Western Union’s Q2 2021 results included the announcement that the company was selling Western Union Business Solutions and refocusing on cross-border consumer payments. I spoke to CFO Raj Agrawal to find out more.

Western Union reported 16% revenue growth in Q2 2021, but the headlines were focused on its sale of Western Union Business Solutions for $910m and its resulting refocus on the cross-border consumer payments market.

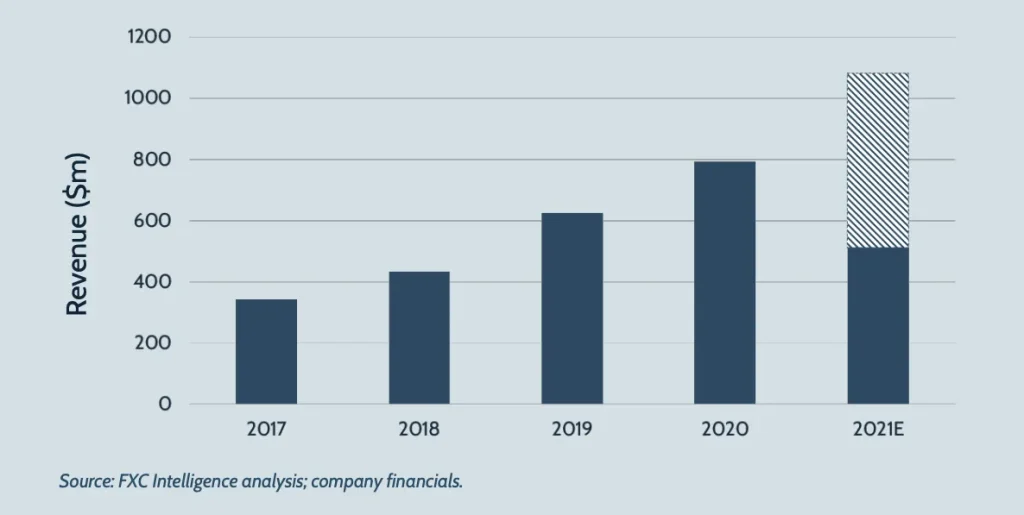

Digital is a key part of this, with digital money transfers hitting a new high of $265m quarterly revenue – a 22% increase on Q2 2020 – and projected 2021 digital revenue of over $1bn. However, the company is also looking beyond remittances, with the launch of a Western Union-branded multi currency bank account, debit card and integrated money transfer solution, which will be piloted in a number of European countries later in 2021.

With this in mind, what is Western Union’s strategy following the sale of its Business Solutions division? Daniel Webber spoke to Western Union CFO Raj Agrawal to find out more.

Topics covered:

- The sale of Western Union Business Solutions

- Market strategy: direct versus white label

- Western Union’s multicurrency bank account

- The shift to digital

- Finding growth in retail

- Pricing trends

The Sale of Western Union Business Solutions

Daniel Webber: Let’s start with the sale of Western Union Business Solutions. Firstly, that’s a good price, so well done, because it’s not an easy asset, particularly with some of the linkages with your bank. And secondly, let’s look at Western Union’s refocusing, which I think is the purpose there. Even though you’re focusing on consumer, it’s a broader view, because it’s powering people that power consumers, rather than just direct to consumer. Is that a fair characterization?

Raj Agrawal:

Absolutely. Let me get into all those, because it’s important for you to appreciate what we’re trying to do here. With the sale of Western Union Business Solutions, first of all, we think it’s a good price as well. We think it’s a good value for shareholders, otherwise we wouldn’t have done it. We gave the last 12 months of data on Western Union Business Solutions, so you can do the math on what kind of multiples that implied, but obviously it’s going to give us a big chunk of cash.

Let me just describe the transaction briefly. There are two closings envisioned. The first closing is probably the easier one, which happens in the early part of next year, and it’s all the non-European businesses. The parts that we have under our Western Union bank in the European Union and the UK are part of the second closing. The first closing is all that other stuff, which is more than half the business, and that’s where we actually get all the cash from the buyer.

