In our latest report in our Post-Earnings Call Series, Payoneer CEO Scott Galit discusses the company’s strong Q4 and FY 2021 earnings and plans for the future.

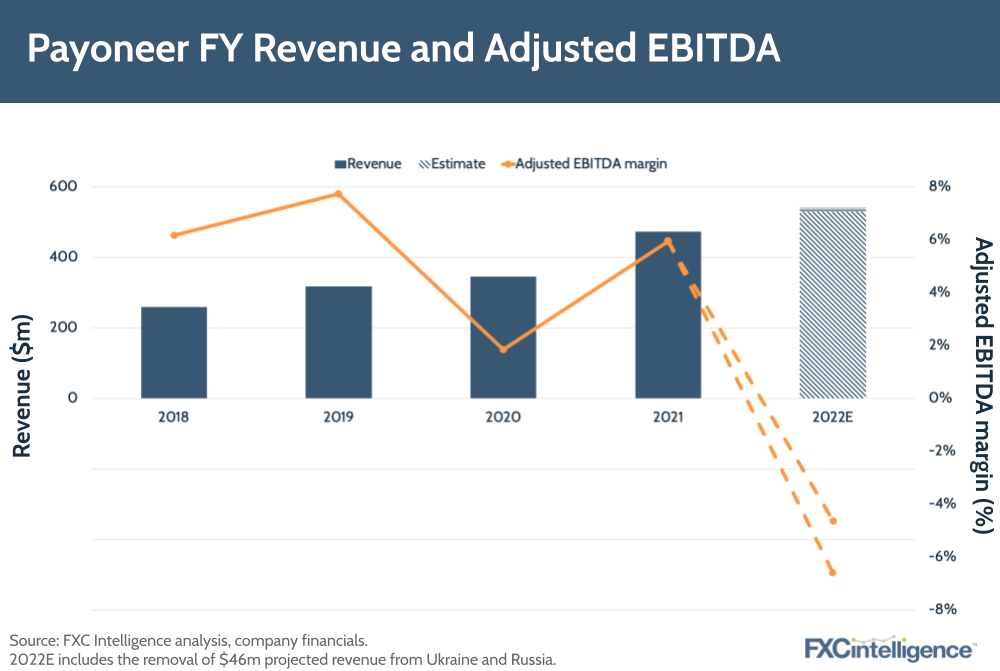

Global payments specialist Payoneer once again exceeded expectations for its FY revenues for 2021, which increased 37% year-on-year to $473m, $11m above the top end of its own projections.

