Ecommerce has seen a widely publicised surge amid the Covid-19 pandemic, but the virus has also led to an increase in costs for consumers when it comes to cross-border ecommerce.

Cross-border retail payments are becoming increasingly popular across the world. While international travellers boost in-person cross-border retail transactions, the rise of e-commerce is making non-present cross-border transactions mainstream both in developed and developing economies.

However, understanding which fees and taxes have been applied on cross-border payments can be complicated. This is especially true for card payments, where consumers have to pay fees applied by the card issuer in addition to the taxes applied by governments.

According to FXC Intelligence’s card pricing data on more than 900 issuers across 130 countries, issuers apply cross-border transaction fees on card payments that are as high as 10%. This does not include the additional taxes on foreign currency exchanges, whose value ranges between 1% and 35% of the cross-border transaction amount, which can significantly increase its cost.

These sometimes hidden or less known costs have big implications on the customer’s journey, which can impact the success of a cross-border strategy. According to Shopify via Statista data, e-commerce sales in the three largest markets globally, China, the US and the UK, accounted for $740bn, $561bn and $93bn respectively in 2019. To be able to take a significant share of such flows, it is important for cross-border merchants, payment processors and card issuers to be aware of local regulations and to address foreign exchange taxes in an efficient way.

Contents:

- The evolution of cross-border commerce

- How foreign exchange taxes developed

- Taxes by country

- What are the implications of taxes?

- Conclusion

The evolution of cross-border commerce

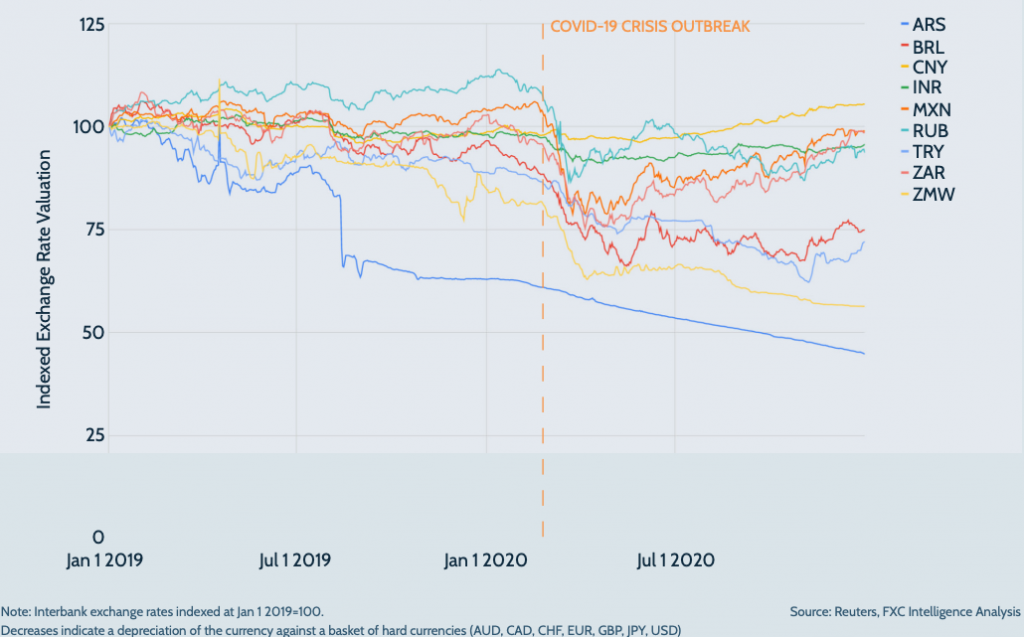

In the past five years, cross-border commerce has been facilitated by the emergence of international marketplaces and merchants that are able to sell and ship across the world. It reported positive growth across all years as a result. However, 2020 was a much stronger catalyst for growth.

As national lockdowns to prevent the spread of Covid-19 were in place around the world for most of the year, consumers started to increasingly shift from bricks-and-mortar shops to e-commerce.

As a result, growth took a much steeper trajectory.

