Last week, Visa reported its Q2 2024 earnings (covering calendar Q1 2024), while this week Mastercard has reported its Q1 2024 results.

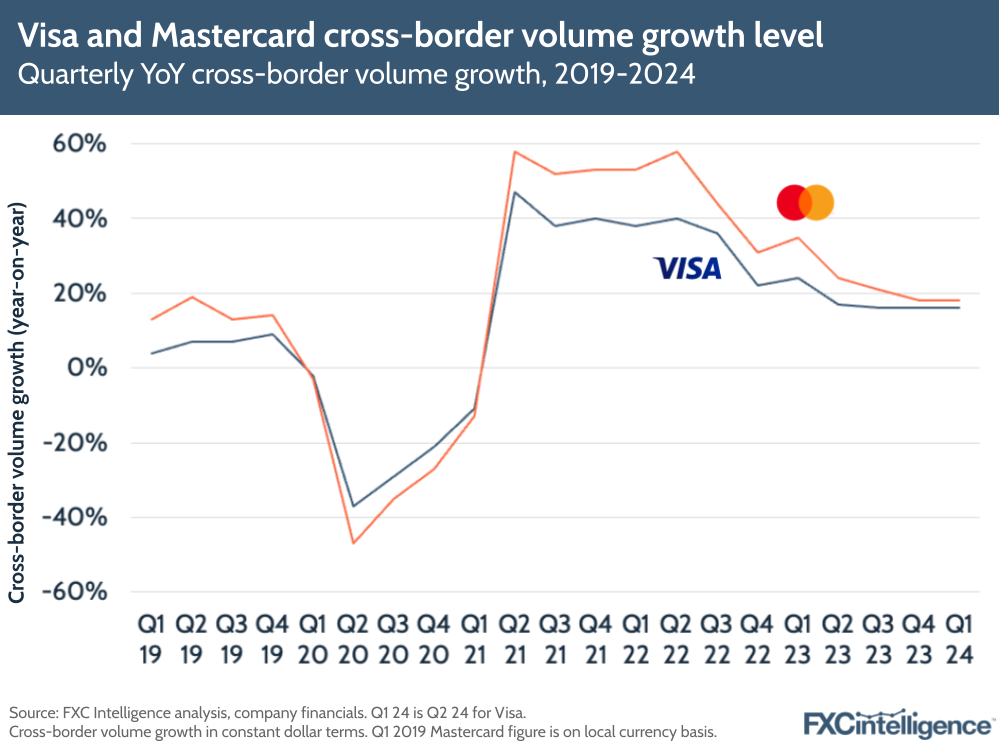

It has been a positive quarter for the two companies, with net revenue increasing 10% for both players, and strong signs in the cross-border sides of the businesses, across both ecommerce and travel.

