Payoneer is continuing to drive growth through a new focus on high-value customers. Following the company’s Q1 23 results, we spoke to new CEO John Caplan and new CFO Bea Ordonez about how this strategy is paying off.

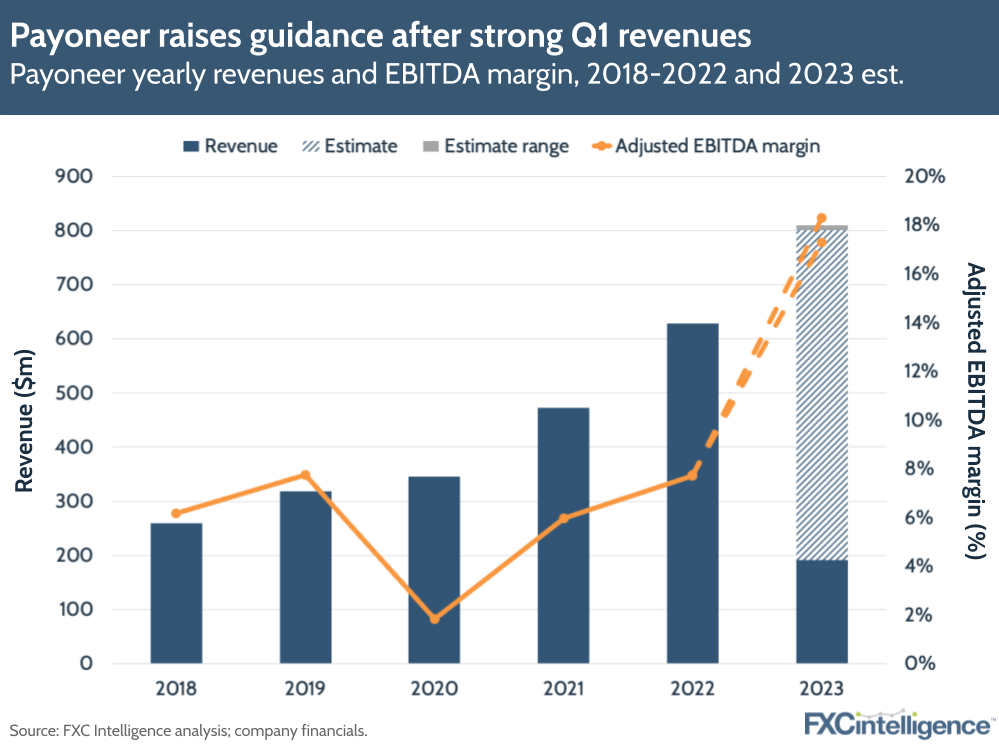

B2B-focused payments company Payoneer reported a 40% increase in revenues to $192m in Q1, with its adjusted EBITDA rising 273% to $38.8m. It’s a strong start to the year, marked by stable ecommerce growth, travel recovery and the company’s new Ideal Customer Profile (ICPs) strategy.