That’s a really important point, because the risk for the second closing is on the buyer. The buyer has to make sure they get the licensing in place, they get the regulatory approvals. We are obviously going to help them with everything, but we’ve already retained the cash at that point, after the first closing has happened.

With the European markets, everything is a little bit more complex. We’re obviously going to help them with it, because we don’t want there to be some alternative scenario where the second closing doesn’t happen. So we’re confident that everything will go as planned. Otherwise we wouldn’t have agreed to this deal, or neither would the other side, but we are very pleased to be able to do that.

It will be cash. We’ll determine the exact use of proceeds when the first closing happens in the early part of next year. The strategy, though, is now to refocus our efforts on the rest of our business: the cross-border consumer payments opportunity.

This includes not just branded offerings from Western Union, but it also includes the digital partnership opportunity, which is where we would provide our single cross-border payments platform that we will now have for the benefit of other companies. It could be for FIs. It can be for fintechs. It can be for telecom type companies. Anybody who wants to use our services for their consumers, that’s the kind of thing that we can do.

Beyond that, we also have the C2B, or consumer to business, and business to consumer payments opportunities, which itself is a $2tn market that we can go after. So the market opportunity for Western Union is quite large already.

We’re also testing the consumer financial services offering that will lead into our consumer ecosystem, which is where we think we have some competitive advantages, and we’re excited about that opportunity.

Those areas are where we were going to focus, and we’re not going to be distracted anymore by Western Union Business Solutions. We like the business, don’t get me wrong, but it’s not really the majority of everything else we do. We really want to focus on the majority of everything else we have in the company. We think that Baupost and Goldfinch are the right buyers for this business, at the right value.

We’re excited about how this positions the company going forward. Obviously the transaction is not closing for several months, the first part of the closing. So business as usual until we do that closing, but it does allow us to make plans in a different way for the future of Western Union.

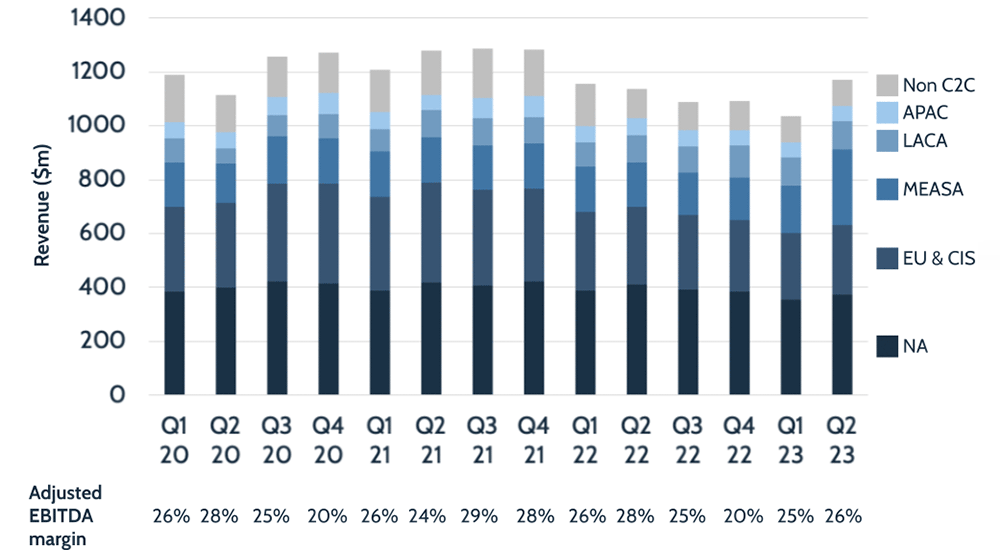

Figure 1

Western Union’s Revenue and EBITDA Margin

Market Strategy: Direct Versus White Label

Daniel Webber: How are you now determining which markets you want to partner in and which you want to target customers directly? For example the Google deal, which is obviously great – they’ve got tremendous reach. How are you thinking about that balance?

