Remitly has once again outperformed the market, with high growth and customer acquisition in Q1. In the latest instalment in our Post-Earnings Call series, Remitly CEO Matt Oppenheimer talks about how the company’s approach to unit economics is driving its consistent growth.

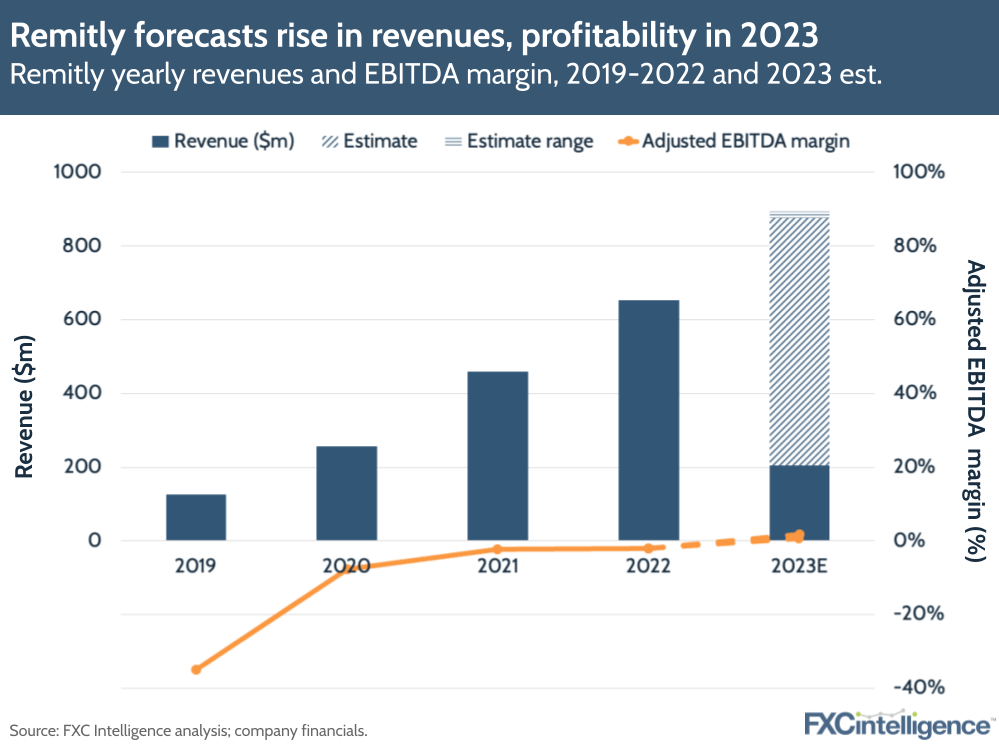

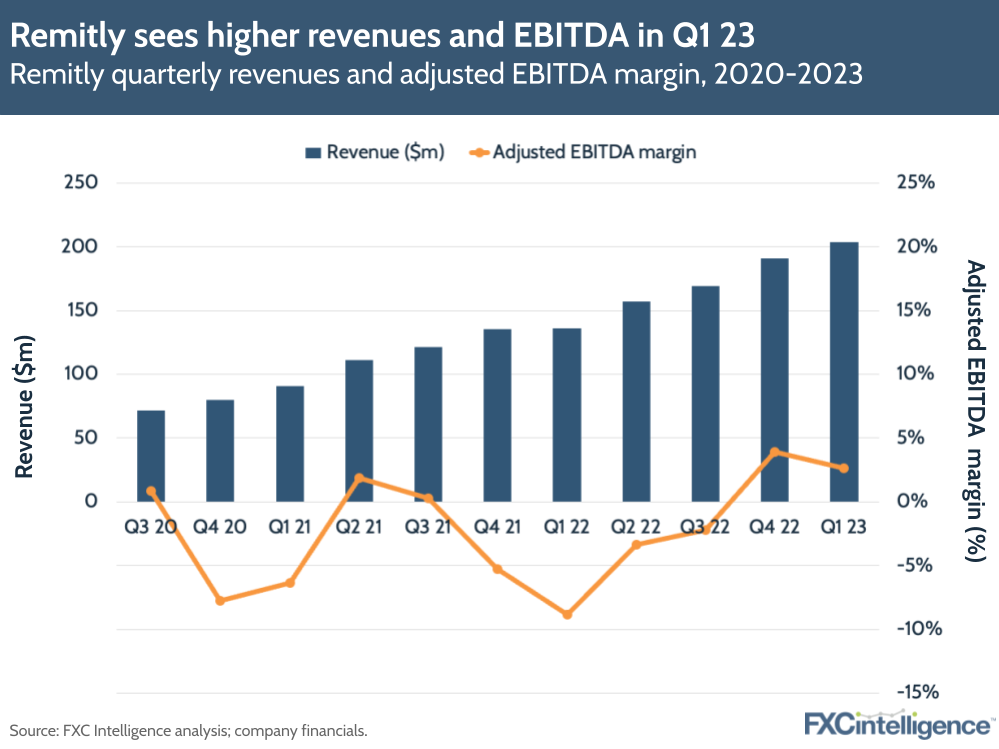