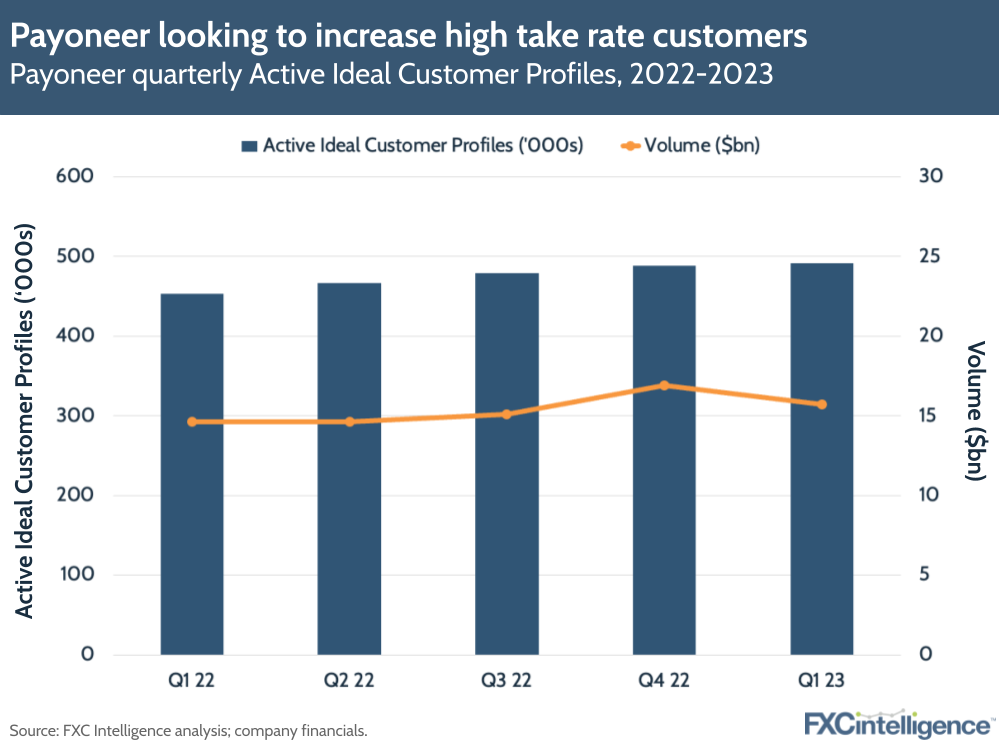

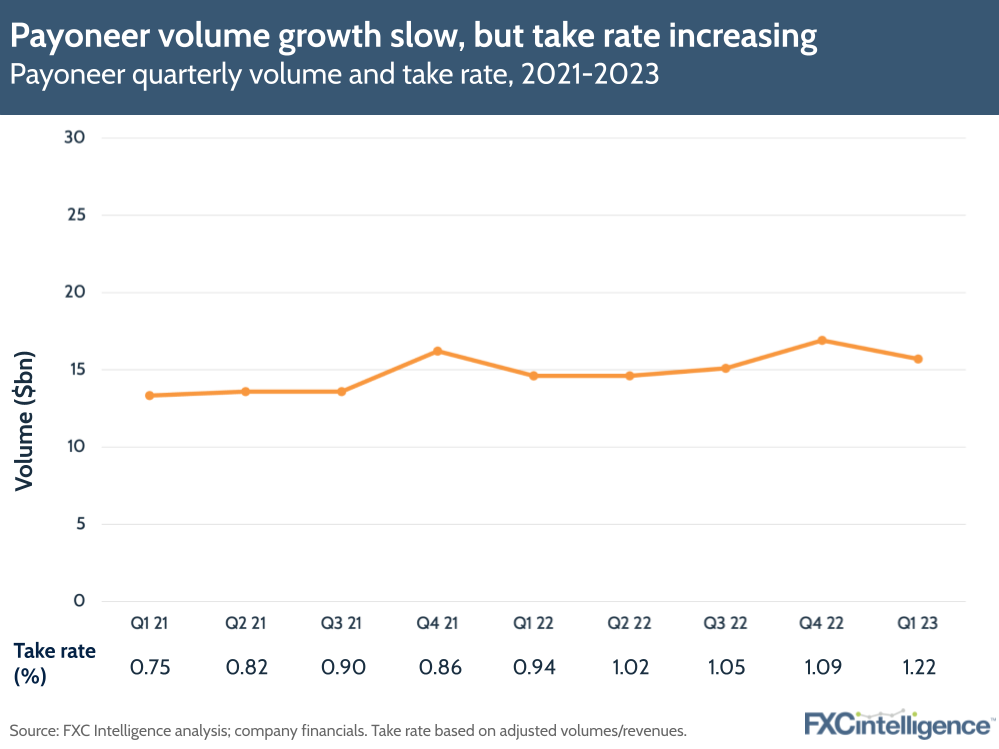

ICPs – customers that have on average over $500 a month in volume and were active over the trailing 12-month period – remain the focus for Payoneer and are helping drive a higher take rate for the company. Though volume growth was lower than last year, at 7.5% (to $15.7bn), Payoneer’s take rate has risen from 0.94% to 1.22%, with the company benefitting from higher interest income ($49m) from customer balances on its platform.