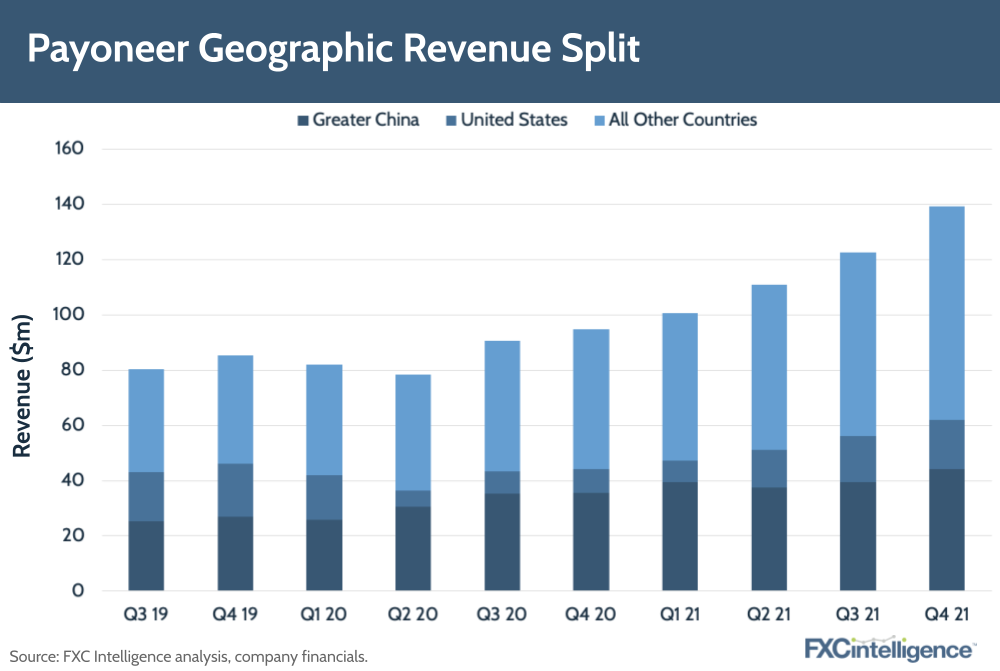

Strong new customer acquisition, increased adoption of higher value services and fast-growing international markets have been key growth drivers for the company, which saw a 47% increase to $139m in Q4. YoY growth rose above 50% in some regions, including Latin America, Southeast Asia, South Asia and MENA.

Now Payoneer is looking to further expand its B2B AP/AR offering – a key contributor to its Q4 growth – as well as increase sales resources, invest in R&D, develop new services and continue compliance.

With the company still rolling out its Payoneer Checkout product for small businesses, how will it aim to strengthen its position in developing markets and how is it responding to the changing industry? Daniel Webber spoke to Payoneer CEO Scott Galit to find out.

Payoneer’s primary growth drivers

Daniel Webber: Scott, it was a great quarter and a good year. What has been driving growth for Payoneer?

Scott Galit:

We executed really well last year and everything that we had control over actually ended up going well. From that perspective, we’re really happy with how the year went and thinking about our sales execution, and services that really create value beyond just the movement of money is something that has been a focus for us for a while.

That really got amplified during the year, particularly as supply chain and logistics issues and some of the other headwinds that started to impact ecommerce kicked in a bit. It helped us really highlight some of the breadth geographically, some of the diversity from a vertical market perspective and then some of the growing strengths in some of these other higher value services that we’ve been putting time and effort into to support our customers, their growth and our financial growth.

At the end of the day, growing 47% on the top line to $139m in the fourth quarter – we were thrilled. The team did a great job. Drop in the amount of profit that we achieved while we’re ramping up investments and that just gives a sense of some of the leverage in the business model. We think we’re still really early days in building out what we think is a global-scale platform with a number of multi-trillion dollar addressable market opportunities that we’re pursuing, some of which we’re quite early in pursuing.

Overall, we’re really happy with the fundamental execution. If we had gotten a little bit of tailwind instead of headwind from ecommerce I think the numbers would’ve been really amazing. Obviously, we’re sad for the people of Ukraine now and it’s obviously having some effect on our 2022, but that’s more of an emotional impact for all the people that are there.

Figure 1

Building global digital businesses in developing markets

Daniel Webber: The take rate is becoming a complex calculation because it’s definitely going up, which reflects adding more value-add services. What are the core products that have been driving growth for your company?

Scott Galit:

You raise a really important point, which is that we have more work to do to actually simplify the way folks understand our business, and take rate is complicated. Our business has a number of dimensions and variables to it: we support small payments for travel platforms that have one take rate, and we support small payments for freelancers or content creators that have another set of pricing to it. Obviously there’s going to be a different take rate on a $250 transaction than there is on a $25,000 transaction.

We have a number of larger customers that are moving much larger sums. Even within our B2B AP/AR we have this blend where we have a self-serve set of customers doing smaller transactions with a higher penetration of things like credit card for the buyers. Then we’ve got a bigger portion, which is actually growing even faster, which is the bank-to-bank payments. All of these things do create a bit more complexity where mix plays a bit more of a role than ideally it would. We’re trying to think of ways to actually come out with some clearer metrics that make it easy to understand without having too many of them. That’s part of what we’re sorting through.

In terms of what’s driving growth in some of the developing markets right now, the B2B AP/AR is certainly the most exciting. We still have a lot of runways with marketplace ecosystem activity across a number of these regions, which include Latin America, Southeast Asia, South Asia, Middle East and North Africa.