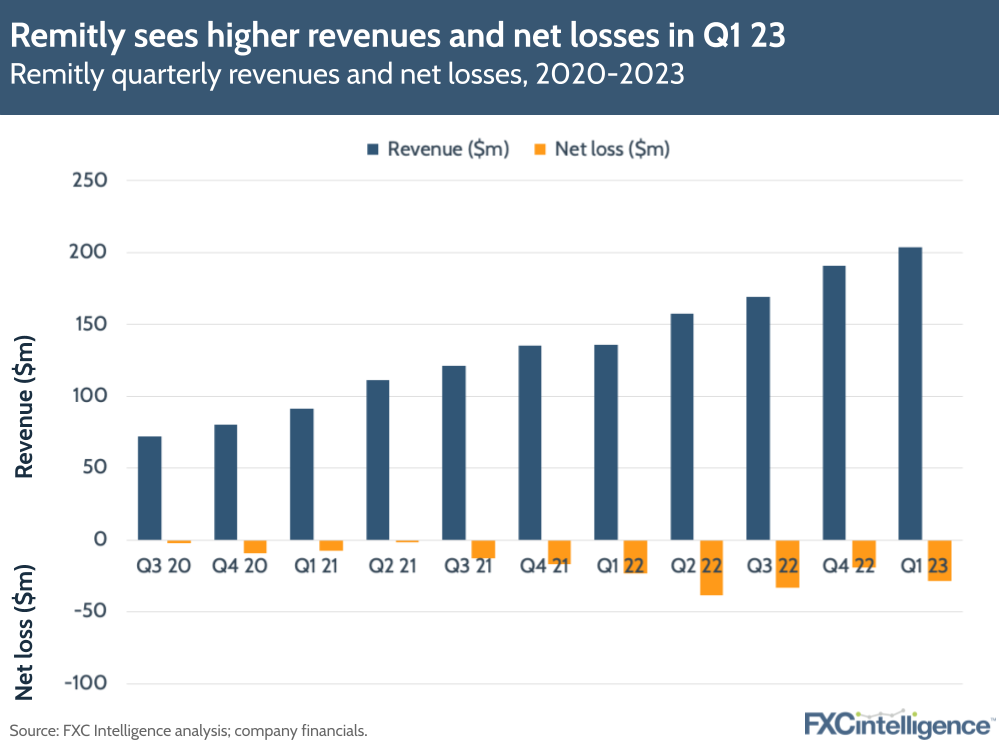

Remitly’s revenues rose 50% to $203.9m in Q1 2023, contributing to a rise in share price as the digital remittance company continues to outperform other legacy players on growth. The company also continued its profit streak, with an adjusted EBITDA of $5.4m and an adjusted EBITDA margin of 2.6% (up from -8.9% last year).