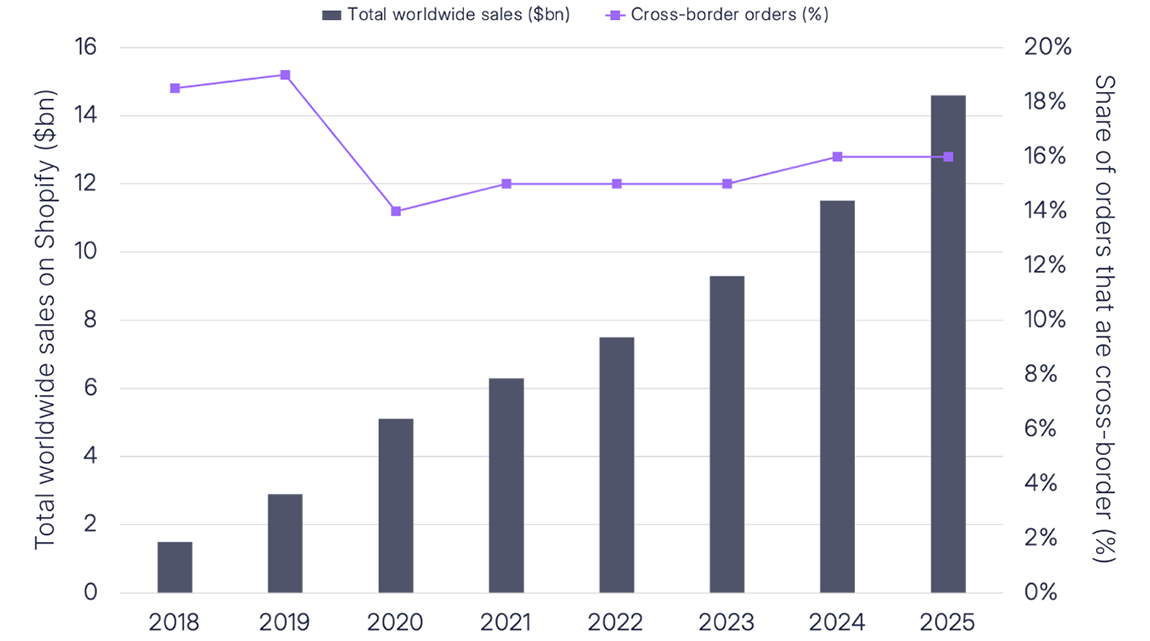

Figure 1

Global retail ecommerce sales, 2016-2020

Global e-commerce sales rose just under 28% to reach USD4.3tn in 2020. Part of this growth can be attributed to cross-border e-commerce, although official figures are difficult to retrieve.

According to Shopify (via Nielsen data), an average of 57% of online shoppers worldwide make purchases from overseas retailers.

Online shoppers in Europe are those that rely most heavily on international merchants, with 63.4% of them making purchases overseas, followed by 57.9% of shoppers in Asia Pacific, 55.5% in Africa and 54.6% in Latin America.

According to JP Morgan’s Global Payment reports 2019, this translates into 18% of total e-commerce being cross-border in the UK and 12% in the US. We can expect 2020 figures to overtake the latest available data.

A different figure emerges when looking at cross-border payment flows. Mastercard and Visa both recorded negative growth across all quarters of 2020, with the third quarter of the year posting -35% and -29% growth respectively.

In preceding years, however, their cross-border businesses experienced continuous double digit growth, and we can expect this trend to rebound when the crisis is over.

The rise of globalised commerce, combined with increasing currency outflows, have prompted governments to take action on this matter across the years.

How foreign exchange taxes developed

Foreign exchange taxes and stamp duties have been in place for decades – and in some cases centuries – across the world, with the first Stamp Duties tracking back to the 1600s.

For instance, in the Bahamas, a duty applied to the remittance of foreign currency through any means of payment abroad was introduced in the 1920s.

Regulations have been constantly emerging and changing in the past two decades, with 2020 and the Covid-19 pandemic representing a significant turning point.

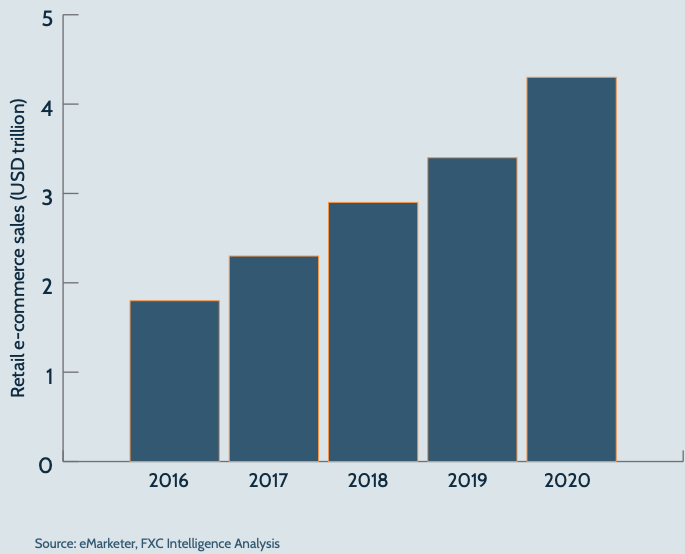

The Covid-19 crisis triggered major disruptions for exchange rates, especially in emerging economies (Figure 2).