These are large regions with geographic diversity, and they’re a bit behind on digital opportunity pursuit compared to some of the other regions. We’re really excited, because we see a lot of young, digitally savvy people that are coming up in these regions and looking to build global digital businesses. We’re seeing just the tip of the iceberg start to poke through.

Over the last few years, we’ve put teams on the ground with terrific leadership in these markets coming from global leaders, such as the person that runs South Asia, Middle East, North Africa and spent several years at Amazon. We’ve got people that have spent years at Google and in Latin America, coming out of Mercado Libre. We’ve got folks with relevant backgrounds from a global commerce and locally relevant perspective.

We’re basically getting the infrastructure in place to really put the foot on the gas in these places. There’s a wide open market opportunity to help people pursue marketplace, B2B and cross-border sales, and ultimately, which we haven’t launched yet in most of the world, Payoneer Checkout to help them on their web stores. That’s something else that we’re excited about that will start to roll into more of the world this year.

Figure 2

Effective product rollout strategy

Daniel Webber: On the earning call you were asked, perhaps a slightly unfair question, ‘why didn’t you launch all these products five years ago?’. What do you think about that from a strategic point of view? Why do you roll out products sequentially as opposed to concurrently?

Scott Galit:

For one, when you’re introducing risk-bearing products that are regulated, it’s not the same as putting up a consumer website.

There’s all the things that you have to get right in terms of compliance and risks and all the legal and regulatory components, and then obviously all the money has to tick and tie and reconcile. There’s a whole bunch of stuff that comes along with it that is not trivial and can be the difference between not just success or failure, but whether you allow bad things to happen or whether you take on risks that shouldn’t be borne.

Some things just aren’t built to go from zero to 60. With working capital, you don’t really want a million orders and then figure out later whether your risk models were tuned correctly. You need to take it step by step. The way we approach it, we’re very much a customer-backed company. We try to think about what our customers need and then form a holistic view of what that looks like, and then we try to operate.

Believe it or not, we actually try to operate on three time horizons at once. I’m a big believer in a business with this kind of complexity. I’ve been this way since before I joined Payoneer. Having done fintech-related stuff for over 20 years at this point, you’re always going to have something that you’re selling aggressively that has a fairly mature product-market fit. Behind that, you have something that you’re still in your product-market fit iteration. You’ve got some sense of traction and fit, but you still haven’t filled in the full scope of the opportunity. It’s not just a sales execution game, you’re still making sure you’ve got everything tuned correctly to broadly address the needs of the market.

Then you should have things that are in your infrastructure development phase, where you are trying to get something out and figure out the product market fit, even at the most basic level. You always want to have your pipeline built behind things that you’re pushing through that same process. I usually have in mind three-year cycles: laying the groundwork for something now, there’s something else that next year will hopefully be ramping through the iteration curve – through product-market fit – and then hopefully the year after we’re focused on really driving scale.

I’m always trying to make sure that we’re feeding things in. We’re trying a parallel process, we’ve done a lot to expand the leadership capacity of the organization to give us the ability to do more. But again, you’ve got to get everything lined up. Even getting into things now, we’re still a bit variable in the sophistication of our go-to-market teams and their ability to sell in several products at once to customers.

It’s interesting. Even when you get the machine built so you can parallel process multiple large new product categories, you have to then rework your sales leadership to be able to create a broader customer sale and figure out how you support the kind of breadths and diversity of different products in a go-to-market perspective, as opposed to starting with something simple that you’ve just got to get as many people to buy as you want.

B2B for us is not an overnight success. We’ve been working on it for over five years. We bought the Optile platform – we closed the transaction in the first quarter of 2020, right as Covid hit. When we made the acquisition we already had the strategy of where we were going to go with Payoneer Checkout. Before we even signed or did our search that found them. These are things we’ve been working on for a while.

