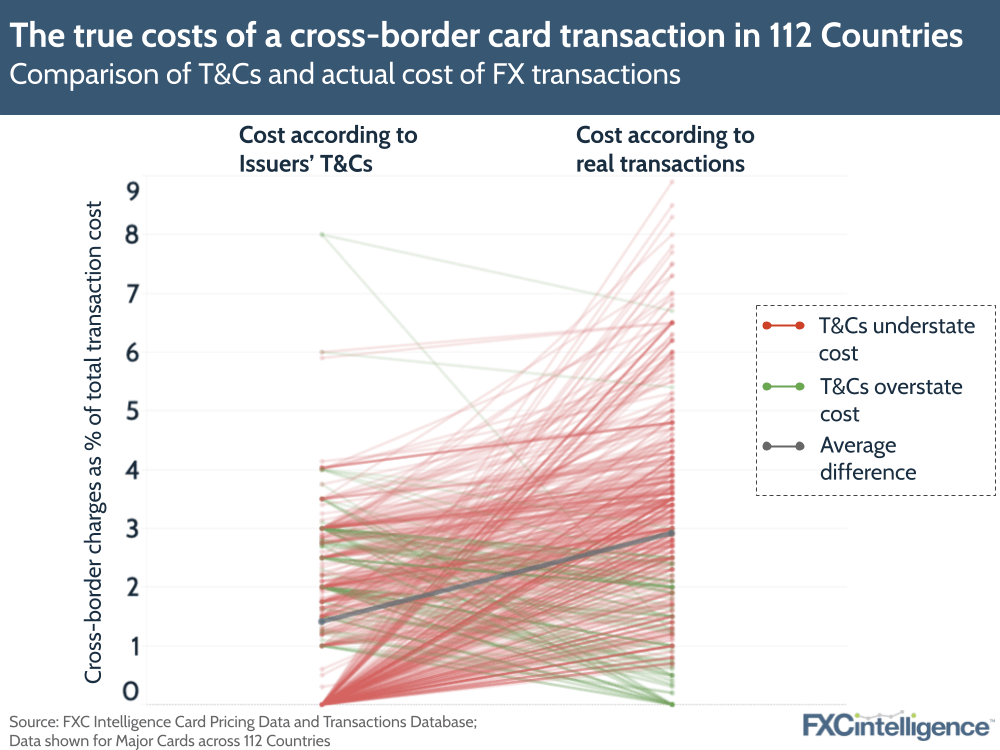

Our global card dataset tracks the costs of using a debit or credit card for a cross-border transaction (ecommerce or POS). This week, we uncover one of the core findings of our data utilising our database of real cross-border transactions:

60% of card programmes charge a higher fee than what is reported in their issuer’s official T&Cs. In some cases, the cost of using a card can easily result in an additional 3-10% more on the total cost of the transaction versus what is mentioned in the T&Cs.

This cost and transparency problem offers an opportunity for merchants and payment processors to provide customers with different solutions. They can offer the customer the ability to pay in their home currency on international websites – not always a zero cost but often lower (see our data). They can also improve the customer experience by highlighting these costs. Or they can offer their own lower cost FX experience unlocking significant margin opportunities.

In the FXC Intelligence Card Pricing dataset, we have been tracking the true cost to customers of FX payments made through debit and credit cards across 112 countries for a number of years. This data can help you:

- Optimise DCC, MCC and MCP strategies to improve margins.

- Improve transparency by breaking down currency conversion costs and retain customers.

- Improve customer service and the customer journey.