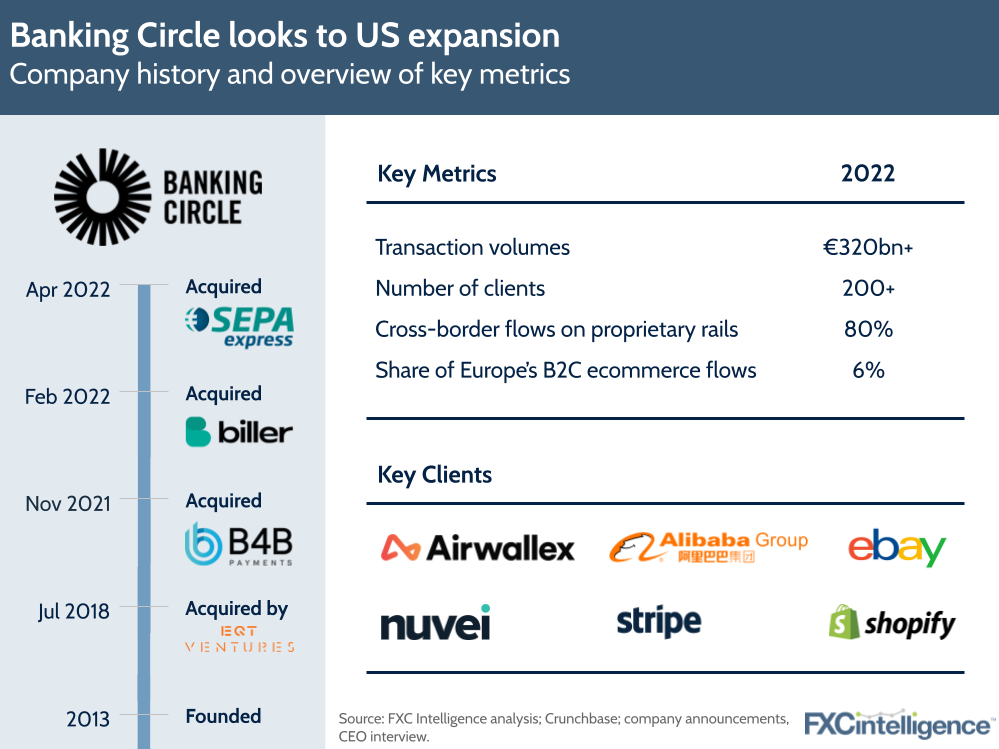

European banking services provider Banking Circle Group has made enabling interoperability a key focus for the company, and this will only continue as it gears up to launch in the US. In my latest Forbes column, I spoke to CEO Anders la Cour and CGO Søren Mogensen to find out more.

You can read my full conversation with Anders and Søren in Forbes, but here are some of the key takeaways:

- Anders sees the company as a bridging service, connecting previously fragmented systems that make up much of the world’s payments. This has made interoperability a key strategic area for the company, across areas including cards, account-to-account transfers and cross-border payments.

- The goal is to build “one piece that connects everything”, connecting to the various regional and international schemes that are developing, including the planned FedNow.

- In the nearer term, Banking Circle has developed a solution to connect national mobile payment systems in Europe based on European Mobile Payment System Association (EMPSA) specifications. At present this is just operating between German-Austrian Bluecode and Swiss TWINT, but it is hoped that EMPSA will opt to extend it in the future.

- The US launch is set to see Banking Circle provide solutions to operate in and out of the US, primarily enabling US businesses to connect to Europe and vice versa.

- On crypto, the company remains uncertain about how much of a role digital currencies will have in the future, but remains committed to supporting connections as demand requires.

Read my full conversation with Anders la Cour, CEO of Banking Circle Group, in Forbes