The value of such currencies is strictly linked to the price of oil and other commodities and is heavily reliant on trade with developed countries.

The pandemic brought along a series of macroeconomic shocks that led to a steep fall in emerging currencies’ value, especially at the onset of the crisis (between March and mid-May).

Figure 2

Exchange rates variations for selected emerging economies, Jan 2019 – Dec 2020

Several responses were put in place by governments and international organisations to counter the fall in currencies’ values.

One example has been the application of new foreign exchange taxes. This type of soft capital control is a tool for governments wanting to reduce currency outflows and protect their home currencies against the devaluations generated by the Covid-19 pandemic.

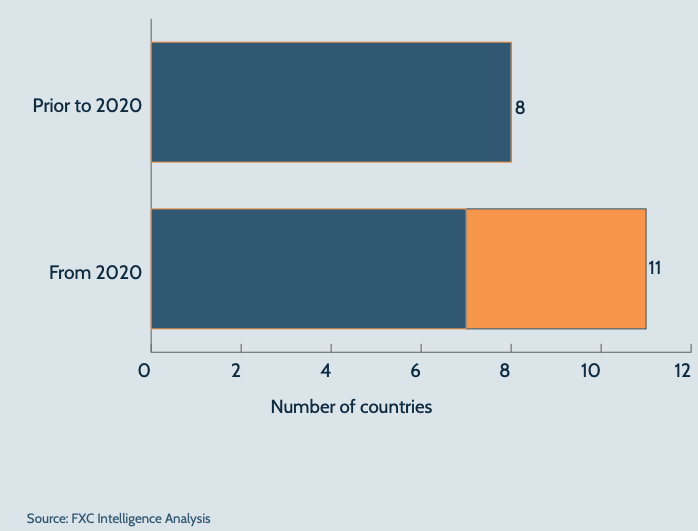

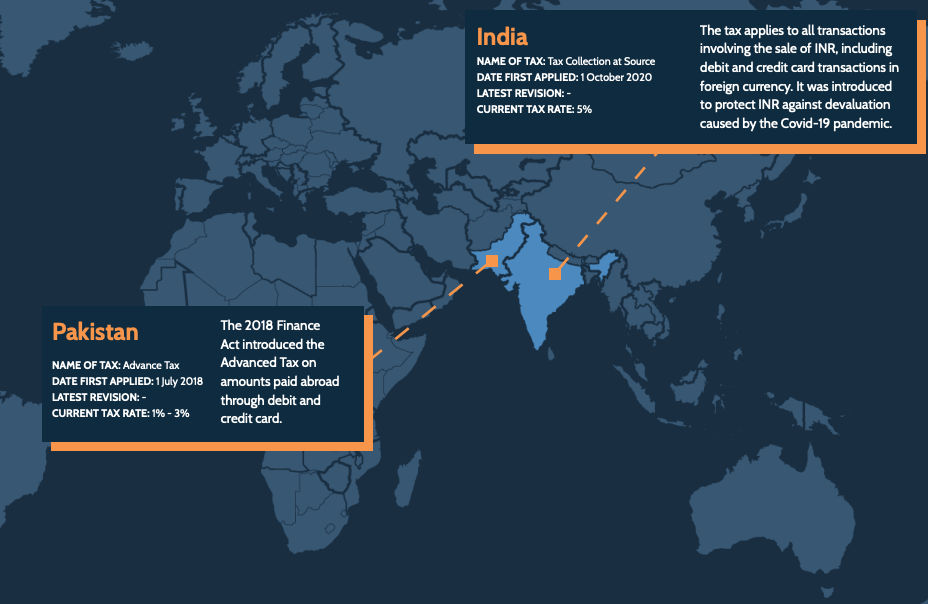

Four countries applied taxes on foreign exchange payments during the past year, including India and Turkey (see below for a full summary of foreign exchange taxes).

This brings the total number of countries with such restrictions in place to 11, compared to eight in the pre-crisis period (Figure 3).