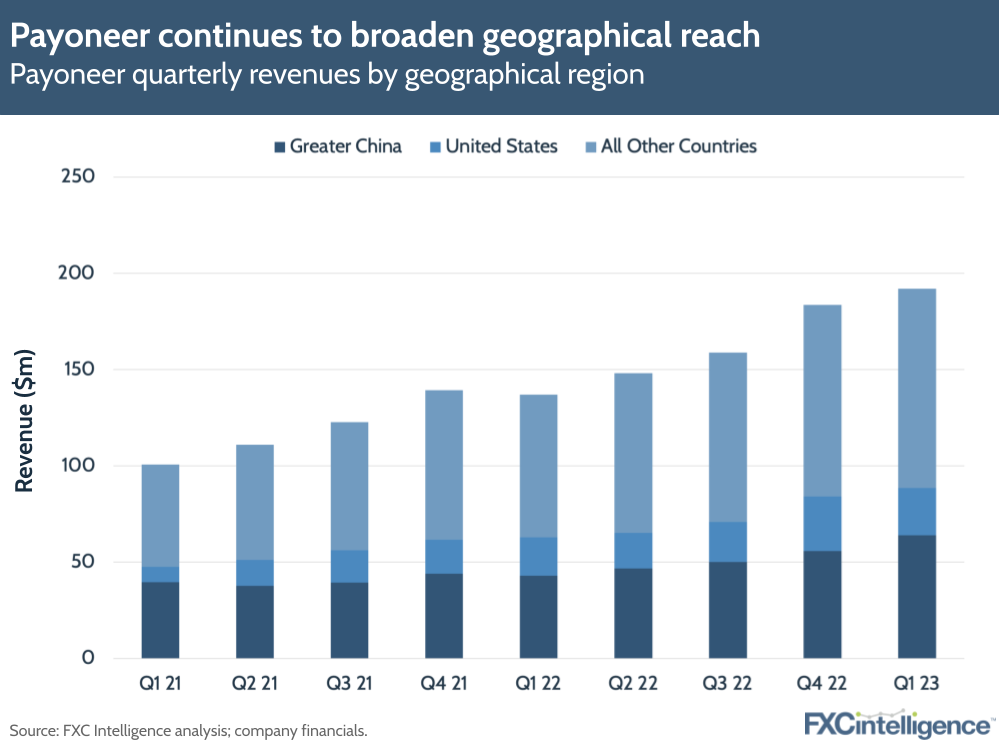

Turning to market expansion, Payoneer saw 25%+ growth across all regions, including 50%+ growth in key markets such as Argentina, Colombia, Vietnam, Mexico and the UAE. On the back of its results, the company has now raised its revenue guidance for the year to $810m-820m (a growth of 29-31%), with adjusted EBITDA expected to rise between 189% and 209% to $140m-150m.

Daniel Webber spoke to CEO John Caplan and CFO Bea Ordonez – both of whom were appointed on 1 March – to find out how the company aims to continue its growth trajectory through its high-value customer focus.

Payoneer revenue growth drivers in Q1 23

Daniel Webber:

What’s driving top-line growth for Payoneer in Q1 23?

Bea Ordonez:

We saw great top line growth and were very happy to grow 40% [in revenue]. We obviously have the tailwinds from so-called float income, but as we’ve said repeatedly through calls, we view that as core to the value proposition of what we deliver to SMBs that use our platform.

We’ve been able to grow balances on our platform by 2x, as well as the amount of volume on our platform (in terms of growth) for three years, and we think that demonstrates the utility that we provide and hence the income that’s coming in there.

40% top line growth is really premised on a few things. Flow income is definitely a part of that. We were happy with the early momentum and our ability to grow ICPs on our network. As we begin to pivot the organisational focus to acquire and serve more ICPs, we can begin to unpack that, but we were pretty happy with this early momentum.

