In our latest Post-Earnings Call Series report, Intermex CEO, President and Chairman Bob Lisy talks about the company’s promising Q1 results and why retail will remain at the heart of the company’s growth strategy.

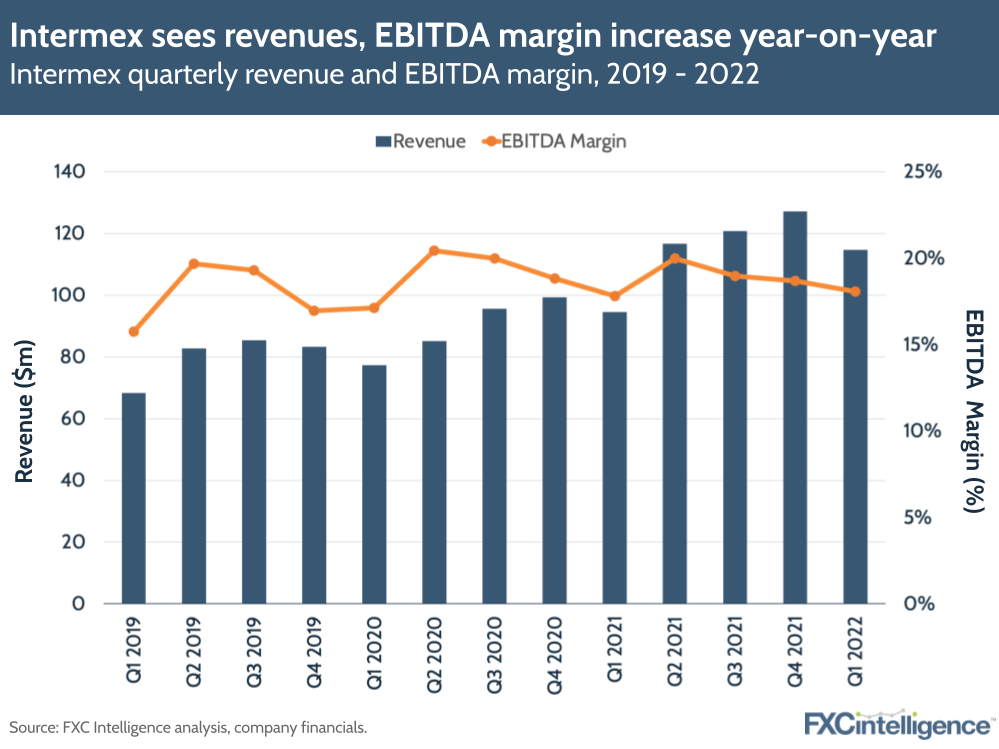

Latin America-focused remittances provider Intermex made good headway in Q1 2022, posting a 21.2% YoY revenue increase to $114.7m and adjusted EBITDA growth of 23% YoY to $20.7m.

