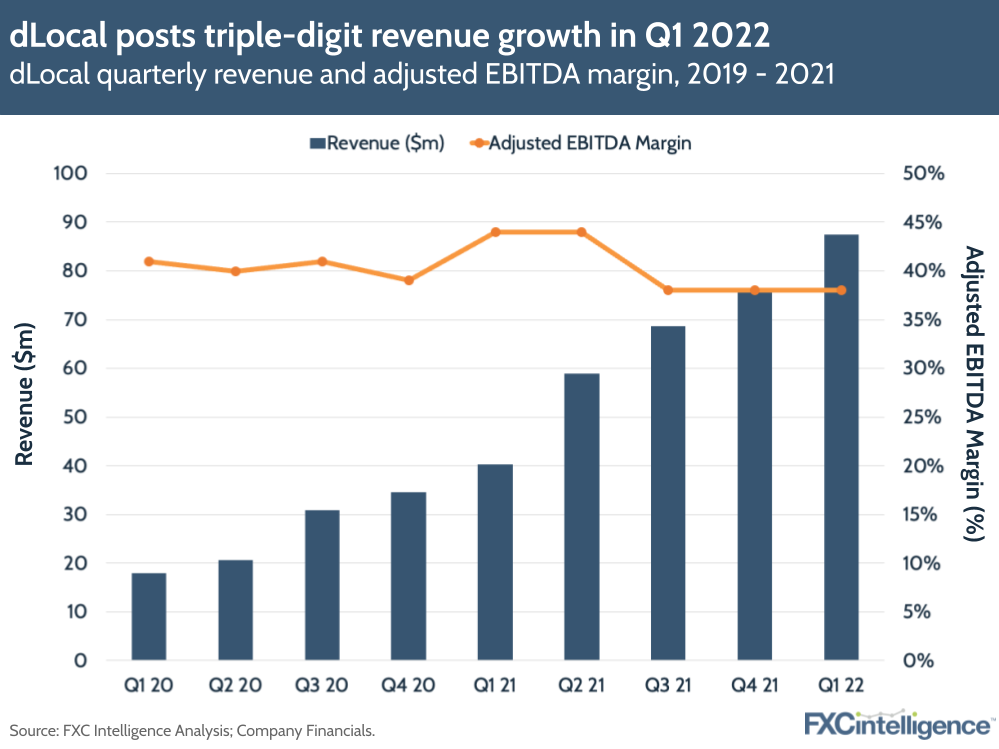

Unphased by market pressures, cross-border payment specialist dLocal had a strong opening quarter in Q1 22, marking a 117% increase in total revenues to $87.5m. The company’s diversification strategy and high net revenue retention have given it a good foundation for growth in 2022.

Key takeaways from dLocal’s Q1 results:

- Revenue and total payment volumes saw triple-digit growth, with the former growing 117% to $87.5m (from $40m in Q1 21) and the latter growing 127% to $2.1bn (compared to $926m in 2021).

- Adjusted EBITDA margin remained in line with Q4 2021, but declined to 38% from 44% in Q1 21, whilegross profits grew 87% YoY.

- Latin America continues to be the company’s main growth region, more than doubling revenues from $36m to $78m over the yearly period. The company’s efforts to secure new business in Asia and Africa also paid off, with these areas seeing a 127% YoY increase to $10m overall.

- Revenue is being driven primarily by the rapid expansion of existing clients. The company saw net revenue retention of 190%, with existing merchant revenues growing from $33m in Q1 21 to $77m in Q1 22. New merchants (including 10 new ‘significant’ additions) provided an extra $11m in revenue for the year.

- Diversifying merchants has boosted the company’s resilience. dLocal executives said that it supports merchants from 10 different verticals, with no single vertical accounting for more than 20% TPV in Q1 2022.

- dLocal also expanded its presence to Ivory Coast and Rwanda, bringing its total number of countries served to 37.

- The company saw little to no impacts from the Russia/Ukraine conflict, due to the fact it has no exposure to the countries involved.