Intermex CEO Robert Lisy discusses factors behind the company’s Q3 2021 success and future plans as part of our Post-Earnings Call Series.

Intermex’s Q3 2021 results have been some of the best in the remittances space, with 26% year-on-year revenue growth on a 2020 quarter that had already rebounded from the pandemic.

The company has also seen a record number of remittance transactions, which grew 23.4% year on year.

Intermex attributes this to its ongoing omnichannel strategy, which sees it maintain a strong focus on retail while continuing to grow its digital offering.

However, with Facebook making its market entry in one of Intermex’s key markets, how does the company plan to continue its success?

Daniel Webber spoke to CEO Robert Lisy to build on the company’s latest earnings call and discuss its future strategy.

Finding growth in retail and digital

Daniel Webber: Let’s start with the top line. A really good quarter, particularly compared to your peers. 26% year-on-year revenue growth, 36% principal growth. What’s driving that?

Robert Lisy:

It’s always hard to say what’s going on with other people, but it’s a pattern, right? Western Union and MoneyGram have been suffering for a number of consecutive quarters at both top line revenue, either lackluster or negative growth year over year, and then reflected in their EBITDA some quarters. They have a bit of mastery where they produce a 5% EBITDA growth on a 2% revenue growth, but generally it all starts with the top line and peels down to the bottom line.

In the case of Euronet’s money transfer business, it’s even harder to understand because their revenue’s been doing pretty well, but their EBITDA, it’s not doing as well as us on the top line, but it’s doing well enough to do better on the bottom line than they are. And they’re suffering a 25% EBITDA decline in a quarter.

I’m not an expert on their business. I would guess that some of this stuff is happening because people shut down during Covid and expenses were really low. So you were able to have whatever came over the transom in the case of Ria, Euronet, and they didn’t have all the commensurate expenses. Now the expenses are back and they haven’t had tremendous revenue growth.

I can only continue with the same things that I said when the pandemic happened. When early on, almost before it even got here, of course, Western Union, Moneygram all had a presence in Europe and it was there first, they were all suffering already in the first quarter of 2020. They fell off the cliff in the first, second quarter of 2020. Then there was a mild recovery in three and four.

One of the biggest worries we had this year is we said, the market’s not going to understand that we really had a good third and fourth quarter in 2020.

These guys are going to come in and they’re going to have great quarters because they’re lapping horrible numbers. It’s almost incredible that they lapped horrible numbers with lackluster or horrible numbers. And we lapped really pretty strong numbers with super strong numbers.

Now what does that bring us to and why is that happening? Not an expert on their businesses, but I think if you’re in retail you’ve got to dance with the dates that brought you to the ball. And they’re not. They’ve given up on retail; they’ve turned their backs on it and tried to convince the market that look, I’m really digital.

We’ve talked about the complexities, what’s digital and what isn’t digital, but they’ve tried to convince the market, hey, I’m really more digital than you think I am. And with that, they haven’t really gotten the credit for being digital. Why? Because the top line is shrinking: Western Union and MoneyGram are smaller companies than they were three years ago.

The top line is shrinking so much that the digital growth they have is not really being rewarded. Or if it’s being rewarded, it’s being counteracted by the punishment they’re getting because their overall businesses are shrinking.

Here’s what my thoughts are about retail business. Let’s say that Mexico grew 12 to 15% in September. I think Mexico’s digital may be growing 40%, 50% or 100% on a small number. But the actual retail business is not shrinking. Retail may not be growing at the same rate as the business overall, but retail today is bigger to Mexico in the third quarter – that’s my belief, no one knows the number – than it was in 2020 in the third quarter.

Now that might be 3 or 4% bigger. It might be 5% bigger. It’s not 20% because bigger growth is happening in digital. But we’re the only guys of the public companies that are diligently, not just trying to hold our own, but we feel like there’s a huge amount to be harvested in retail. Particularly in certain states in the US, particularly with certain corridors and we continue to work it that hard.

It’s not a business that’s shrinking in absolute terms. It may be shrinking in terms that its share of the overall business to Mexico is getting smaller or to Guatemala, but it’s growing and staying steady enough that it’s a bigger business today than it was in 2020 and a bigger business than it was in 2019.

I don’t know whether it will be a bigger business in 2022 than 2021, but it won’t be smaller by such a degree that will offset the lack of focus from people that are trying to convince the world they’re more like digital and are turning their backs on it.