We were able to grow ICPs on the platform at 9%, versus 6% in active customers as a whole. We were especially happy to be able to grow larger customers within that ICP cohort (those that do under $20,000 of volume in a year versus the $6,000 bar) by 18% quarter-over-quarter. That’s the early momentum around that pivot that we have been focused on for several months – [towards] ICP, float income, regional growth and increased adoption of high-value services. Certainly we saw some headwinds around B2B, but it’s still growing in terms of revenue pie at a pace that is more accelerated than our core revenue growth, and we see enormous opportunity from an adoption perspective.

We’re growing our card usage and driving ahead on working capital. Those are higher take rate offerings. They demonstrate our ability to grow the product suite and sell them into our network, and we see enormous potential to continue to drive those adoption rates up, to capture more take rate and drive that flywheel.

John Caplan:

There’s only one thing I would say: 70% growth year-over-year in Latin America indicates the product market fit and momentum we have in a region with 800 million people that the outsourced economy is increasingly focused on and that we are uniquely positioned to serve and capture. The ICP work, the regional growth and the momentum we have as a firm is evident in those high growth numbers.

Defining Payoneer’s target customer

Daniel Webber:

How do you define an ICP? And what’s the benefit of this customer type to your business?

John Caplan:

ICPs are customers who had financial activity in the last 12 months that have averaged over $500 in volume per month, in each of those months. The take rate applied to these customers is based on the geography they’re in, because obviously some geographies are 2% take rate geographies, while others are 0.5% take rate geographies.

Those same customers are maintaining balances with us on our platform, which is why the balances are core to the product we’ve offered. For example, if you’re hypothetically keeping a thousand dollars or two months of balances at any point and we’re earning interest on those balances, that’s incremental revenue on that customer. That customer is trusting us for their transfers, their financial operating capability and for keeping their funds in a dollar-denominated account in a G-SIB bank that they feel that they can trust.

It’s one of the reasons why balances are core to the revenue model of our business; you acquire customers, they’re profitable and they maintain funds on the platform so that they can use those services and a platform they trust.

Bea Ordonez:

We view it as a flywheel where adoption drives revenue, APPU and more balances, and higher-value customers will adopt more products. Customers that adopt more products typically keep more balances with us in their account. Customers with more balances will in turn adopt more products, and so on. It’s a wheel that we can continue to drive in terms of amplifying the value of the services that we can deliver through that account framework.

Daniel Webber:

What happens to the other customers? Are you changing the pricing or letting them taper off?

John Caplan:

No, we love those customers as well, and we see lots of opportunity to monetise them more effectively and sell them additional products and services. We’ve begun experimenting with account fees and pricing.

Changing Payoneer’s market strategy

Daniel Webber:

Given your ICP focus, how are you now picking the markets that you want to focus on?

John Caplan:

We are uniquely positioned in the fastest-growing emerging markets worldwide, including Latin America, India and Turkey, and across the globe. When you look at the growth we’ve had in the last five years, we’ve doubled our share of revenue that’s coming from those markets. It took us five years to double it, and it will take us less than five years for those emerging markets to be greater than 50% of the total pie at Payoneer.

Daniel Webber:

So how do you change the go-to-market now, given the ICP focus?

John Caplan:

There’s a few things. We identify which categories or industries in each geography contain the most ICPs. The partnership ecosystem around which software, partners or local banks they use is driven by that. The compensation formula or the tools that we provide to our sales organisation reflects it. Everything about our organisation is around acquiring and engaging high-value, emerging market business owners and helping them in the connected global economy. That’s what we’re doing.

Our go-to-market function is adjusting, so in markets where we have too many people or we’ve allocated people where there are no ICPs, we can move those people to markets where there are lots of ICPs.

Why Payoneer is targeting emerging markets

Daniel Webber:

What draws you towards emerging markets while other players may be looking more at developed markets?

John Caplan:

It’s really straightforward: we are uniquely positioned to win as a global player with capability in those emerging markets. The landscape is probably less competitive. We have the regulatory framework, the banking network and the brand in place; that makes our costs to acquire and serve those customers there (with enough size) highly profitable for us, and there are a ton of them in those economies that are growing so quickly.

