From a cross-border perspective, banks have seen several trends in 2023, including partnerships to launch new products aimed at fending off digital challengers; the delivery of central bank digital currency projects; and real-time/instant payments.

Banking partnerships to improve payments offerings in 2023

Continuing a trend from last year, banks are partnering with companies to help improve their payments offerings, with one example being buy now, pay later (BNPL). For instance, US bank Standard Chartered has been introducing online and instore BNPL options for credit cardholders in APAC, while French bank BNP Paribas has teamed up with B2B BNPL Hokodo to provide BNPL services to businesses.

Banks such as BMO and CaixaBank have also been introducing mobile wallets to enable more seamless payments. In CaixaBank’s case, its wallet is specifically designed for cross-border payments and offers virtual accounts to businesses to help them send and receive global payments across over 50 currency pairs.

There has also been a continued focus on open banking, which allows financial data to be shared between banks and third-party service providers (e.g. mobile apps). UK bank NatWest, for example, now allows businesses to make payments through a secure payment link sent by email, text or social media, even if they don’t have the recipient’s account details. It was reported in July 2023 that 11 million UK payments were made using open banking technology that month; up to July, open banking payments rose 102.4% compared to 2022.

Money transfer service Wise and messaging platform Swift have also introduced a new correspondent banking product to help increase cross-border payment options for financial institutions. Essentially, banks will be able to route the cross-border payments messages they would usually route through Swift directly through Wise Platform, which Wise says will make payments much faster – without a massive changeup to legacy systems.

“The broader theme in the market right now has turned a corner on a past theme of different networks trying to compete with each other for the future of payments,” Wise Head of Americas Ryan Zagone told FXC recently.”Now, there’s actual ways we can collaborate using the technology that’s already plugged in.”

Instant payments continue to rise

Continuing the theme of payments collaboration, instant payments has continually been a theme for banks in 2023, as countries around the world move to introduce seamless, 24/7 payment processing through specific rails. Under a recent European Parliament mandate, for example, banks and other payment providers that enable euro transfers will be required to make these services instant, at no extra cost.

According to the European Central Bank, there are now more than 70 domestic fast payment systems around the world. Some of the best known are India’s Unified Payments Interface (UPI), Brazil’s Pix and the UK’s Faster Payment System. In July of this year, the US launched the FedNow instant payments service for domestic payments and is in the process of trying to persuade banks in the region to join.

Continuing from 2022, a key focus has been to link these domestic payments systems across borders, thus enabling cross-border payments to be completed quickly and in the payer’s native currency. For example, earlier this year, Singapore linked its PayNow system to India’s UPI, which allows financial institutions to transfer funds instantly between bank accounts.

This has been one of several linkages of such systems recently in Southeast Asia, which may be because countries in the region have rapidly adopted e-wallets and mobile money that already make payments more seamless. However, in countries like the US, where many still use checks and are used to legacy ACH systems, encouraging buy-in from banks to systems like FedNow (and RTP, another private instant payments service) has taken much longer. In an FXC report on FedNow earlier this year, experts said that it’s unlikely to be linked up with other domestic payments systems any time soon.

Also folded into this has been a move from banks to adopt ISO20022 – a certification for payment messages sent via Swift that is supposed to be more transparent, hold more data and boost interoperability between banks. Following the launch of Swift’s migration in March, banks have been moving to adopt the new messaging system so that they are ready to start using it in 2025 – but many banks have raised concerns that they won’t be ready by then. This is because many banks are still using legacy payment systems, which take a long time to update.