Figure 1

Intermex revenue and EBITDA margin, 2016 – 2021

Mexico, Guatemala and the rise of Novi

Daniel Webber: Let’s talk about Mexico. What is changing in the corridor?

Robert Lisy:

There’s change going on everywhere. We’re seeing more people, but the deposits into bank accounts are growing, continue to grow. We’re seeing people taking money in mobile wallets, a very small piece. We’re seeing people getting paid out at ATMs.

That really all supports the notion that we talk about, which is an omnichannel approach. It’s not a single one approach, but you have to be able to offer everything a consumer might want so that the consumer can pick and choose, rather than force them into a certain channel.

There’s a really big leap here. You’ve got to go and say: people are going to go on WhatsApp and send this money; they’re going to be willing to do it in cryptocurrency. And how are they getting paid? Cause they’re not getting paid in cryptocurrency.

When the guy gets picked up, the Guatemalan at Home Depot on Saturday, for the person that wants to plant some begonias and roses and some bushes, they don’t end the day and say, let me give you some whatever cryptocurrency. They pay them typically in cash. That’s what happens. All of that has to be seen.

Anytime there’s a movement of a behemoth, if I’m a mouse in the room and there’s an elephant that’s moving around, I’ve got to be aware of that. It doesn’t mean that I’m necessarily going to be threatened by it, but you’ve got to be aware of that.

Obviously Facebook has got a tremendous amount of following, assets, all of that. And all of the customers I think use Facebook, but the whole notion of if you’re not banked, but you’re going to be banked with crypto. How are you going to get the crypto? You still have to convert the way you get paid from the people that you do the work for into a crypto and then send it on WhatsApp. That’s where the devil’s going to be, in those details. And that’s where I don’t know.

They’re free wires, so certainly that’s going to seem compelling, but when the guy gets dropped off after he painted your patio or he planted your bushes and you give him $150, how does he turn that into crypto? And why does he turn it into crypto versus just get dropped off right in front of the retail store that he sends the money with and he keeps 20 bucks for spending on his own and he sends 130 home. How do you do that? That’s the part I’m not really clear about.

You have this tremendous power of Facebook, but I don’t know if it has the nimbleness to really do what it needs to do. Not dismissing it, but I don’t know if it has the nimbleness that it needs.

Daniel Webber: Let’s talk about Guatemala. The biggest news there is Facebook and the Novi launch. I’m fascinated by your thoughts on that. Have you seen any impact from it?

Robert Lisy:

There’s just not enough known. Many of us that know people that are living in parts of the world where they don’t communicate with their family as well, or know our customer, know the power of Facebook but even more so the power of WhatsApp. We know that’s really powerful.

You’ve got to be able to leverage that and leverage that also with this cryptocurrency. We hear some people saying that a lot of people have cryptocurrency and a lot of people that are immigrants and customers of remittance companies have cryptocurrencies. I don’t buy that right now. I don’t think there’s a lot of holding on to a lot of cash or I guess assets like that.

There’s a really big leap here. You’ve got to go and say: people are going to go on WhatsApp and send this money; they’re going to be willing to do it in cryptocurrency. And how are they getting paid? Cause they’re not getting paid in cryptocurrency.

When the guy gets picked up, the Guatemalan at Home Depot on Saturday, for the person that wants to plant some begonias and roses and some bushes, they don’t end the day and say, let me give you some whatever cryptocurrency. They pay them typically in cash. That’s what happens. All of that has to be seen.

Anytime there’s a movement of a behemoth, if I’m a mouse in the room and there’s an elephant that’s moving around, I’ve got to be aware of that. It doesn’t mean that I’m necessarily going to be threatened by it, but you’ve got to be aware of that.

Obviously Facebook has got a tremendous amount of following, assets, all of that. And all of the customers I think use Facebook, but the whole notion of if you’re not banked, but you’re going to be banked with crypto. How are you going to get the crypto? You still have to convert the way you get paid from the people that you do the work for into a crypto and then send it on WhatsApp. That’s where the devil’s going to be, in those details. And that’s where I don’t know.