We’ve had a sense of where we’ve wanted to go from a big picture perspective for quite some time. We’re happy with where we are and we think we’re doing meaningful things. I don’t think there’s anybody on a global basis doing the B2B AP/AR stuff for SMBs to use the way we are. We’re doing really interesting work and the same thing on some of these other areas that we’re focused on.

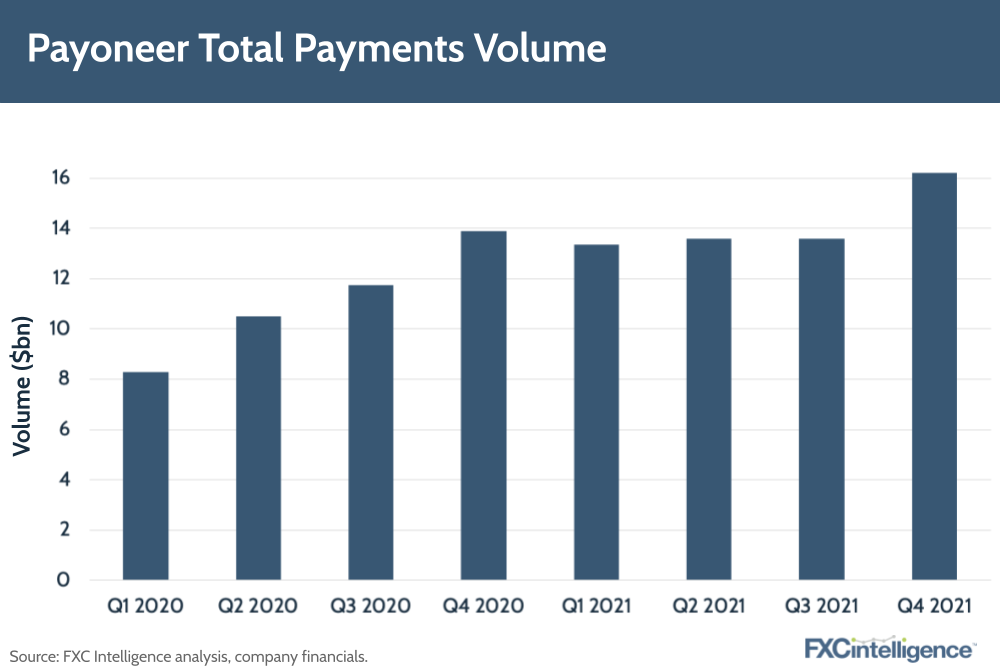

Figure 3

Expanding B2B offerings for SMBs

Daniel Webber: Let’s talk about B2B AP/AR. Where are some of the sweet spots? What’s the mix between domestic and cross border payments? And where have you really positioned yourself in the market versus others?

Scott Galit:

B2B AP/AR really highlights what’s so fun, interesting and exciting about our business in general. We support over 7,000 trade corridors, as well as sellers from over 190 countries selling to buyers in over 150 countries, who are using our platform every year to pay and get paid.

We’re pretty unique in our angle in that we’re primarily focused on small and medium-sized businesses, ranging from very small customers that are mostly service providers when they’re very small to larger customers that can be goods exporters and services exporters, and it’s almost all cross-border. The big thrust of what we do is on the accounts receivable side for small and medium-size businesses. Compared to a Bill.com, anything that they’re doing internationally is much more on the cross-border accounts payable side for SMBs, whereas what we’re doing is much more on the receivable side.

For us, it’s almost all rest-of-world to larger developed markets. There’s a long tail, but it’s mostly going to be Europe, UK, US, Canada, Australia, Japan, Singapore, Hong Kong – markets that are buying from suppliers that are usually in the rest of the world. For the most part, our primary customer is that exporter from the rest of the world and that’s our flow.

We get a fair number of payments every month from Bill.com coming to our customers around the world. In percentage terms, it’s really insignificant, but it’s interesting to see how it’s actually much more complimentary than not.

