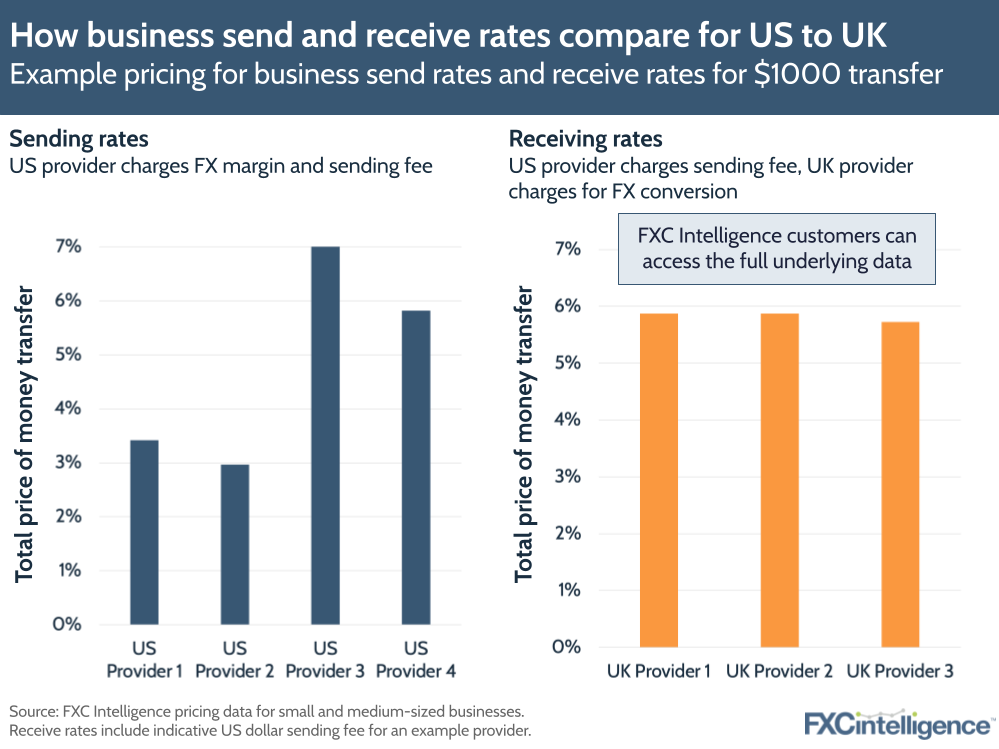

Sending rates are a widely discussed part of cross-border payments, but receiving rates are often far less well known, and when discussed are often assumed to be a significantly more expensive option. However, our own receiving rates data suggests the reality is more complex.

Receiving rates are the costs associated with receiving a cross-border payment in the sender’s currency rather than the recipient’s one, and are sometimes known as automatic currency conversion. For example, if a company wishes to send $1,000 from the US to the UK, they have the option to use a US-based bank or money transfer provider, which converts the dollars into GBP and provides an up-front price to send this amount. This is known as a sending rate.

However, the company may instead opt to send the payment in USD using the same bank or a provider, in which case the recipient’s bank in the UK will perform the conversion (automatically, unless it lands in a multi-currency account). In this case, the customer will pay a fee to the sending institution but the UK bank will charge to perform the FX conversion, taking this out of the money received. This is known as a receiving rate, and it is much more opaque.

The second option is less widely discussed in the industry, but it is a common practice, particularly for business customers. In countries such as the US where 90%+ of cross-border trade is conducted in dollars, this conversion on receipt is the norm.

It is often thought that receiving rates are always the more expensive option, however our own pricing data shows that this is not always the case. While analysis of our example of providers suggests average receiving rates prices are higher than sending rates, sending rates can vary more broadly and so can end up being the more costly option. Knowing which is the case for what corridor can form a more sophisticated product strategy for a bank or payment company.

Moreover, providing alternatives to comparably more expensive receive rates are a big opportunity for the banking sector in particular. To date, we know this is an area that has not received nearly as much product focus as it likely deserves.