In the latest in our Post-Earnings Call series, we speak to Payoneer co-CEOs Scott Galit and John Caplan about what’s driving growth for the company’s B2B offering, its SMB strategy and strength in emerging markets.

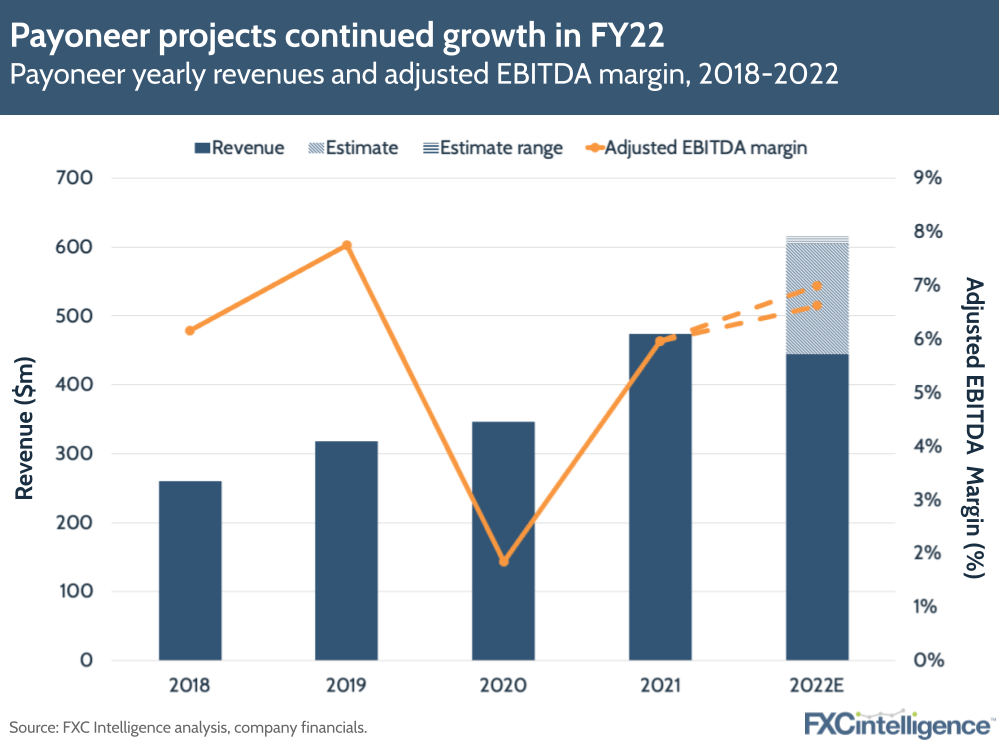

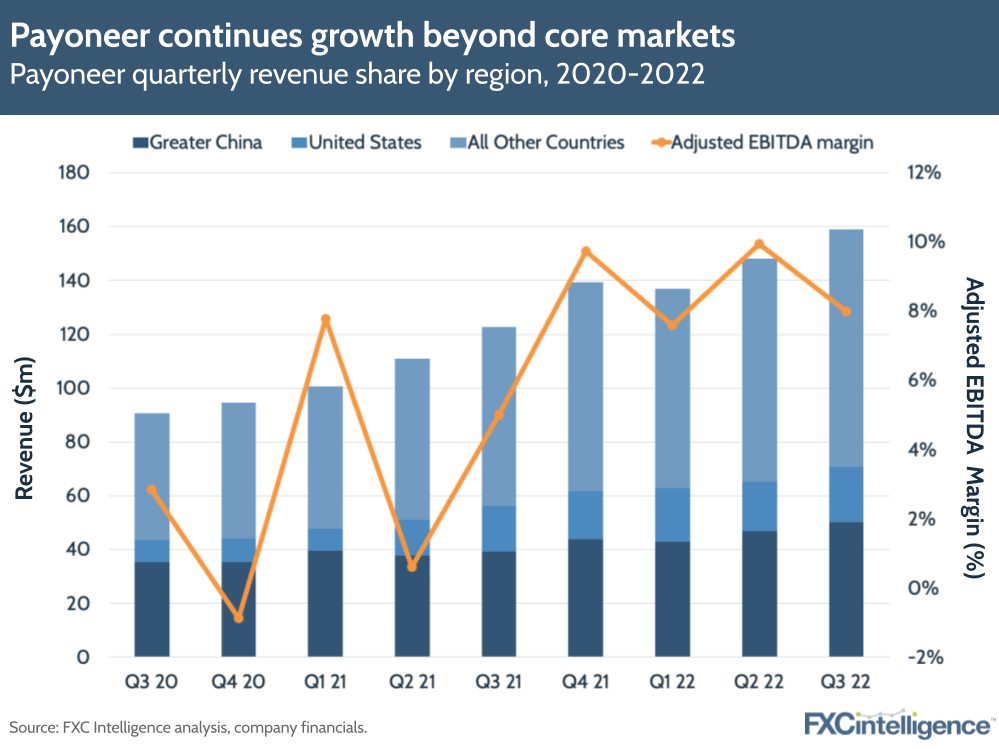

Payoneer continues to outperform the market slump, having seen a 30% YoY revenue growth to $159m in Q3 2022. The US-based payments platform also saw its adjusted EBITDA rise by more than 100%, to $12.7m, giving an adjusted EBITDA margin just under 8% – up from 5% in Q3 2021.

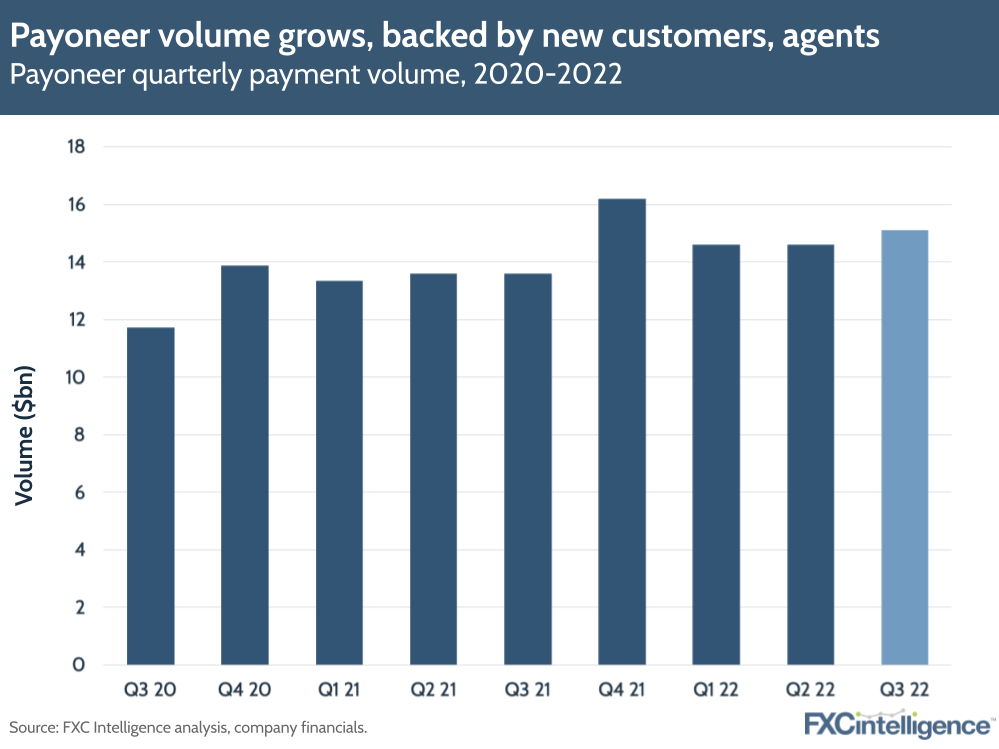

Payoneer mentioned continued strength in its B2B AP/AR offering, with B2B volumes growing 39% YoY and representing 12% of total volume for the quarter (up from 9% a year ago). The company has also seen the benefit of growing interest income, accrued from stored customer funds on its platform (above $5bn as of 30 September), which was partially due to the US dollar’s rising value.

Emerging markets were a big theme in Q3, with 39% combined YoY revenue growth across selected emerging markets, including Latin America, Asia, the Middle East, Africa and more. Payoneer saw 50% YoY revenue growth in Latin America, while revenues from India-based SMBs grew 35% vs the first nine months of 2021.

As a result of gains in Q3, Payoneer has once again raised its FY22 guidance. It now expects full-year revenues of $605m-$615m and an adjusted EBITDA of $40m-$43m. To find out more about what’s fuelling growth, we spoke to Payoneer co-CEOs Scott Galit and John Caplan.

Payoneer key growth drivers in Q3 22

Daniel Webber:

What’s been driving the strong growth in the last quarter?

Scott Galit:

The themes are pretty consistent with what we’ve been focused on for the last couple of years. It’s still very early days in penetrating the really big opportunity to help small businesses engage in cross-border commerce, and there are a few key vectors there.