Visa Q2 2024 highlights

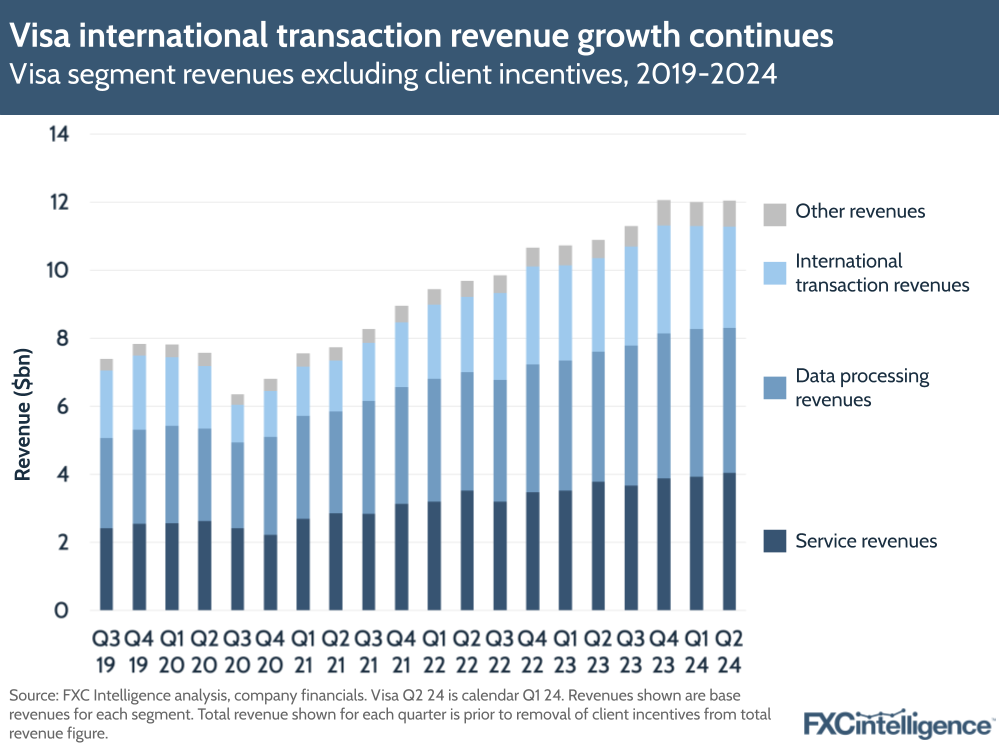

- Overall, Visa saw net revenue climb 10% YoY in its Q2 2024 results, to reach $8.8bn in the quarter.

- The company also saw payments volume increase by 8% YoY, while processed transactions grew by 11% over the same period to reach 55.5 billion.

- However, cross-border was a key growth driver for the company, with cross-border volume both in total and excluding intra-Europe climbing by 16%.

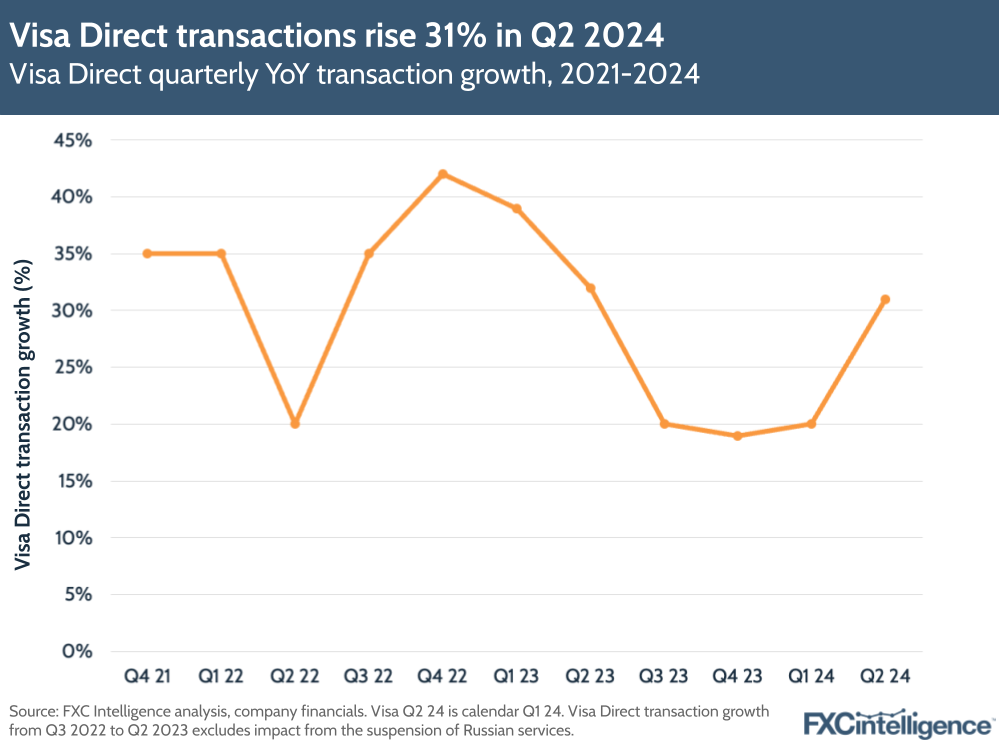

- Visa Direct, the company’s cross-border B2B2X platform, also saw a 31% rise in transactions.

- The company also completed the acquisition of cloud-native issuer and core banking platform Pismo in the quarter, which will enhance Visa’s support for emerging payment schemes and real-time payment networks.

- Visa now expects FY 2024 revenue growth in the low double-digits. The results, which were above expectations, prompted a share price rise.

Mastercard Q1 2024 highlights

- Mastercard saw Q1 2024 net revenue increase 10% YoY, or 11% on a currency-neutral basis, to $6.3bn.

- Gross dollar volume saw 10% growth worldwide to reach $2.3tn, with the US seeing 6% growth while the rest of the world climbed by 13%.

- Cross-border was a key growth driver for Mastercard, with cross-border volume growing 18% YoY on a local currency basis.

