With Black Friday on the horizon, online retailers will be looking to profit from another frenzy of ecommerce activity, not just in their home markets but across the globe. However, given the recent downturn in ecommerce, we are surprised to still see so few merchants leverage opportunities to offer home currency solutions for cross-border sales, where there are significant margins to be gained, as well as providing a better customer offering.

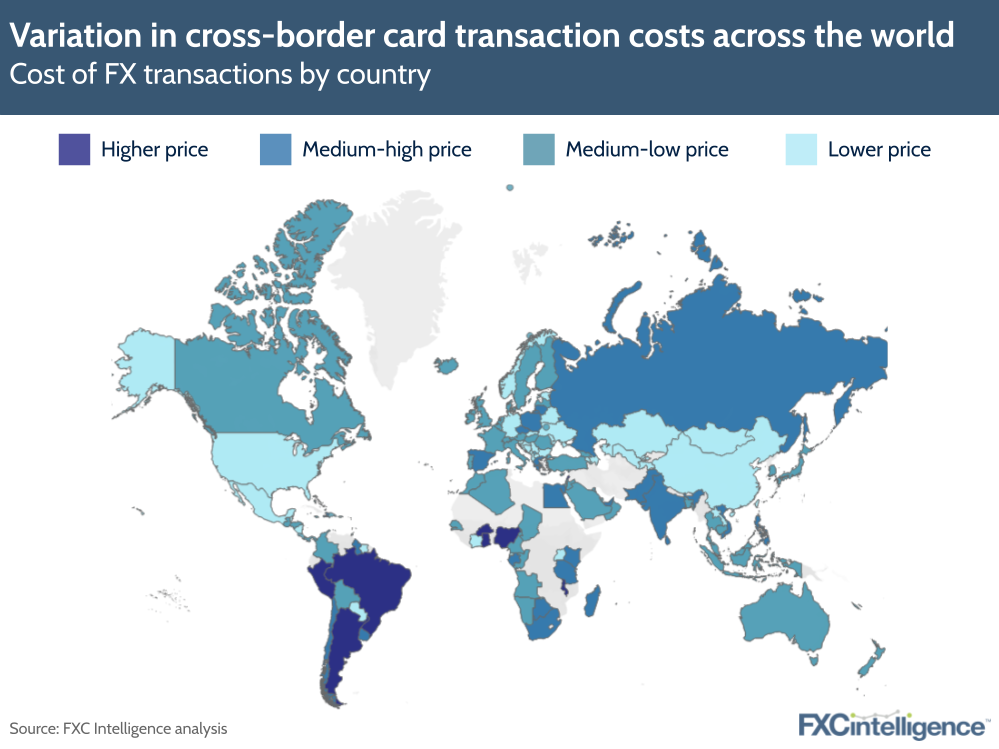

Our global card and transactions dataset, which tracks the cost of using debit and credit cards for cross-border transactions across 700+ issuers in 120 countries, highlights how varied cross-border transaction costs are across the globe.

Cross-border card transaction costs vary widely across countries and show little in the way of regional coherence. Regional neighbours sit next to each other in stark contrast, falling into opposite categories of very high versus low fees.

Brazilian card issuers, for instance, collect very high fees, while issuers in neighbouring Paraguay tend to charge relatively low fees. This is similarly the case with Ghana and Côte d’Ivoire, with customers having to pay high fees in the former country, and low fees in the latter. Sometimes fees in certain countries can even surpass 10% of the transaction amount for a cross-border transaction.

A number of factors influence how much an issuer in a certain country may charge for a cross-border transaction, such as exchange rates and the margins applied by card networks; currency exchange fluctuations; government regulations, which cap how much issuers can charge; and undisclosed processing costs.

Our data reveals, however, that banks often levy fees that exceed what is stated in their T&Cs, or don’t even publish T&Cs, ultimately leaving customers in the dark about how much a cross-border payment will cost them. This provides merchants the opportunity to offer customers alternative solutions, such as the ability to pay in their home currency, and capture additional margin on the transaction.