Raj Agrawal:

We want to do it all, if I can say it that way. So we want to be a branded offering everywhere we can be, with multiple channels. And we also want to be the white label provider or the backend provider to other organizations that may want to push their own brand for their own consumers. For example, obviously you have Saudi Telecom in Saudi Arabia. We also now have a WU.com business in Saudi Arabia. Most people don’t know it, really, but we have it there.

It’s not very big, and the Saudi Telecom deal is much bigger than anything we have with our branded offering. That’s okay for us, but we’re picking up a little bit of incremental business with our branded offering as well, because some people like the Western Union brand. So we want to be able to provide services in whatever way consumers want to interact with us. That’s really the objective here.

With Sber in Russia, that’s growing gangbusters for us. Just like Saudi Telecom, they’re the largest bank in Russia. They have millions of consumers, and they have a great platform that they’re leveraging with our platform to be able to move money seamlessly for their consumers. That’s great, but we also have branded offerings there. We have our own entity that provides retail-oriented services. We also have a WU.com business there, but it’s smaller in nature, and that’s okay.

Now in other markets, the branded offering is the primary offering that we have, like the United States or various other parts of Europe. Now, if you think about what we do across the world, most of our services outside of North America, about 70%, are through banks and financial institutions, and other governmental type organizations, where we are providing retail walk-in services. So for us, it’s not a big stretch to think about doing what we do in retail from an account standpoint.

When we talk about the remittance market, about half the remittance market is controlled by the banks. Typically people will go to the bank to move money around; that’s half the remittance market. So we’re not trying to replace the banks. We want to enable the banks to be able to provide their consumers a better service, a better offering, just like we do at retail for them. We’re just saying, “Let us also do it from an account standpoint for you, because we have this breadth of network that you can leverage.”

That’s why Sber signed up with us, because they don’t have to use the correspondent banking system to deliver money around the world. They can use our services. That’s really a remittance-type of use case. So to answer your broader question about, are you going to go it alone in the market? Are you going to do a partnership? We’re going to do it all, is what I said at the beginning, because of what I just described to you: consumers want to use us in different ways.

We’re basically saying that we understand that when we talk about digital partnerships, everyone is vying for the consumer’s attention. They want their eyes to be focused on them. If that means that, just give me a white label offering, I don’t want to use the Western Union brand, that’s okay. We know equally important is the Western Union brand for a different kind of offering that consumers want to use, so it’s okay to do it that way.

Western Union’s Multicurrency Bank Account

Daniel Webber: A partner for you has got to have a strong enough brand and tight enough relationship with a customer that it wouldn’t be so easy for you to win them away. What thought goes into that, given that you’re effectively marketing in multiple ways in the same market? And how does that feed into your new multicurrency offering?

Raj Agrawal:

Where the brand is going to become important for us is in the consumer ecosystem opportunity. The nine million consumers we have on WU.com, from last year, they use us on a transactional basis. They trust us; they know the brand Western Union; they know what we’re capable of doing. So it’s not a big stretch to now add to the portfolio of services that we’re offering our branded Western Union consumer with more branded offerings.

So we’re going to give them a multicurrency bank account. We will give them a debit card. Why do we think we’re going to be good at this? Because they trust us. They already trust us to move their money around. We want them to trust us and come back to us, and have more throughput of their funds.

We don’t want them to just use us on a transactional basis. We want them to put money in the account. We want them to shop in our marketplace and our consumer ecosystem. And we want them to also send money to their loved ones.

The test we’re going to do is a sending market and a receiving market in Europe. Why we’re doing it in Europe is because we have our bank there, fully fledged bank license.

So the sending and receiving market are equally important to us. We want the receiver to also have a relationship with Western Union. We want them to also have an account. In an ideal world, you would have a sender and receiver transacting and doing stuff in our consumer ecosystem and marketplace. And they would also be moving money to each other seamlessly.