One is building out a global go-to-market organisation that is enabling us to further penetrate larger SMBs. We’ve got a high-tech, high-touch combination approach to onboarding and serving these larger SMBs with a portfolio of global services that they need to manage their global business.

We’ve continued to make investments there and those are paying off as our customer acquisition was up 9% sequentially. It’s not a spectacular number, but despite the macro environment we’re seeing continued strong demand for cross-border trade and Payoneer in particular.

Secondly, we’ve talked about our portfolio of high-value services that we’re using to deliver more value to more customers and make Payoneer more attractive. B2B AP/AR really continues to resonate on a global basis for us. It’s a huge, multi-trillion dollar universe of opportunity that’s just focusing on small and medium-sized businesses.

We seeing tremendous opportunities all over the world. We’re very well positioned to essentially move businesses from relying on legacy payments provided by local banks to leveraging a much more modern, global and localised infrastructure to help them do business around the world. That’s one highlight and it continues to grow strongly. We continue to have strong acquisition momentum and very good retention.

We also highlighted our virtual commercial card, where we talked about triple-digit growth rates. That’s on the accounts payable side or the expense side of our customers’ businesses, where our customers that have used us to get paid now are increasingly able to use tools we provide to manage their expenses.

That’s a really high value tool because it helps match their dollar income with their dollar expenses. Instead of repatriating funds and then having to deal with all that complexity, they can just keep it in dollars and match everything off. It doesn’t cost them anything, and it saves them the cost of repatriating the funds.

Finally, we generate a higher take rate than our average take rate in our business. It’s a great win-win, providing utility cost savings for customers and a higher take rate in the process for us.

John Caplan:

To amplify a point that Scott made, we’re confident in our ability to meet our updated guidance, both on revenue and EBITDA, even with the macro crosswinds that folks are seeing in the macro economy. We delivered a very strong Q3 and it’s our customer value that’s driving the momentum the company has.

Figure 1

Payoneer’s B2B AP/AR revenue strategy

Daniel Webber:

You have multiple B2B revenue streams. Can you talk us through?

Scott Galit:

The foundation of our business was really related to marketplaces and marketplace sellers, and that’s still the biggest part of our business. In that context, the vast majority of the revenue we generate comes when a customer has been paid into their Payoneer accounts, and then they’re using the money in the account. The most common thing they do is settle into their home bank and their home currency.

With B2B AP/AR, this adds a payment processing front-end on the account that is geared towards them. We provide a way for them to do the billing and also to process the payments from buyers around the world. Some of those payments are driven by the accounts payable system of their buyers, while some are through an online payment processing flow. That could either be a bank debit or it could even be a card that we’re processing for some of that activity.

We charge fees for that payment processing on the front end, but then the money still ends up in the same Payoneer account that it did for their marketplace sales. Then, we still monetise it the same way on the back end with whatever they’re going to do to pull the money into their bank.

With marketplaces, money came into the account and then it came out. Now you have B2B coming in where we’re processing the payments. With the commercial card, instead of pulling money into your bank, you’re using us to make purchases.

Now, instead of paying us a fee to settle the funds in your local currency, you’re not paying us a fee. You’re using the card to make purchases of your advertising and all your cardable expenses and we’re monetising that through the interchange.

Figure 2

Offering more services for SMBs

Daniel Webber:

What’s your strategy regarding SMBs?

John Caplan:

We’re providing a utility and solving a real problem that entrepreneurs face worldwide. They need to do business globally, and with digital technology they now have the opportunity to reach around the globe. They need a financial partner who’s also global, digital and has local high-touch services and the technical capacity and capability that we have.

Today, we’re adding customers and upselling products and services to those customers. They do harder work than we do frankly. Whether they are an SMB making phone cases or a freelancer, that person is serving a customer across the board.

Having an ally in Payoneer that handles the financial infrastructure of their cross-border activity is increasingly valuable to our customers. They’re rewarding us with their loyalty and the utilisation of our platform.

Payoneer is uniquely positioned to provide an exceptional service to people in emerging markets. In India, when you sit with a husband/wife team of entrepreneurs and ask them, “What is it about Payoneer that is so valuable and useful to you and what can we improve?”, you hear, “You make it easy for me to get paid. You make it easy for me to trust that I can get new distribution relationships because you’ve helped introduce me to new points of distribution. And you provide a safe place for me to hold funds or pull my funds into my bank so that I can use the full utility of the Payoneer account”.

We’re hearing this over and over again. We’re just at the beginning of the penetration in the markets around the globe where SMBs are over 50% of the GDP and exports are over 50% of the GDP. That’s our sweet spot. It’s those people we serve, and we’re laser-focused on providing them with something that nobody else offers at this level of capability, with the team or brand that we have. Coming off earnings, I feel very confident in the team and our momentum and where we’re headed.