Libya was the only country to remove its foreign exchange tax in 2020.

The deep economic crisis caused by years of ongoing conflicts pushed the government to introduce a package of economic reforms to boost the economy in 2018, which included a 183% tax on foreign currency transactions.

Lowered to 163% the following year, the tax was removed in 2020 when an official, common exchange rate was agreed upon by the official and the militia government.

Figure 3

Number of countries applying foreign exchange taxes pre and post Covid-19

Revisions of existing tax rates were also quite common in 2020, with Argentina raising its PAIS tax from 30% to 35% in September 2020 to once again contain the effects of the pandemic on an already volatile currency.

Taxes by country

Africa and Middle East

Asia

Americas

What are the implications of taxes?

Consumers are those who bear the cost of the tax. In situations where a consumer uses their debit or credit card to pay for goods or services purchased online, the tax is levied on top of the fees that the card issuer applies to cross-border transactions.

This significantly increases the cost of the purchase. In addition, there may be a lack of clarity about how the final price is reached if the customer is not provided with a clear breakdown of the charges.

Case study

The full cost of an FX transaction with taxes

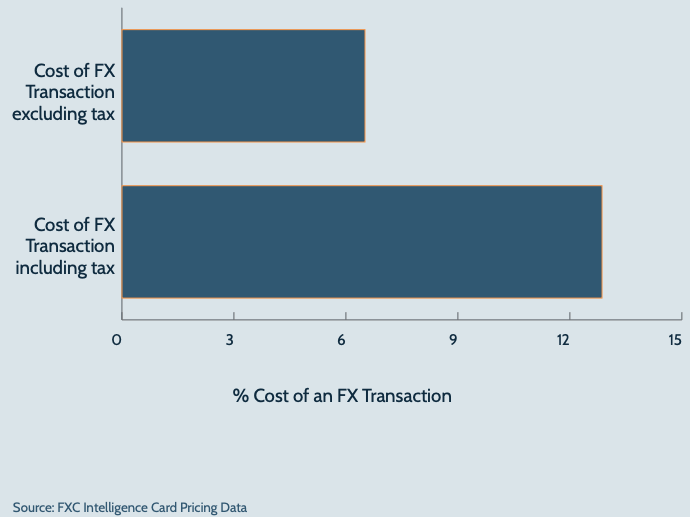

This example shows how much a Brazilian customer pays for buying goods from a European merchant paying in EUR. In this case, the consumer faces both the 6.38% IOF tax and the FX fees the issuer charges to convert EUR into the local currency BRL.

When excluding the effect of the tax, the consumer faces fees of 6.5% of the transaction amount. When including the tax, though, the percentage cost for the consumer almost doubles. This indicates how taxes can increase the burden on consumers. The final, high cost can work as a barrier for cross-border transactions in countries where significant bank fees and taxes are charged.

To avoid this last friction, card issuers, who are responsible for collecting foreign exchange taxes, need to ensure transparency when redacting bank statements.

To specify the exact amount of taxes and of fees charged by the card issuer on the statement is extremely important. In this way, consumers are presented a clear cut distinction of the charges they need to pay.

Marketplaces and merchants selling cross-border need to make the cross-border shopping journey more efficient for customers.

In light of the various taxes, it is still essential that they possess specific local knowledge of the markets where their customers are located. This helps to improve product pricing so that customers do not feel double charged.

It also helps to prevent or contain customer complaints about the price they have been charged for certain transactions.

Conclusion

Taxes on foreign exchange transactions have a relatively long history. However, 2020 and the Covid-19 pandemic represented a key turning point.

On one hand, the pandemic boosted cross-border e-commerce. On the other hand, currencies in emerging markets significantly devalued. This pushed some governments to strengthen the control of currency outflows by implementing new foreign exchange taxes.

Tax measures put further pressure on consumers. In fact, cross-border transactions become more expensive and their full cost can be as high as 40% of the transaction amount, considering the fees applied by the card issuers and the additional tax.

This is an important aspect for both card issuers and merchants to consider when setting up pricing for their products. Transparency in card statements is also essential to avoid customer complaints.

A deep understanding of the total costs of cross-border transactions in a given country, including hidden costs like foreign exchange taxes, is essential to prevent dangerous frictions in the consumers’ journey and improve cross-border commerce strategies.

FXC Intelligence card pricing data covering more than 900 issuers across 130 countries can help you understand cross-border card pricing and boost your cross-border strategy. Get in touch with us to discover how we can help you.