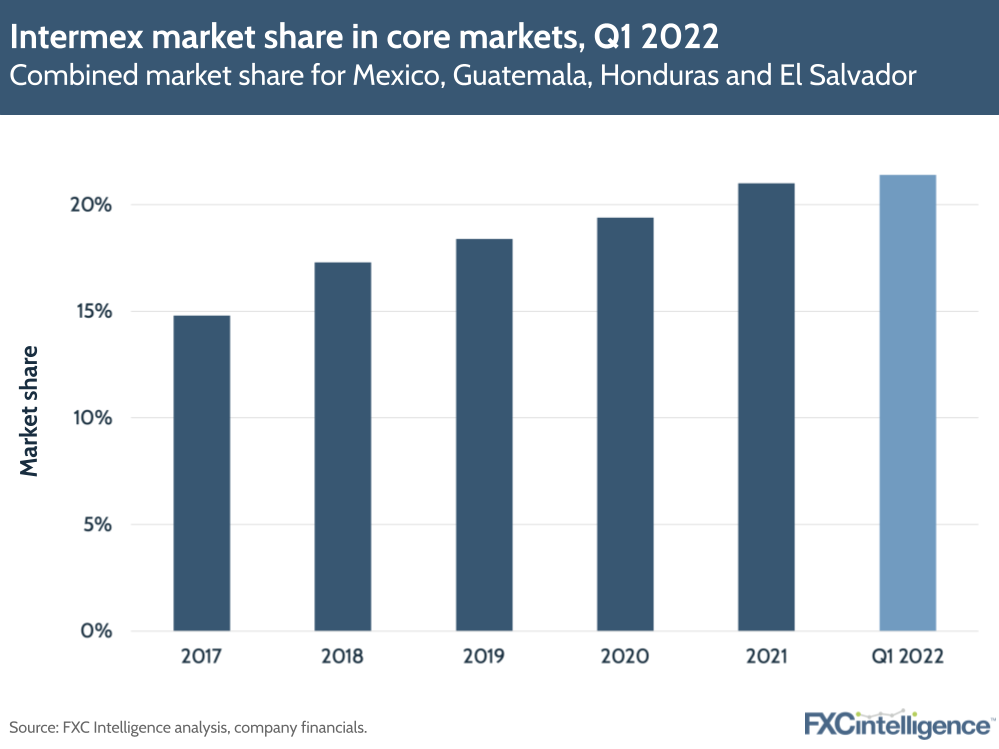

The money transfer company has grown its share in core markets – Mexico, Guatemala, Honduras and El Salvador – to 21.4%, while also seeing a 28.5% growth in transactions across emerging markets. Now, Intermex has set its sights further afield, with its recent acquisition of La Nacional expected to provide access to more corridors in Europe.

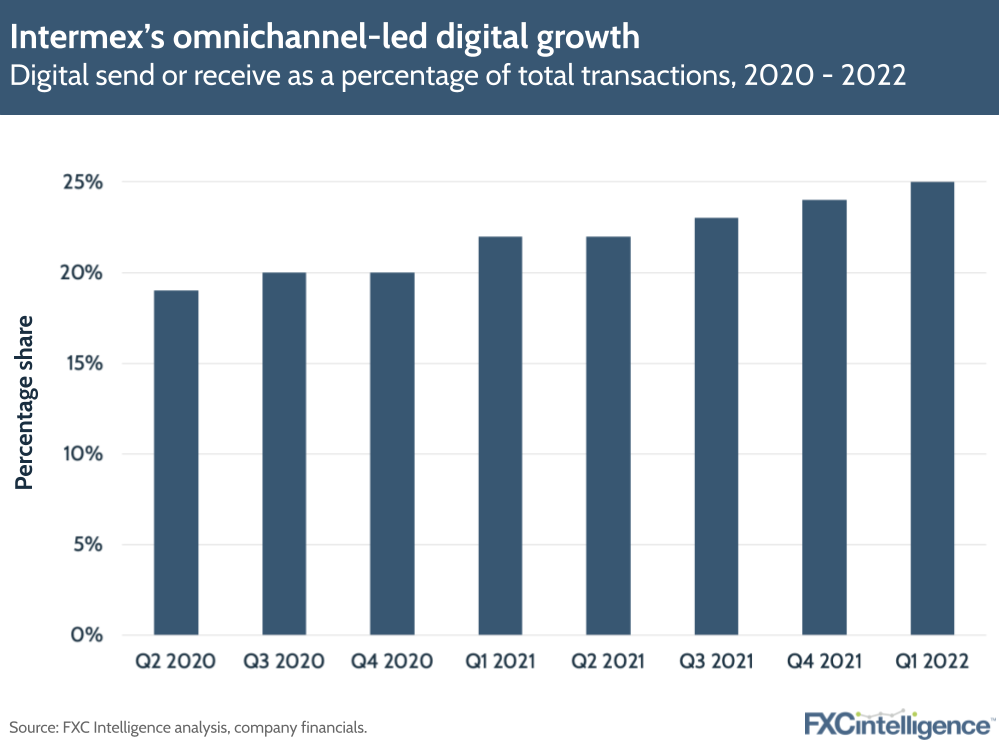

‘Omnichannel’ was a key term for the quarter. The rollout of the company’s new mobile app contributed to a 104.6% YoY increase in digital transactions. However, the company continues to advocate for retail, setting it apart from competitors that are increasingly prioritising digital transfers.

Daniel Webber spoke to Intermex CEO Bob Lisy to gain more insight into key growth drivers for Q1 and delve into its plans moving forward.

Intermex’s key growth drivers for Q1 2022

Daniel Webber: Well done again, you are outperforming the sector. What is Intermex doing to perform better than other remittance companies?