Now, if they want to get money paid out at a retail location, that’s great. They can take it from their wallet, or their account that is holding money, and they can then direct it to a retail location. If they want to buy something with it in the consumer ecosystem, that’s also fine. They can take the money, and they can shop with other services that we might have available to them. Western Union is going to make money by increased retention of those customers, and by the additional services that they may acquire through us.

Daniel Webber: What’s your sense of the profile of the customer for the multicurrency account? Are you targeting converting cash-based or the under-banked, or are you going for a banked person, but switching them to your bank?

Raj Agrawal:

We’re going after the current migrant customer that is already using our services. Now they likely have banking services available to them, but they may not be fully utilizing those services. They may not have a place to go buy insurance services, or maybe even get a loan.

We’re not necessarily going to provide all these things directly to consumers; it’s going to be from our markets.

What we want to do is say, “Yeah, we know that you might have financial services with some other bank or something like that, but just do it with Western Union, because you already trust us with your money. You have an ongoing need to move money to your loved ones. So just put it in our ecosystem and use it. It’s convenient for you as a consumer.”

That’s why it’s going to drive higher retention levels than we already have. That’s really the power in this. Maybe it becomes a bigger customer acquisition vehicle down the road, as people learn more about this, but initially it’s going to be for our current customers that are using us.

Daniel Webber: Because you’re a bank if you want to offer savings and interest-based products and loans, you could do it, correct? You have one initial competitive advantage that you’ve been a real bank there for a while, so that you can offer those types of services, which I know plenty of competitors can’t. They have an e-money license powering a multicurrency card, but it’s really just a debit card sitting behind it.

Raj Agrawal:

We’re absolutely going to offer real banking services. But the differentiation that we provide is that it’s going after the migrant customer. That’s really important because others that are flying high these days, that think they’re flying high, are going after a different kind of customer. They’re not going necessarily after migrant customers.

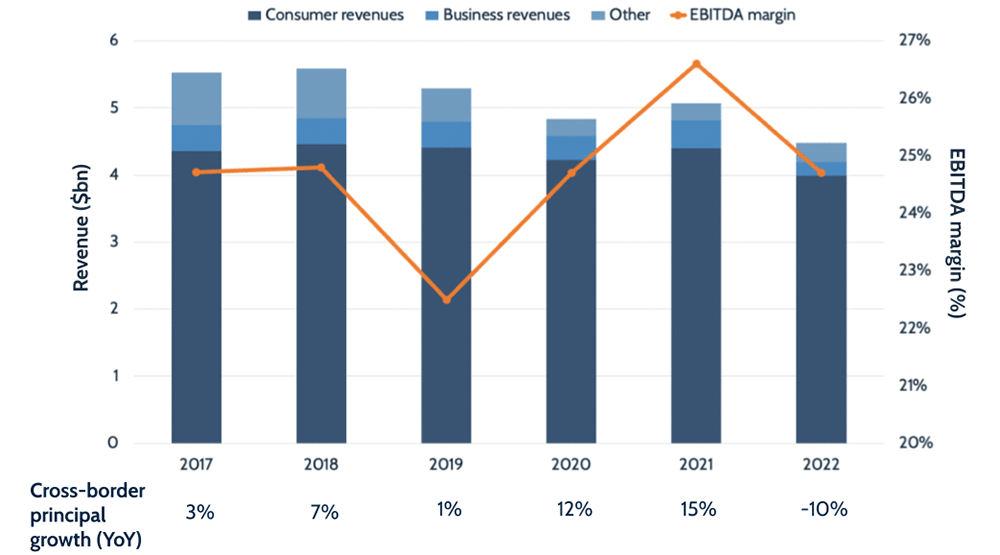

Figure 2

Western Union’s digital business

Customer Profile of Western Union’s Digital Business

Daniel Webber: About 20% of your run rate of your digital business is going account-to-account. That seems to be growing extremely fast. What’s the profile of that customer and what is driving that? Because I think that may also tie back to the banking product you’re about to launch.