Our customers are selling into the US, into Europe, into other markets and Bill.com is doing a nice job of helping on the import side. I think a good number of businesses are importing services and goods from the rest of the world as they’re managing their businesses. That’s a very modern way that the business world operates: I’m buying services from Ukraine and people that are there, and I’m buying goods from other markets and sourcing from wherever I’m going to source.

Daniel Webber: We recently spoke to Flywire, which is very accounts receivable-focused. How would you position your company differently to them?

Scott Galit:

I can’t think of a single time that I’ve ever heard somebody internally say we’re competing against Flywire. My impression would be that they’re upstream a bit in size, but closer geographically to a Bill.com. Even if they’re AR-focused, they’re more AR-focused in developed markets for companies that have global buyers, but I’m not under the impression that they are really covering 190 countries in terms of where suppliers are selling from.

It’s not something that we actively position against. My impression is that they are a mostly one-sided business model, meaning they work with universities, they work with billers and they’ll help them get paid. Whereas for us, we actually are working on both sides with a pretty unique emphasis on the foreign side of things. Flywire, I don’t think they’re building relationships with students coming from China. I think they’re facilitating the payments. They may be doing other things that I’m not aware of but I think they’re mostly supporting universities getting paid and that’s the way that they get the flow.

Daniel Webber: There’s nothing more fragmented in the world than B2B payments – I don’t think anyone has more than a few percentage points of the market.

Scott Galit:

When you think about the market cap of consumer payments companies and how many of them are public companies built around the Visa/Mastercard ecosystem that are processing payments between consumers and merchants, it’s a huge number.

You look at a Stripe, an Adyen and a PayPal and all these other companies – it’s a gigantic and massively diffused market and we’ve had zero public companies that are focused on the B2B side of that because there hasn’t been the unifying ubiquitous infrastructure like Visa and Mastercard for everybody to just piggyback on. So B2B payments is bigger than consumer to business payment by a long way, and there’s lots of room to run.

Serving the changing needs of B2B customers

Daniel Webber: How do the rest of your services round out the experience to keep people within the Payoneer ecosystem?

Scott Galit:

At the end of the day, the way we think about it is, ‘how are we going to help our customers address their needs?’. They are businesses and with businesses there’s not a lot of rocket science.

For example, we’ve spent time examining the services that Citi provides to its corporate clients. They’ve done an amazing job for a number of years as a global leader in providing companies with services, but they typically move that machinery for large companies that are typically in the west. And what we’ve been doing is actually globalising it and democratising access to the smallest of small businesses, and making it natively digital.

People talk about real-time payments, and it has a place in B2B, but the problem with B2B is not whether your money comes in half a second, a minute, an hour or the next day; it’s that you’re waiting 90 days for your buyer to actually pay the invoice. I’m not saying that you wouldn’t rather get it today than tomorrow, I’m just saying that in the grand scheme of things, that doesn’t tend to be the most exaggerated of working capital cycle needs.

It’s a different world. Everything has changed and we see the same fundamental business needs and concepts being adapted for a digital world that’s integrated, interconnected and global with a lot of different types of participants that never had access to these kinds of tools before. We don’t have to be brilliant, we just have to listen well and pay attention to things that have worked before and then adapt it to the modern reality.

Moving into the cryptocurrency arena

Daniel Webber: What are your thoughts on the crypto space? Are you seeing demand for businesses to make payments in crypto?

Scott Galit:

We will continue to listen to our customers and provide them the services and solutions that they are requesting. At Payoneer, we’re ‘currency-agnostic,’ which means that regardless of what currencies our customers want, we have the ability to connect to it and support it, provided it is within applicable legal and compliance frameworks.

To date, we do not see much interest from our customers around using crypto within the transaction chain; rather, they’re more interested in it as a store of value or asset class. We have also commented publicly about our collaboration in the Regulated Liability Network, a cross-industry distributed ledger infrastructure spearheaded by Citibank.

There is clearly a lot of activity in the crypto space, and we will continue to engage with customers and monitor developments.

Daniel Webber: Scott, thanks very much.

Scott Galit:

Thanks, nice to see you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.