- Cross-border assessments, which are the fees associated with transactions for cards issued in regions other than where they are acquired, also saw the greatest growth among payment network-related fees, increasing 21% YoY to reach $2.2bn in Q1 2024.

- The results saw Mastercard beat analyst expectations, however the company reduced its FY 2024 expectations. It now expects FY net revenue growth at the low end of low double-digits, having previously projected growth in the high end of this range. This, combined with a slowdown in volume in April, led to a share price drop.

Cross-border continues to drive Visa growth in Q2 2024

The continuing outperformance of Visa’s cross-border payments services across its business highlights the significance of it for Visa, with CEO Ryan McInerney citing the volumes posted by the company as indicative of “stable consumer spending”.

Within this, Visa reported cross-border card-not-present volume growth, which generally covers cross-border ecommerce, in the mid-teens – higher than expected. However, cross-border travel volume was particularly strong, increasing 17% YoY and up 152% on pre-pandemic 2019 levels.

Travel was particularly strong in Latin America and the Caribbean, as well as in Europe and the Middle East and Africa. Inbound US travel, meanwhile, continues to recover, however Asia-Pacific travel volumes were lower than expected, which the company believes is the result of currency and macroeconomic weakness in the region alongside lower airline capacity.

Visa expects to see strong mid-teens growth in cross-border volume excluding intra-Europe, with strong ecommerce offsetting the weakness in Asia.

On consumer payments, the company is bullish on future prospects, highlighting a total addressable opportunity topping $20tn. Here the company is focusing on expanding Visa credentials, including converting domestic-based cards around the world, and highlighted its upcoming Olympic sponsorship as a key opportunity. It also sees opportunities in co-branded issuance and newer digital-first players, including adding card credentials to expand the capabilities of digital wallets.

Visa also sees tap-to-pay and ecommerce being vital elements in the digitisation of payments and the move away from cash, with the company continuing to see ecommerce volume grow at a faster rate than face-to-face spend in many parts of the world, including the US, Canada, Brazil, Australia and India.

Visa Direct also plays a critical role in the company’s ongoing growth, with the company reporting a 14% YoY growth in new flows revenue and Visa Direct transactions climbing 31% to reach $2.3bn in the quarter. Latin America’s increased P2P app interoperability was a particular driver of growth in the quarter.

The company is focusing on growing Visa Direct through several areas, including new use cases, geographies and enablers. The company cited its recent partnership with Thunes as a key example, alongside the news that long-standing partner J.P. Morgan Payments would be integrating Visa Direct into their acquiring operations.

Mastercard sees cross-border-led uplift in Q1 2024

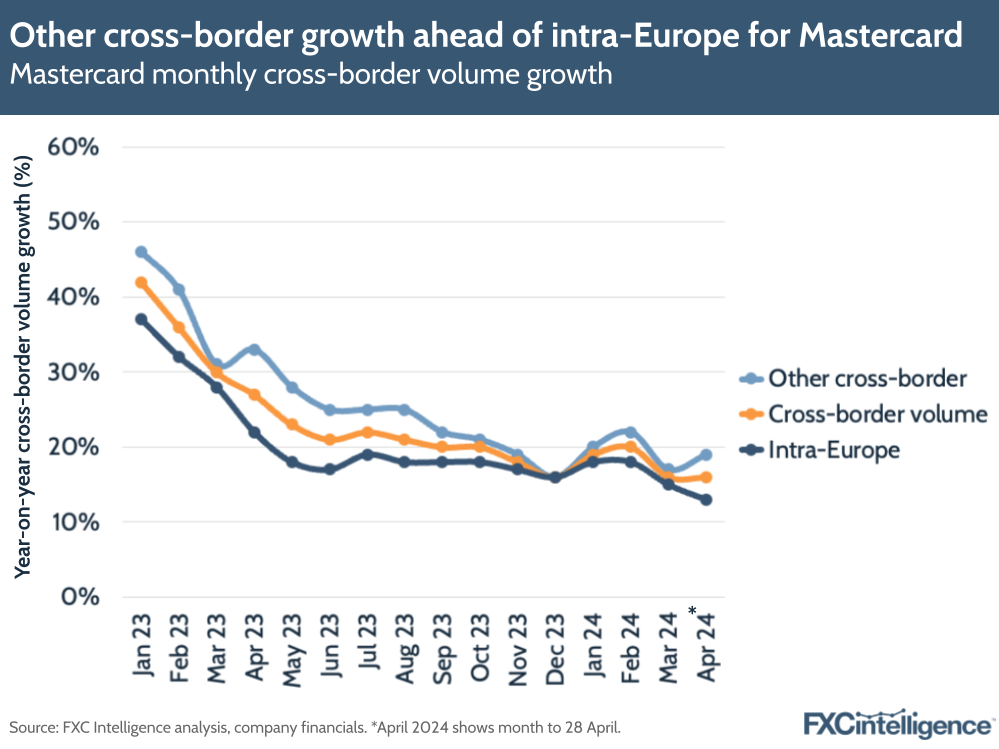

Mastercard highlighted “strong cross-border volume” in its Q1 2024 earnings, which saw 18% growth YoY on a local currency basis.

