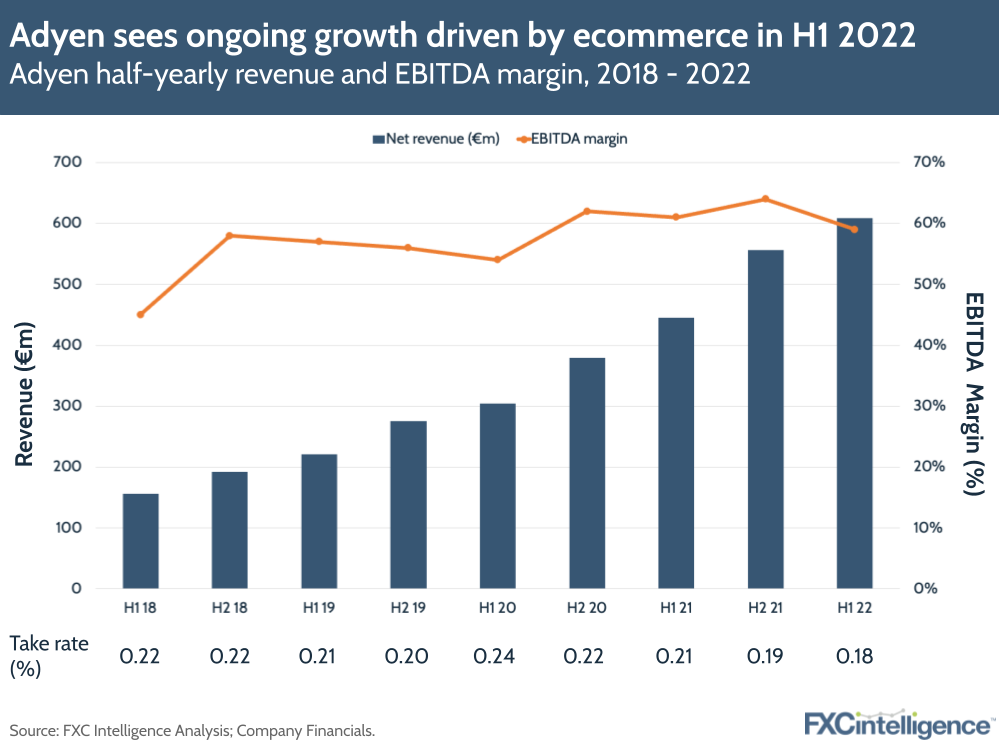

Despite posting a net revenue increase of 37% YoY, to €608.5m, payments processor Adyen saw its share price fall by as much as 11% after releasing its earnings for H1 22. Investors responded negatively to a decline in profits caused by increased hiring spend and company travel/events-related expenses. However, the company is confident that future investment will push its margins back in the right direction.

Adyen’s EBITDA increases YoY, but EBITDA margin drops

Total processed volume increased 60% YoY to €345.8bn. EBITDA was up 31% YoY to €356.3m, while EBITDA margin was 59% (lower than the 61% in H1 21). Adyen’s investment in more employee benefits and travel contributed to a 47% YoY rise in operating expenses – to €277.7m.

On the other hand, the post-pandemic travel boom also drove significantly more point-of-sale (PoS) transactions, up 97% YoY to €44.9bn (matching the growth in H2 21). Adyen says it is continuing to see the growth of ‘unified commerce’ – bringing together purchases in the online and offline space – and is capitalising on this further with the launch of its first ever PoS terminals designed in-house.

Revenue grew across all regions, with APAC growing the most (up 53% YoY), followed by North America (up 52% YoY), EMEA (30%) and LATAM (25%). EMEA remains the biggest contributor of revenues at 57%, but lost about 3% of its share in the mix, while North America (25%), APAC (11%) and LATAM (7%) all saw marginal increases.

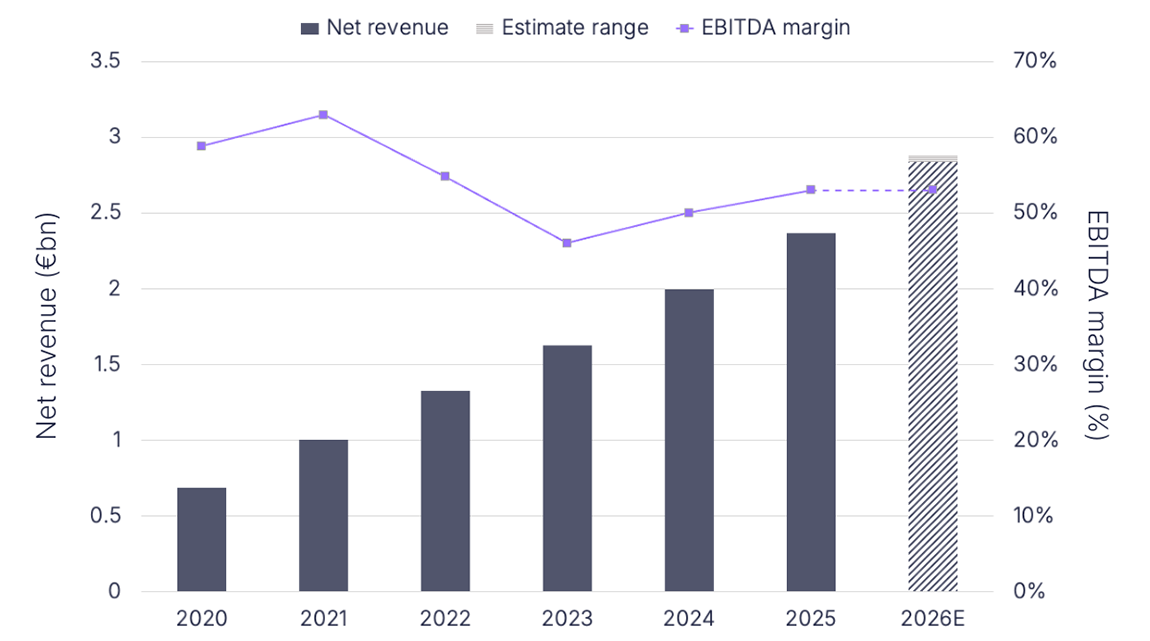

Looking forward, the company wants to push for a compound annual growth rate between the mid-20s and low 30s in the medium term. It also wants to increase its EBITDA margin to above 65% and maintain a sustainable capital expenditure level of up to 5% of net revenue.