They’re free wires, so certainly that’s going to seem compelling, but when the guy gets dropped off after he painted your patio or he planted your bushes and you give him $150, how does he turn that into crypto? And why does he turn it into crypto versus just get dropped off right in front of the retail store that he sends the money with and he keeps 20 bucks for spending on his own and he sends 130 home. How do you do that? That’s the part I’m not really clear about.

You have this tremendous power of Facebook, but I don’t know if it has the nimbleness to really do what it needs to do. Not dismissing it, but I don’t know if it has the nimbleness that it needs.

Daniel Webber: Did you have any feedback from your partners on the ground in Guatemala? We certainly heard from people with partners there that the banks were not happy.

Robert Lisy:

I am not aware of any. We could get feedback, but we’ve got folks in that area of the business that take care of those relationships and it hasn’t rolled up to me. There could be concern. Just like from our perspective that we’re not without concern, we’re just not going to overreact to something that to me is not really clear how it tactically can unfold. But we’d be better off if Facebook didn’t even think about it.

Daniel Webber: In the markets you were virtually unscathed by it, whereas those with more digital exposure were the worst hit.

Robert Lisy:

I think that says a little bit about where that’s really going to go. I know a lot of folks that are on WhatsApp and I could see them potentially doing this.

I do think there’s still going to be people that are concerned. What does this crypto mean and how can it hold its value and what’s the value and all that. I still think there’s challenges there, but I think the guy at retail who just got paid for whatever work he did for the week or the day, I just think it’s a real challenge to figure out how to get him or her in a situation to be sending this way.

Figure 2

Intermex’s quarterly performance

Intermex’s retail partners

Daniel Webber: We’ve talked plenty before about the uniqueness of how you look after your retail partners. Is there anything particularly new to talk about there?

Robert Lisy:

There are a couple of things that are going to make us better and I think it’s going to help our capturing of our market share with individual retailers. We’re rolling out new software, upgraded, similar to what we have, but an upgraded version that we think people are going to think is even snazzier. Whenever they have an alternative to choose to use us or a competitor, they’re going to want to do it.

Along with that, we’re putting out new hardware – some of the hardware out there was ours and others is old stuff. I think people will look at that and go, oh great I want to go on the new machine with the new software. So I’m not looking at that or saying that’s a whirlwind, but it’s going to make an impact.

We continue to do those things because we want to make sure that at retail, we hold service on that differentiation between us and the competitors. I think that’s what we feel like that does. It keeps us with our software being better, and with the machine that they’re doing it on, we’re going to put out pieces of equipment that have increased processing and memory capabilities to what we have out there, but even what our competitors have out there.

So it’s going to be top of the line in every way, and we think that will be important for us. That’s going to be rolling out all throughout 2022.

Growing Intermex’s digital business

Daniel Webber: As your digital business is growing, are you seeing any changes or bifurcation where your digital customer is beginning to look different to your core cash-paying customers?

Robert Lisy:

The intent is that it’s a different customer because of the way we go about capturing them. Our intent is to capture a different customer because we’re not really today wanting to encroach upon our strong retail business or do anything to have our retailers be worried about us encroaching on that.

If we did go to our 4 million plus, distinct and unique customers that use this in the course of a year then it would be a different path to gathering customers.

When we go after a customer at digital, digital online, our process looks a lot more like Remitly trying to get a customer than anything different with us migrating a customer. Because we’re going through the normal path of social media to attract someone to our site who wants to send money.

However, we’ve seen a group of customers that have done both; there’s those that continue to do retail and digital. So it’s really contrary to those in digital who say, once you go digital, you never go back to retail. That’s one thing we’re not seeing.

We have more of our customers who do both that have gone back to retail and stop digital completely, than people who have gone to digital and moved on and don’t come back to retail. Those are some important things that we’ve noticed that seem to indicate for us, for our customer. Maybe not necessarily someone sending money to a different corridor, from a different originating country, but our customers to Guatemala, to Mexico, El Salvador, Honduras, our core customers – they’re migrating back and forth. And if they do go back to one or the other, they’re more likely to go back to retail than they are to go solely to digital.