Within this, cross-border card-not-present excluding travel, which is the metric for cross-border ecommerce, saw particularly strong growth of 21% YoY. This follows YoY growth of 18% in Q4 2023.

Cross-border travel, meanwhile, saw 17% increase in Q1 2024, following an 18% increase in Q4 2023.

There was also some variation in growth between intra-Europe cross-border volume and other cross-border volume. Here, other cross-border growth has been consistently a few percentage points higher than intra Europe, a trend that has continued across the last few quarters.

Notably, initial data for April, which runs until the 28th of the month, shows growth at a slightly lower rate than for Q1 or any of the months within it, with month-to-date overall cross-border volume at 16% YoY growth. This is consistent with other non-cross-border volume metrics, and is thought to have contributed to the negative market reaction to the results.

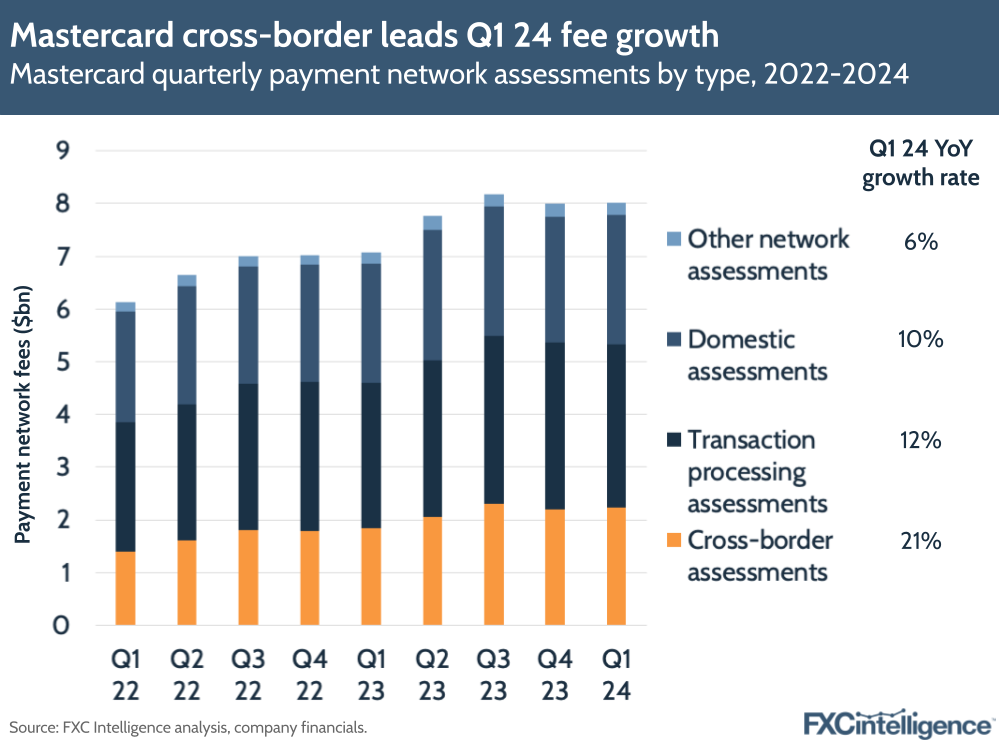

Meanwhile, data on Mastercard’s payment network assessments – the fees that the company charges for different types of transactions – shows that cross-border assessments have seen growth at a significantly higher rate than other segments.

While it produces lower total fees than domestic or transaction processing assessments, it grew 21% in the quarter, while transaction processing, the next fastest growing type, grew by 12%.

Looking more generally, while Mastercard saw revenue overall increase by 10% on a GAAP basis, its payment network saw a YoY increase of 7%. However, its value-added services and solutions segment, which covers areas including cybersecurity and intelligence solutions including those focused around identity and authentication, saw growth of 16%.