Bob Lisy:

[In remittances], there are probably some other private companies that are growing. They’re discounters, so they’re not showing the same bottom line results that we do.

The marketplace has been misled by the fact that Western Union, MoneyGram and now even Euronet’s Ria division have grown revenues, but their EBITDA performance has been really bad over the last several quarters. It’s bad for us too, because it leads people to think that the retail side is dissipating quicker than it is. It’s not really even dissipating.

In 2013, about $47bn was sent to Latin America and the Caribbean. Trying to be as fair as we could, we said that probably about 10% of the money back in 2013 was sent on a digital basis, which would mean there was about $42bn coming from retail.

Fast forward to 2021, when $104bn was sent to Latin America and the Caribbean, our payers thought about 20% of the send was digital. So retail went from somewhere around $42bn in 2013 to about $83bn in 2021. We think that year-over-year, there’s more money in absolute dollars being added to the retail stream of money than the digital stream. The percentage of digital continues to grow bigger and faster because it’s a small denominator compared to the retail business, but retail is still really vibrant.

One of the things that has differentiated us, particularly from Western Union and MoneyGram, is that they abandoned the retail side of the business far too early. They really didn’t understand it, and started to cast their lot in with digital. Now we’re even seeing Western Union saying that they have omnichannel. They’re trying to pull back and say, “we’re not completely out of retail”.

All the things that we’ve done consistently are [part of] the House of Brick, which is a stable business, that’s built on value-added customer service. Remitly said on their website during Mother’s Day Weekend “Expect customer service delays up to 30 minutes.” We pick up our customer service usually in four seconds, but I asked our chief operating officer “How bad will we be on Mother’s Day?” He said, “seven or eight seconds”. Seven or eight seconds versus 30 minutes. That’s a big difference.

So it’s about that value-add of high-quality customer service, the speed of our technology at retail, the banking relationships that cause retailers to stay with us and carefully chosen retail locations. It’s not the same as Euronet’s Ria division, which basically blankets the market with retailers and hopes that they do wires. It’s a very defensible House of Brick philosophy that doesn’t waste resources, doesn’t waste time and doesn’t waste energy. That’s sustained us well, and will continue to.

Figure 1

New and emerging markets for Intermex

Daniel Webber: What else do you see contributing to Intermex’s future growth?

Bob Lisy:

We’re growing, more than 20% in the Western states, but there’s still so much more to do there, particularly in the huge states like California and Texas. We’ll open up the door to the European Union when we close on the La Nacional deal and their subdivision of iTransfer, which will be doing business out of Spain, Italy, and Germany. We don’t think it’ll be difficult for us to spread anywhere in the European Union wherever we would like to be going outbound, which then opens up different corridors for us.

It probably opens up the online a lot more than it does in retail, because some of those countries – whether they are in the Indian subcontinent or the Philippines or Vietnam – are much more geared towards online than they are towards retail. We see a lot of opportunities and we just continue to execute.

While we had Western Union and MoneyGram basically subscribe to digital and cast aside their retail efforts, we stayed loyal to retail and took some heat. Now the chickens are coming home to roost. When you see a company like Remitly, which lost $10m in 2021 and is set to grow 35% this year and then lose $40m, you start to see the unit economics and customer acquisition costs related to online.

That doesn’t mean online’s not going to work and there’s not going to be a bigger share of wires going online, but nobody’s got it figured out exactly yet. We’ve never adopted someone else’s thoughts just because they sit in their office on Wall Street. We said, “No, that’s not right. You guys have the wrong conception, you have the wrong understanding. Here’s why it works. And here’s why we continue to grow.” Being true to the truth is what’s really helped buoy us and help us grow.

Figure 2

The importance of omnichannel customers

Daniel Webber: In its Q1 earnings call, Western Union said that its omnichannel customers were worth twice as much as its other customers. Who is the critical customer for you?

Bob Lisy:

Across the numbers that we’ve seen, a big share of the people that start either at retail or at digital cross over back and forth. The ones that end up just sticking with one, tend to stick more with retail. Particularly for Latin America, people will cross back and forth from online to retail.

You need to have both, because you’re really playing in only half the game if you only have one or the other. Right now, if you only have digital, you’re only playing probably 20% of the game in Latin America.