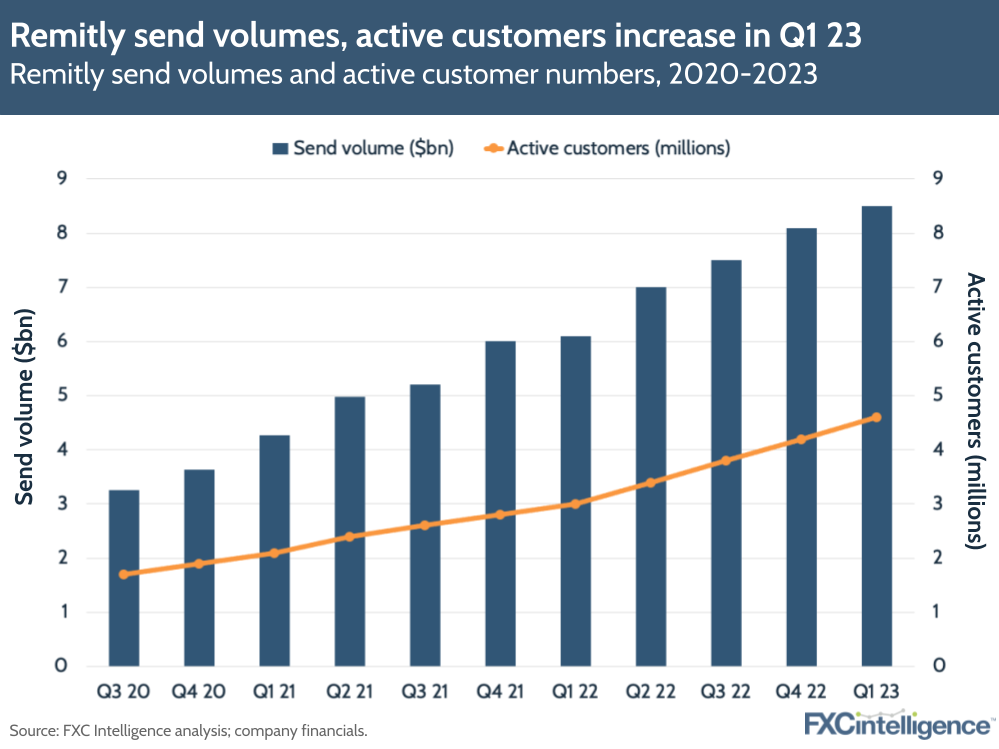

Revenue growth was driven by both existing and new customers, with active customers rising 50% to 4.6 million, while total send volume rose 40% to $8.5bn. In addition, customer acquisition costs dropped 31% YoY, helping to drive profits as Remitly scales up its business.

Remitly has nearly doubled the number of corridors it serves to 4,500, spanning more than 170 countries, around four billion bank accounts, more than 445,000 cash pickup locations and around 1.2 billion mobile wallets. Having recently acquired Israel-based Rewire and expanded to the UAE, the company is now looking for further growth opportunities across the Middle East, Europe and Asia.

On the back of a strong opening quarter, the company has raised its FY 23 revenue expectation to $875m-895m for revenue, and now expects an adjusted EBITDA of $5m to $15m. We spoke to CEO Matt Oppenheimer to find out what’s been driving growth for Remitly in early 2023.

Remitly’s revenue growth drivers in Q1 2023

Daniel Webber:

What’s driving consistent high growth for Remitly?

Matt Oppenheimer:

Credit, again, goes to our customers and the team. We’re really proud of 50% year-on-year revenue growth in Q1 at our scale and size. In terms of where the growth is coming from, it’s easy to forget that the remittance industry is very fragmented. The largest player has 15%+, the second largest has 5% and everybody else has sub-5%.

The natural question is: where is the rest of the market in terms of how people are sending money home? Also, the business is based on trust, which is paramount for anybody sending money back home and providing a remittance company with a lot of their personal information.

Historically, the way a lot of remittances have been sent home is via a cash-based legacy remittance provider, which is specific to a certain geography. For example, there might be a remittance company that’s a well-known brand for [transfers from] the US to the Philippines or the UK to Kenya.

If you are subscale and if you’re legacy, it’s really hard to build a great digital customer experience that has the peace of mind and lower cost that we provide. That is why the industry has seen some consolidation. The reason we’re outperforming is because we are executing well towards a vision of a digital first remittance provider that has scale, and that we can use to drive down costs and improve the customer experience.

On investors’ response to Remitly’s earnings

Daniel Webber:

What are you hearing back from investors? What’s driving Remitly’s share price up?

Matt Oppenheimer:

We’re really proud of our consistent track record of delivery in Q1 (and throughout). That’s a reflection of our customers that send money from developed to developing or low and middle income countries. Their grit and tenacity, as well as the non-discretionary purpose of sending funds are a key part of why we’ve had that continued success, and that is starting to add up now.

The second thing is we’re outperforming in terms of overall growth of remittances because of our strong execution. And as our business continues to get more scale, it’s self-reinforcing. Investors are seeing that in our numbers and we’re really excited about Q1 and what’s to come.

Driving down customer acquisition costs

Daniel Webber:

How are you driving down customer acquisition costs?

Matt Oppenheimer:

We take a unit economic approach, so we have a good sense of our customer acquisition cost and lifetime value, and we look at that by marketing channel, by geography and so on.

Customer acquisition costs came down 31% year-on-year, and that’s due to a variety of factors. We’re building out a marketing platform that gives us the ability to target the right new customers in the right geography, in the right marketing channel, and then have that be a seamless customer experience to onboard and build trust efficiently with new customers.

The more scale we get, and the more we’re able to invest in our marketing platform, the better it gets. Also, we have better data and analytics to predict lifetime value and match the customer acquisition cost in a more precise way.

The third benefit when it comes to scale is just word of mouth. We were sharing a customer story with our team, from a customer, and the way she found out about us is her friend told her, “Hey, try this out because instead of paying $10 with a legacy cash provider, it’s instant, it’s more affordable, it’s transparent and you should try this service.” We had 4.6 million active customers just in Q1, so that word-of-mouth effect also has a benefit when it comes to customer acquisition content.