Figure 3

Geographic split between marketplace and SMB customers

Daniel Webber:

How big are the differences in your geographic split between the traditional marketplace business customer and now your SMB customer?

Scott Galit:

It’s fascinating when you see the different pockets of activity around the world. There are some markets where there is a strong correlation between marketplace activity and direct B2B trade. And then there are other markets where it’s really not very correlated.

For example, in greater China, you see a lot of marketplace sophistication and cross-border trade sophistication. In Latin America, I would say we are seeing more just cross-border trade sophistication than we are marketplace sophistication.

Our go-to-market team in Latin America is often leading with B2B AP/AR services for those customers. In a place like Greater China, they will cross-sell exporters that are selling on marketplaces on the B2B AP/AR side.

There are also those that are selling new customers as well, but there’s much more overlap and much more of a pool of activity that is underlying both marketplace sales and direct trade. It’s a mixed bag that ends up colouring how our teams focus their go-to-market efforts and the positioning of the services.

Interestingly, in the US we lead with a B2B AP product. It’s not marketplace-centric for SMBs and it’s not AR-centric. The US is probably the single most inwardly facing market in the world, but we do have a growing number of small businesses that are using us to pay international suppliers; in particular, contract workers and service providers around the world. That ties into the B2B AP/AR ecosystem that we’ve created where for some of it, we have customers on both sides.

John Caplan:

We’re probably the leader in the marketplace space, and we have a great deal of humility about our position and cherish those customers and the opportunity. But we also have a far bigger set of solutions and services for the emerging market, particularly SMBs.

We obviously love US SMBs as well, but it’s a different vector into our platform. The US SMB is using Payoneer to pay people around the globe, whether it’s a freelancer who’s working for them in Ukraine, a group of engineers or a stock photo agency.

The solution is a solution for the world’s SMBs, primarily focused on the value proposition to the SMBs in emerging markets, because that’s where we have a unique wedge and opportunity. But we have lots of customers here in the US. Those are the customers that recognise cross-border trade is really valuable for their business.

On Payoneer’s Mastercard product

Daniel Webber:

Is your Mastercard card product focused on cross-border trade?

Scott Galit:

Today, the focus of the product is for our customers that are using Payoneer to get paid. It’s one of the additional services we provide to help them better manage their business and cost structure.

In practice, it tends to skew more towards our accounts receivable customers. So far, we haven’t really taken it out and tried to package it up just for a US SMB that’s just doing domestic business. There isn’t a card limitation, but it’s really more about amplifying and leveraging our strengths.

Exploring opportunities in India

Daniel Webber:

You mentioned India in your earnings report. What opportunities are you seeing from this market?

John Caplan:

Our business in India is growing 35% in a country whose GDP is growing 7%. We estimate we’re 1% or less penetrated in the market. There is an entrepreneurial energy in Mumbai and Bangalore that’s extraordinary and we are well positioned there. We have a great team, we have a strong brand, we have great bank relationships. And we believe that there is substantial upside ahead for Payoneer in India.

We have been hosting events across India recently, and there’s been a post-pandemic surge of energy for people to go to them. There’s a pent-up demand for cross-border trade. We’re pulling people together in forums to educate them, connect them to one another and provide the financial infrastructure so that we make it easy for them to do business.

Scott Galit:

From a trade perspective, we had initially expected India would be very services heavy. India is certainly a very sophisticated services export market. I would say I was very pleasantly surprised by the robustness of the goods exporting industry there, which is really much more sophisticated than I expected.

It still pales compared to the sophistication of China, but it’s a big market, very export and globally oriented with a smart, well-educated, technically savvy population. Like a lot of other developing markets, there are lots of young people.

There’s an entire fintech ecosystem that’s been developing there. It’s not the same as Tel Aviv, Silicon Valley or London, but it’s getting there in the level of capital available. It’s an interesting time and a really interesting place. When you look a decade ahead, there will be significant opportunities in India and there’s just tremendous growth potential.

Driving profitability in the future

Daniel Webber:

With top-line numbers going up, what can you tell us about profitability going forward?

John Caplan:

As we said in our call, absolute EBITDA will grow in 2023. EBITDA margins will grow moderately in 2023. We raised our guidance for 2022 on revenue and EBITDA. Our business is strong, our balance sheet is healthy, our team is focused. This is a growth company with good margins and momentum.

Daniel Webber:

Great. Thanks very much to both of you.

Scott Galit and John Caplan:

Thank you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.