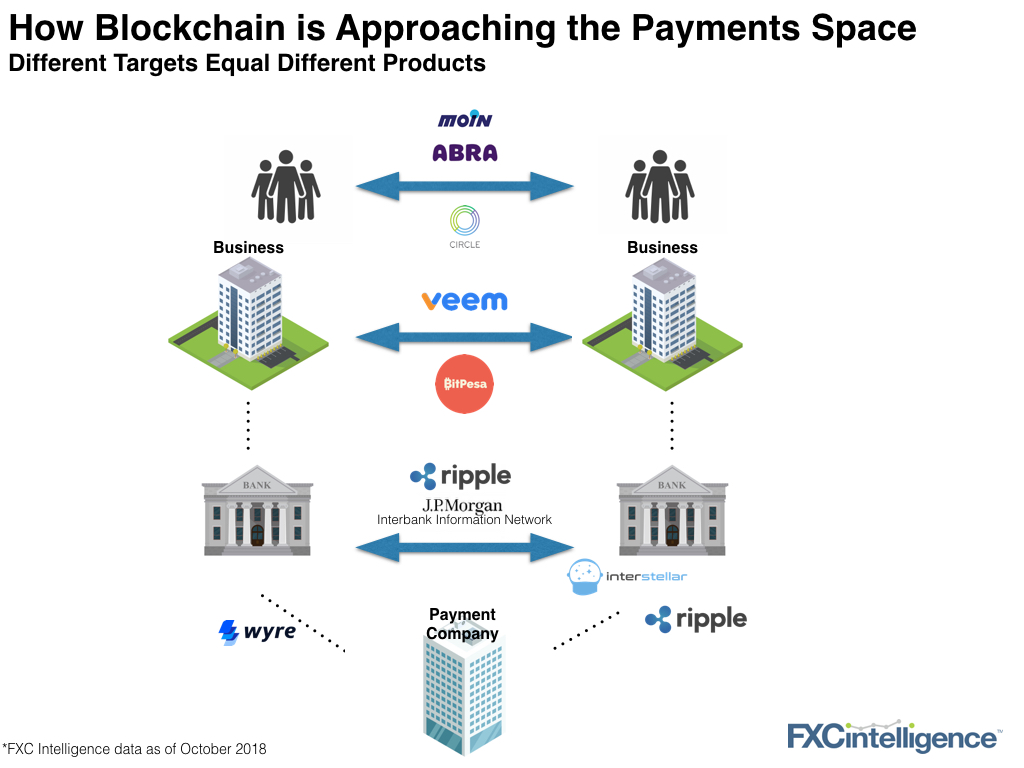

In our chart, you can see that blockchain technology goes far beyond peer-to-peer payments, with products being developed for two core purposes.

- Customer facing products: Individual to individual payments and business to business payments

- Supplier facing products: Bank/payment companies to bank/payment companies and liquidity

The main benefit is often around speed, especially moving funds from or to developing markets, which benefits financial inclusion too. Second, blockchain can provide accurate tracking and messaging through its ledgers. Third, treasury functions can be optimised by reducing the need to pre-fund in the recipient market.

The big question on everyone’s mind is not whether blockchain can become a larger part of the payments world. It’s already there. Of the companies above, Ripple is certainly furthest along operating in 40 countries for its RippleNet (SWIFT alternative) product and JP Morgan has 75 banks signed up to its initiative.

The questions are how blockchain moves beyond its focus on solving developing market settlement issues and reducing counter-party risk and how it moves from pilots to widespread use. Aside from the lack of (centralised) regulation and common technology standards, what else is holding this development back?

[fxci_space class=”tailor-6331b024d1f8h”][/fxci_space]