Raj Agrawal:

A couple of points to make before I dive into what the customer looks like. It is almost a $200 million run rate, and to your point, maybe it’s getting close to that 20%, not quite there yet. But the great thing about this is that we already have tremendous coverage for retail payout, which is the majority of our digital revenues today. So digitally initiated-to-retail payout.

We’re also extremely good at the account-to-account, and it’s growing really fast, so customers are using us in different ways. Most other providers don’t have the omni-channel capabilities that we have. And that’s really a big differentiator here, because it’s ultimately about, how does the customer want to use this? That’s really the most important thing here.

If they want to use us to pay money out to an account, perfect, we have it. If they want to pay out to a retail location somewhere in the Philippines, because that’s what their relative needs, perfect, we have it. If they want to fund from an account, that’s great. We have it. They want to use a credit card, debit card, that’s also okay. It’s really about the omni-channel capabilities that most other companies will never have to the extent that we have. And the account-to-account offering, it’s still going to be a migrant customer, but it’s a different use case.

Typically when money is moving from an account to an account, it’s going to be a higher principal amount, because money is not necessarily just for that day’s needs, or the need for that week. It’s going to be money that’s going to be drawn down over time.

When I send money to my relatives, if I’m moving money to a retail location, I’m not going to send them $1,500 in a retail location. I’m going to send it to their bank account, because I know that most of that money is going to sit there for awhile.

They may take $200 or $300 out because they need it right away, but that money is going to sit there. So it’s different use cases on why people want to use this account-to-account. It may still not be the really high principal amount that might be going through other companies, like a Wise or someone else. It is still for the remittance use case, maybe if it’s going from an account to an account, it’s an ongoing need.

The people who are moving money account-to-account, they’re also going to be more technically savvy. They’re more used to using technology; they’re more comfortable with it. That’s the kind of customer we typically will have in our digital business, but the way the customer on the receive side receives it is based on their need.

Do they need money that’s going to be for the next six months or nine months? Then maybe it’s going to go into an account first. Or do they need money for the week? Then maybe it’s just $100 or $200 at a retail location. That’s really the difference here.

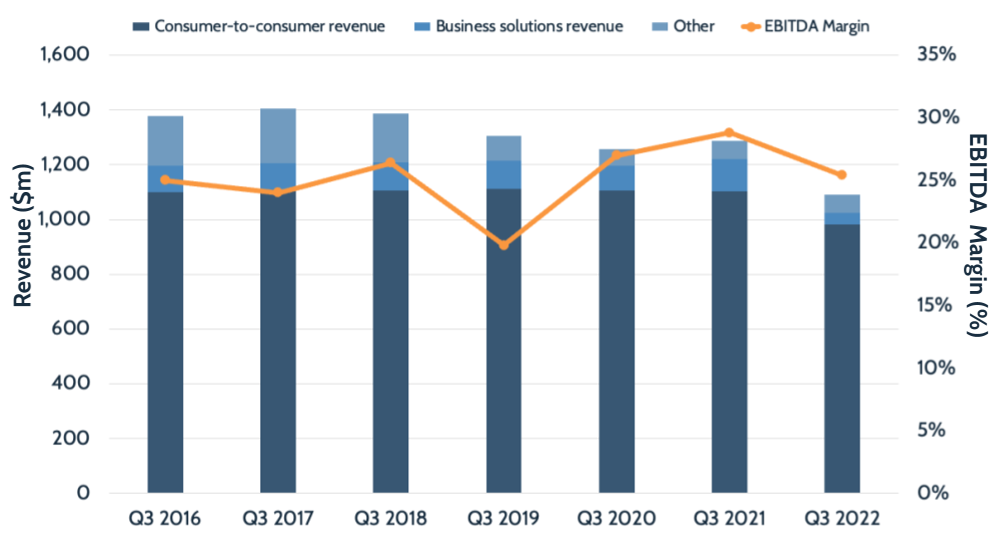

Figure 3

Western Union’s digital revenue versus competitors

The Shift to Digital

Daniel Webber: Digital is going great, while pure retail cash-to-cash is seeing slow growth; it has pandemic headwinds, and just there’s a natural movement to digital. However, around 80% of your digital customers are new to the brand. Given that, why not try to move more customers from retail to the higher lifetime value digital?