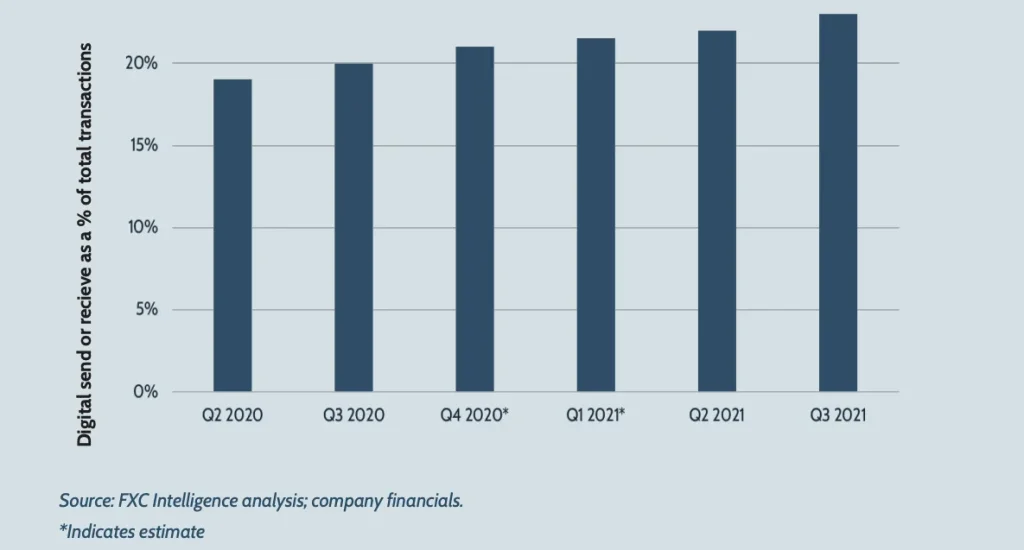

Figure 3

Intermex’s digital share

Intermex’s card products

Daniel Webber: Let’s move on to your card products. Where do they fit into your overall strategy?

Robert Lisy:

It is a new vertical. It’s a vertical that we believe is certainly digital. Cards are, I know they’re physical, but they’re also digital, they can be done online. And it facilitates consumers today with us that can’t do a wire online to be in a position to do that because now they have a card.

The provider that we have gives us the flexibility not to have a social security number, which is really valuable for us to get a consumer a card. And that’s really helpful for us to put the card in the hands of people, new and different. Most of the card people out there can’t do that.

We have two different cards, or at least they start out differently, and they may look different in the hand of the consumer. One of them is the card that we’re pretty far down the road with that we’ve assembled a sales team to sell, which we’re basically selling to people who create payroll. Could be a big farm. It could be a big factory that employs a lot of our consumers and we’re selling them on, Hey, you do paper checks, we know that because we see them cashed at our retailers and we can create this payroll mechanism for you with our card.

The other card is a GPR card, and that card is really one that will sell through our retail network and possibly augment it with other retailers. It starts out with a prepaid card, but you can convert that card to a re-loadable MasterCard, which will act the same way.

You could actually put your payroll on it, but it’s not starting and initiating as a payroll card. We think that one’s got sort of a broader appeal in some ways. The payroll card has got a very rightful shot approach because we know a lot of the companies that create a lot of checks for our consumers today and we’re calling on them to convert their payroll to our card. Now, in either case that consumer will then be able to go online and do a wire if they choose.

But there’s another phenomena that we don’t talk much about that most of our other competitors don’t have, or don’t have on a large scale. We take debit cards in retail for wires. We do it and we’ve been doing it for a while. We do it in all of our own company-owned stores. We do it in hundreds of other retailers and we’re rolling it out to more and more retailers because we recognize a lot of customers will be somewhat digitalized with a card, but they still like retail even with a card. It’s still like retail because for them it’s easier and faster to do and they’re there in retail anyway.

So that we think is also sort of a quasi digital product. Is it digital or not? If we qualified digital as not exchange of cash, then it seems like it would be digital. But it’s another option that the card gives us for our consumers to be able to send money both digital at retail and digital online.

Daniel Webber: Is it going to function as a pseudo bank account too, so it will be used to hold value?

Robert Lisy:

Of course, it’s a debit card. So it’s a bank account. It has value. You could keep money on it and it’s more secure, obviously. If you lose it, you can obviously get a new card and no one can get to your card unless they have the card and the pin.

So absolutely, a bank account is attached to it. You have to have that. And it’s attached whether it’s the payroll card or it’s the debit card, they’re both debit cards.

Daniel Webber: Bob, as ever a pleasure. Thank you. Be well and happy holidays.

Robert Lisy:

Thank you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.