Despite a deal being secured within weeks of the deadline, most of the cross-border payments space was ready for the Brexit transition on 1 January. The Brexit vote was over four and a half years ago and most players (at great cost), secured European licenses/offices to continue to deliver most of their product sets.

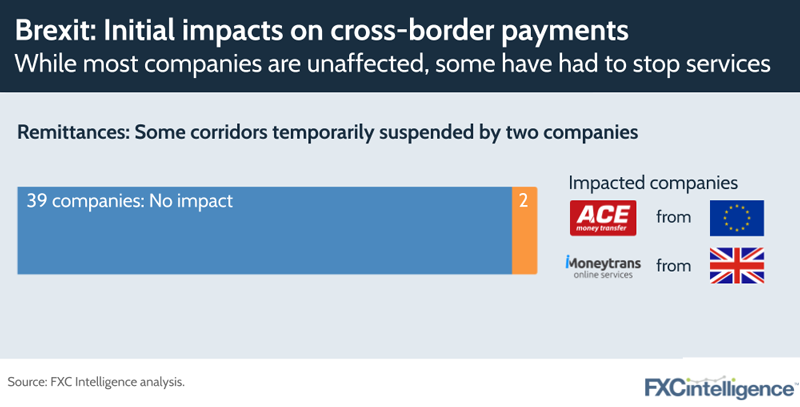

In remittances, out of the 41 payment companies that FXC Intelligence tracks UK outbound pricing data for, two were forced to temporarily stop transfers in some corridors. iMoneyTrans has stopped online services for sending money from the UK, which it says will last for around three weeks. Meanwhile, ACE Money Transfer has temporarily halted services from outside the UK, impacting customers wanting to transfer money from Europe to the UK.

However, in e-commerce the situation has been more challenging, with information about changing VAT requirements coming late, forcing many companies to pause shipping to or from the UK while they arrange appropriate paperwork. For some, the associated increased costs, or other new regulatory barriers, have proved too onerous, leading them to end cross-border trade with the UK indefinitely. The result of this is that cross-border purchases across UK corridors are likely to be hit, particularly among small traders – and therefore their payment providers.

Of course, we’re still in the early stages of the UK as a non-EU country, and many details are still being worked out, including how financial services will operate across borders. Expect more coverage – and, in all likelihood, a few surprises – as the year progresses.

Sign up to our newsletter to stay up to date on industry developments