Externally, the marketing environment has been a tailwind because there are not as many advertisers in the market. That won’t last forever, but is also a tailwind.

Building a strategy to support thousands of use cases

Daniel Webber:

With 4,500 corridors, that’s a huge number of use cases. How granular do you tend to get when it comes to unit economics?

Matt Oppenheimer:

There’s no such thing as an average Remitly customer. There’s very specific use cases and the unit economics vary depending on that. For example, the variable cost or speed may vary depending on whether or not a customer uses a bank account or a debit card, or if it’s going into a bank deposit, cash pickup or a mobile wallet.

The customer acquisition cost and retention may vary depending on whether or not it’s coming from paid search, as a marketing channel, versus referrals and the customer. The lifetime value might also vary depending on whether a customer is sending money to India, the Philippines or Kenya.

Now we’re in 170 countries, and have again added a record number of new customers. We’ve got all of this data and analytics – whether it’s on the customer acquisition, variable cost or retention side – and we’re able to scientifically execute the business so that we can do it in a more precise way, which ultimately builds not only a rapidly growing business but a very sustainable one.

We also showed profitability for the second quarter running with an adjusted EBITDA of $5.36m in Q1. So we’re excited about not only growing, but also running the business in the right way.

Benefits of scaling up for reducing costs

Daniel Webber:

What are the other central costs that you are driving down as you scale?

Matt Oppenheimer:

There are benefits of scale across our profits and losses. We’ve covered variable costs, but with things like pay-in costs, payout costs and fraud costs, you get scale advantages intuitively. On the more fixed costs, there are a lot of benefits as well.

With things like customer contact rates and customer support, there are big benefits there in terms of how we’re automating and therefore improving the customer experience, but also having the opportunity to drive down customer support costs.

Over time, we’re investing a lot in growth into the key areas: it’s marketing; great unit economics; delivering peace of mind for customers that’ll drive down CS costs and build even more of the differentiated experience; and then complimentary new products.

It’s important to recognise that while we’re investing in those areas very intentionally, we still delivered adjusted EBITDA profitability in Q1. When you talk about the fixed opex, the exciting thing is that we have the dials around profitability versus growth. You see a lot of leverage that inherently starts to happen with the payments business at scale, where we can have that adjusted EBITDA profitability and invest in growth in a disciplined but effective way so that we accomplish our vision and long-term growth aspirations.

Remitly’s UAE expansion

Daniel Webber:

Remitly recently expanded to the UAE. What are your next steps there?

Matt Oppenheimer:

The UAE is the second-largest origination market after the US, so it’s a big opportunity, like other markets where we have just launched. We’ll launch, roll out the playbook and start acquiring customers at great unit economics.

It’ll take time for it to actually contribute meaningfully to things like revenue, but when I look back at the countries where we launched a few years ago – going back to the UK and Europe or more recently Australia – those were the seeds we planted that are now contributing meaningfully to our revenue and growth.

Not this year but in years to come, I’d expect the seeds we’re planting in countries like the UAE to contribute to this compounding growth rate that we have, given the corridor expansion playbook that we roll out in new countries.

Remitly’s approach to pricing

Daniel Webber:

Your take rate has remained stable – what’s your current approach to pricing?

Matt Oppenheimer:

[In terms of take rate] we’ve been in that 2-2.5% range for the last 11 quarters now. It was up 15 basis points to 2.39% in Q1, but still within the range.

The reason for that is because customers care about a fair and transparent price, but what they care about more than that is: can I trust this service? Is my money going to get there quickly? Am I going to have any sort of delay? Is this company going to treat my personal information (which we have to collect for compliance and risk reasons) with the security, privacy and respect that it deserves? This is even more important when we think about our immigrant customer base.

Those things sound easy, but it’s very difficult, especially subscale, to deliver that trust with every single transaction. Ultimately, that’s why we see the high retention and high repeat rate.

Because we’re taking a lot of costs out of the system, we can offer a fair price; not always the best price, but it is a fair price, especially compared to the legacy players. But we don’t find ourselves having to compete only on price because of the premium service that we offer. You see that in the retention, the stability and pricing in our Q1 overall growth and results.

Daniel Webber:

Anything else you’d like to add?

Matt Oppenheimer:

There are a lot of businesses out there that are having a tougher time, and the reason that our business has been more resilient is because of our customers; their grit, their tenacity, their commitment to their families and the non-discretionary reason they send money back home.

We have outperformed the market. Our team’s doing an exceptional job doing all the things that we talked about. But that is on the foundation of our customers, who are just inspiring and amazing.

I’m so proud of our Q1 results. And we’re only 2% of the market, so we’re just getting started.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.