Raj Agrawal:

It’s a very good question. The 20% of consumers that are not new to WU.com, or not new to Western Union, are a relatively small piece of retail. It’s a small piece that is actually coming from retail.

Having said that, it’s ultimately about what we just talked about: it’s the consumer and how they want to use our business. They want to keep going to retail, so let’s let them use it, use the retail services, but let’s make it more efficient for them.

The thing that we are thinking about is to digitize the retail experience. So let’s let them stage a transaction on a mobile app, they can complete it at a retail location, or they can go to a kiosk in a Walgreens store here in the US, and initiate the transaction. Then they complete it at the counter by actually giving cash to the frontline associate, because they’re going to do some shopping inside the store.

There are ways to optimize the consumer experience at retail, without it being the old, traditional just: I’ve got to take cash, I’m going to fill out a form at the location, at the counter, and I’m going to give you this cash. It doesn’t have to be like that. We are doing more stage and pay, more digitizing the experience. You can even stage the transaction in your home before you even walk out the door.

What’s going to become important, longterm, is having the best retail payout capabilities in the world, because that payout is always going to be there for a customer in India or a customer in Philippines, or customers somewhere in the deep part of Africa, where they want to get some money into their hands. Those retail locations are invaluable. So the payout side is going to be very important, which is why retail will never really go away. It’s going to be used in different ways in this business.

Finding Growth in Retail

Daniel Webber: Where do you find growth from on the retail side? Hard, isn’t it?

Raj Agrawal:

It is hard, but it’s there to be had. I’ll tell you specifically how you get the retail growth. One is through improving the customer experience, driving higher retention levels. Because retail customers are doing transactions, but they may be using multiple services.

The retention levels in retail are much lower than they are in digital. So driving better retention levels by creating a better customer experience, digitizing the customer experience that we talked about, dynamic pricing opportunities in our business, pricing more strategically.

We’ve talked about it. It’s a sort of time-of-day pricing, location-based pricing, location density-based pricing. So just being more strategic on the pricing front.

Network expansion is the last piece, so going after accounts like Walmart: it’s a new business for us. We’re getting business from other players in the market.

What we always say is that retail is going to be a stable to slightly up business. It’s not going to be a really fast grower, but it’s going to be a stable business for us. And those are the components that can make it a stable business for us going forward.

Pricing Trends

Daniel Webber: What we’ve seen in our data is that pricing has been remarkably resilient in the market. Your pricing has been stable. Now the person who reads all the general press would say, “But there’s all these new fintech players and everyone’s giving everything away for free. Why hasn’t price gone to zero?” What’s been going on that has enabled pricing to actually be stable, as opposed to this thesis of it’s all going to go to zero?

Raj Agrawal:

First of all, you have some other companies that have recently gone public, they play in a different market segment than we are. So it’s not like we’re directly competing with them for the same customers. It’s a different customer segment.

Secondly, the companies that we are competing with, they operate at a relatively low margin already as it is. So for them to now take a further step down in their overall pricing strategy or pricing blend, is going to be very challenging.

That’s what has caused everything to be more stable the last few years, because if you’re operating at 10% margins and you’re already priced lower than other players in the market, why would you take another step down in pricing? All it’s going to do is it’s going to hurt your bottom line. It’s going to be very challenging to do.

So there’s some dynamics like that that make it harder, and there are just costs of doing business. You have compliance; you have regulatory expenses; you have to distribute all around the world; you have to pay your agents. These cost money, right? So you can’t just keep going to the bottom.

Daniel Webber: Raj, this has been great. Thank you for the time.

Raj Agrawal:

Thank you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.