The markets are growing quickly, our product is well-defined for what those customers need and our relationships and ecosystem is best-in-class in those markets. With people on the ground in Argentina, Vietnam and the Philippines, we’re positioned to capture those customers. That’s what we see happening and our competitors are not there.

Which products are Payoneer’s target customers using?

Daniel Webber:

If you think of a typical ICP, what’s the product mix that you would see them using?

John Caplan:

It depends on the geography. They need our accounts receivable solution so that they capture their payments into a dollar-denominated account that we run. We see them increasingly using our [platform to enable] intra-network payments between one another – for example, a customer in Argentina using Payoneer to make a payment to another member of the Payoneer community or network. This is not yet monetised in our business and it will take us some time to get it monetised, but it is a superpower of the network we have and we’re excited about it.

We’re also increasingly seeing our commercial MasterCard penetration and volumes grow. They’re using Payoneer to buy their Facebook or Google advertising and their Amazon hosting. They’re using our capability to source on Alibaba.

Those emerging entrepreneurs recognise that their Payoneer account provides so much utility for them that they can’t get from their local bank, and none of the other global public fintechs are on the ground.

Daniel Webber:

Which products do the high-value customers use?

John Caplan:

The high-value ones generally use more of our tools and capability. One of the things that we offer those high-value customers is a named person to talk to, so we provide support infrastructure on the ground, in the local language, to those customers.

So, there’s a service that we provide that’s unlike anybody else, where they not only have the technical capability, or the banking, wallet or operating system capability; they also have a human that they can connect to with questions, should they have them. That is not easy to deliver, but a very valuable service proposition to our customers that leads to solid stickiness and retention.

Payoneer’s approach to pricing

Daniel Webber:

How do you think about your positioning in the market with regards to pricing?

John Caplan:

It’s different courses for different horses, but certainly for our ICPs, the value proposition is beyond just cheap. [Being] fairly priced and [offering] lots of value to our customers is how we’ve operated and that’s built the business and we’ll continue.

Impact of current ecommerce trends

Daniel Webber:

How are you thinking about the ecommerce market now?

John Caplan:

We’ve seen some rebound in ecommerce across the board and we’re bullish in the long-term on where ecommerce is – certainly on the kinds of merchants who use Payoneer as their solution, because they’re getting paid from multiple marketplaces into their Payoneer account.

That provides a simplicity of service that is unique given our relationships, whether it’s with Walmart, eBay, Amazon, all down the line, or it’s even broader than that. Our ecommerce franchise is pretty healthy and will continue to be healthy.

Bea Ordonez:

Ecommerce has performed in line with how we see peers and pull-throughs from other public entities that have that exposure. We’re not seeing anything that’s surprisingly different to the upside or the downside versus the trends that they’re reporting.

We’re seeing short-term headwinds, which others are reporting, but actually it’s somewhat better than we anticipated coming into the year. As we built our guide and looked at 2023 from a short-term macro, we’ve tended to be surprised a little bit on the upside in terms of ecommerce trends. It tends to be focused from our business perspective more on larger ecommerce players, so not as helpful from a revenue pull-through perspective, but overall we see that consumer spending remains pretty resilient in terms of what we’re seeing through our pipes.

Like I said, we’ve been surprised at the upside around some of the larger marketplaces who are performing a little better. Again, we remain a bit cautious on near-term growth and super bullish on the long-term thesis, which is related to ecommerce and continues intact as we normalise off pandemic spending, but continues to digitise.

We like ecommerce, we think it’s an important part of the business, but we’re a super diversified business with numerous verticals that we’re serving, from freelancing to travel to education and remote work. They all have different characteristics and they’re going to perform differently through the cycle. We could talk about ChatGPT and freelancing and you could always find cyclical and secular things that are helpful or not helpful in the moment. But for us, being diversified, it is a bit of a superpower and we think it is very helpful.

Daniel Webber:

Anything else you’d like to share?

John Webber:

The team at Payoneer is exceptional, focused and delivering. I’ve been CEO since 1 March, and Bea has been CFO since 1 March, and the amount we’re getting done in a short amount of time is awesome. The best people in the world work at Payoneer and we have a big opportunity, and we’re working our tails off to go get it.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.