We want to be able to offer the consumer choice based on what’s convenient to them. We can take a debit card or cash at retail, or our retailers cash checks for our consumers (we don’t cash them, but they do) and then ultimately end up sending wires. On the payment side, we pay directly to bank accounts, over the counter or to mobile wallets, or we distribute money through ATMs.

One of the problems with digital is [some companies] really tried to force people into it, and that’s part of the reason the customer acquisition cost is so high. It’s not that hard (and it doesn’t cost as much) to get people to do something they really want to do. I could sell lots of ice cold bottles of water at a festival in Miami in August, but hot chocolate wouldn’t move so quickly there. So to get people to do something that is maybe not in their field, which is online, has been a challenge.

Omnichannel makes sense in that you can move freely between both and you’re not committed to trying to force the consumer to go online. You’re happy with the consumer making whatever choice they make, and then moving online, as the consumer’s ready to do that. By the way, this whole notion that online is so much more profitable is not true. Retail is so much more profitable.

Daniel Webber: How do you keep your agents happy as you move towards digital?

Bob Lisy:

They feel happy because we don’t encroach on them. We attract the consumer that wants to do digital by advertising to them through social media and other methods, but we don’t go and say, “here’s our four or five million active customers and we’re going to market digital to them,” for two reasons. One is, we wouldn’t want to upset our agent, but secondly we’re a lot more profitable if they do that wire in person at retail.

Our retailers know that we’re not trying to move their business to digital, but we’re going to have a digital option for those consumers. If they’re going to do digital, we want to be the company that they choose when they do it.

Figure 3

How Intermex is competing with cross-border challengers

Daniel Webber: How do you compete against some of the leading non-public players?

Bob Lisy:

If you look at the non-public companies, we’re very much a value-added, rifleshot agent. Viamericas has probably got more agents than us and does less than a third of the business, because they add retailers constantly and they’re not necessarily looking for quality retailers. Their model, although it’s not exactly like Ria, looks more like Ria than ours.

There’s really not anybody out there that follows our model, which is a very disciplined approach to making sure that we can make money at retail. We price ourselves in a way that, if we can make money, then we can provide quality services. That’s how we can make sure that our customer service line picks up in four seconds and tech support in six seconds. That’s why we’ve got the best banking relationships and our compliance is really good, but it’s not an obstacle to processing good, solid, worthy transactions.

Who are the companies shaking things up in retail? Vigo by Western Union is a loss leader beyond loss leaders. They’ll add extra FX points when there’s not any more even needed, so they discount deeply and that causes disruption in the marketplace at times. Consumers and agents don’t value the quality of that service nearly as much as they value ours, but if they’re 10 or 15 centavos better in FX, it can be disruptive.

Second would be Viamericas, which is not at all concerned about the bottom line most of the time. There’s another company, Maxitransfer, that’s pretty aggressive, although they’ve gotten less aggressive since they’ve gotten private equity money. Then, you get into some of the long-standing players, like DolEx and Sigue, who are still competitive, but are not the really aggressive newer guys on the block. Those would be Viamericas, Maxitransfer, Intercambios and maybe one or two others.

These companies are going out there aggressively from a pricing perspective, not necessarily a service perspective, so they approach it differently than us. No matter how much better our quality is, when you start to get too big of a difference in the centavos, they can win some business from our retailers and our consumers because they say, “Hey, I know the quality isn’t there, but if they’re 12 centavos cheaper, I’ll go with them”.

The industry’s view of retail customers

Daniel Webber: Anything else you’d like to discuss today?

Bob Lisy:

You’re seeing a little bit of a shift in the market. Two to three years ago, I was thought of by many people as a dinosaur that just wasn’t seeing the world changing around him. Now, there’s been a little more openness when people start to see the absolute growth at retail and how it’s entrenched in the lives of the consumers, particularly in some of our core markets. The market is starting to catch up with what we’ve known to be the facts.

Again, I don’t want to undersell the value of the online business because we see that as a big part of our future. Right now, we’re in the process of recruiting a new head for our online side, so we’re continuing to invest in that, but it’s still a really small share of the business that we focus on and nobody’s gotten it quite right yet. The world’s starting to see that, such as in the way Remitly is coming back to the pack in terms of its stock price and the way it’s not really performed financially. So, this is a real state of flux.

Daniel Webber: Bob, thank you.

Bob Lisy:

Thank you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.