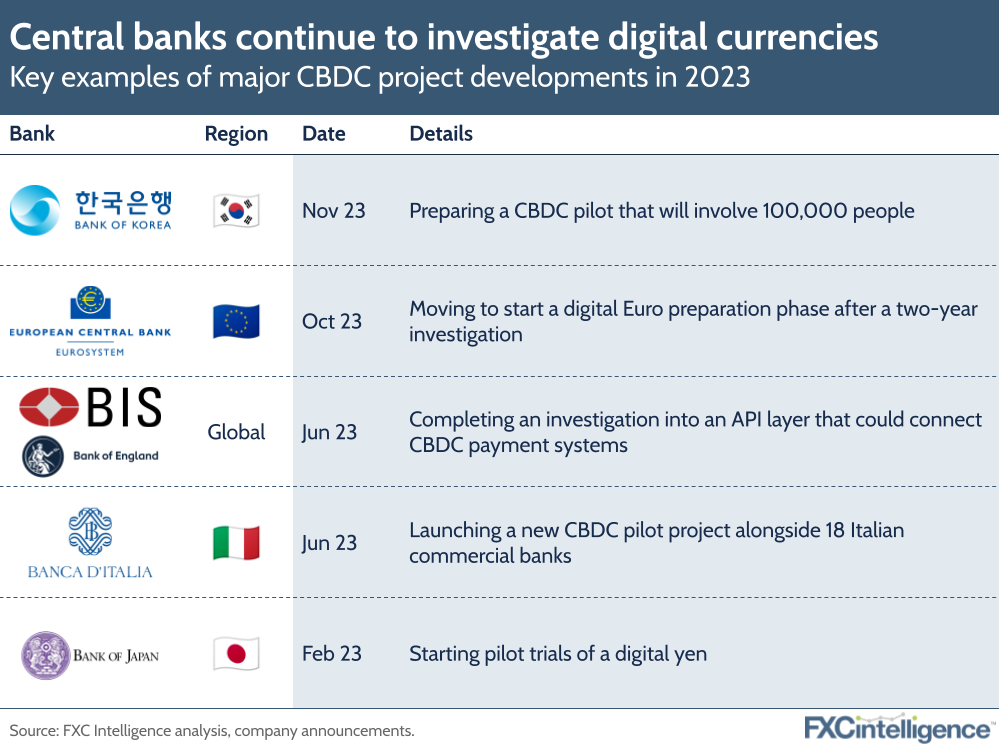

CBDC projects in 2023

Another continued trend for 2023 has been banks exploring the use of central bank digital currencies (CBDCs) – centralised digital assets that are hoped to offer more seamless cross-border payments but without the volatility found with regular cryptocurrencies. Some examples of key CBDC projects are included below.

Research from the Atlantic Council’s CBDC tracker showed that 131 countries worldwide are now exploring a CBDC; of these, around 65 countries are now in an advanced phase of exploration, so have either launched, piloted or are developing a CBDC. Meanwhile, 46 are at the research stage while 16 are inactive and two have been cancelled.

Cross-border settlement has been a key aspect of CBDC development, and is being explored by global projects such as Project mBridge. Unlike many central banks that are developing their own digital currency, this project has been experimenting with a multi-CBDC to find out if this could help eliminate high costs, low speed and transparency issues that often come with cross-border payments.

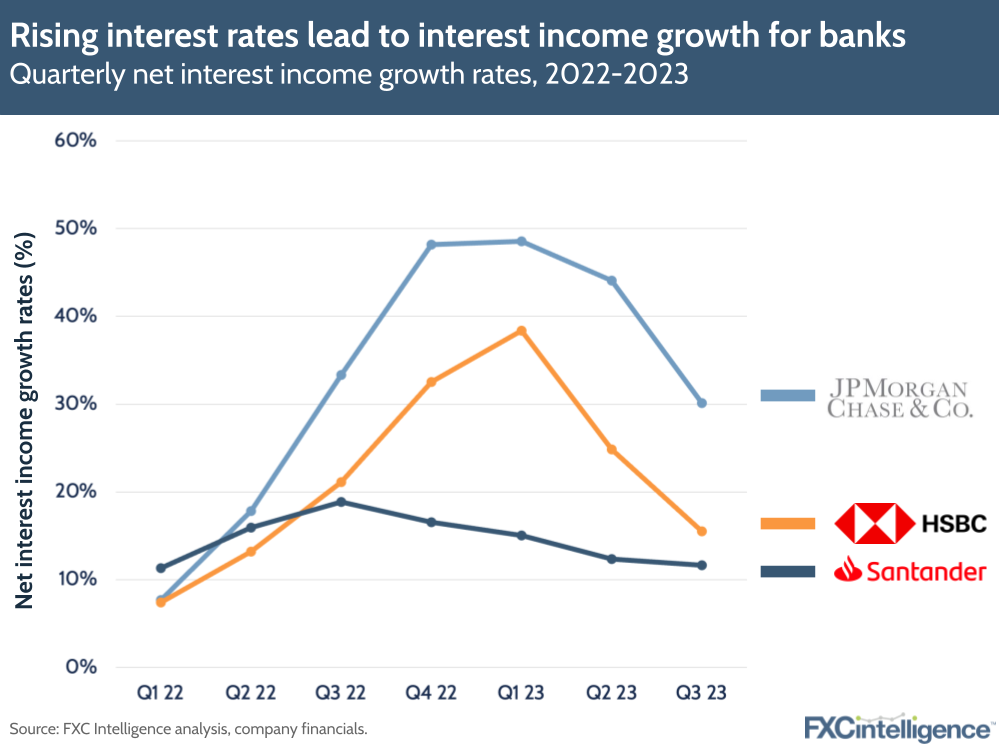

The impact of interest rates on banks

Interest rates continued to rise this year, which in turn has had an impact on banking players. For some, a growth in interest rates has provided benefits from higher interest on mortgages and loans as seen below.

Banks that have seen higher interest income have come under increased scrutiny when it comes to passing on savings to customers. This is an issue we also saw with Wise in FXC’s recent report on the impact of interest rates on money transfer players.

However, rising interest rates have also had a negative affect on some banks. For example, the collapse of Silicon Valley Bank – the largest banking failure in the US since the global financial crisis – has been linked to rising interest rates. This is because the rising rates led to the value of SVB’s portfolio to decline rapidly, which left it facing a potential capital loss of $15bn.

Interest rates are expected to have peaked in some countries, with speculation rife about when central banks, particularly in the UK and US, will cut rates in the new year, given a slowdown in inflation in these countries. However, for the moment, some banks will continue to benefit from higher interest income as a result of high rates.