In our latest Post-Earnings Call Series report, Intermex CEO, president and chairman Bob Lisy shares his views on key drivers for the company’s strong Q4 and FY 21 results and its future digital strategy.

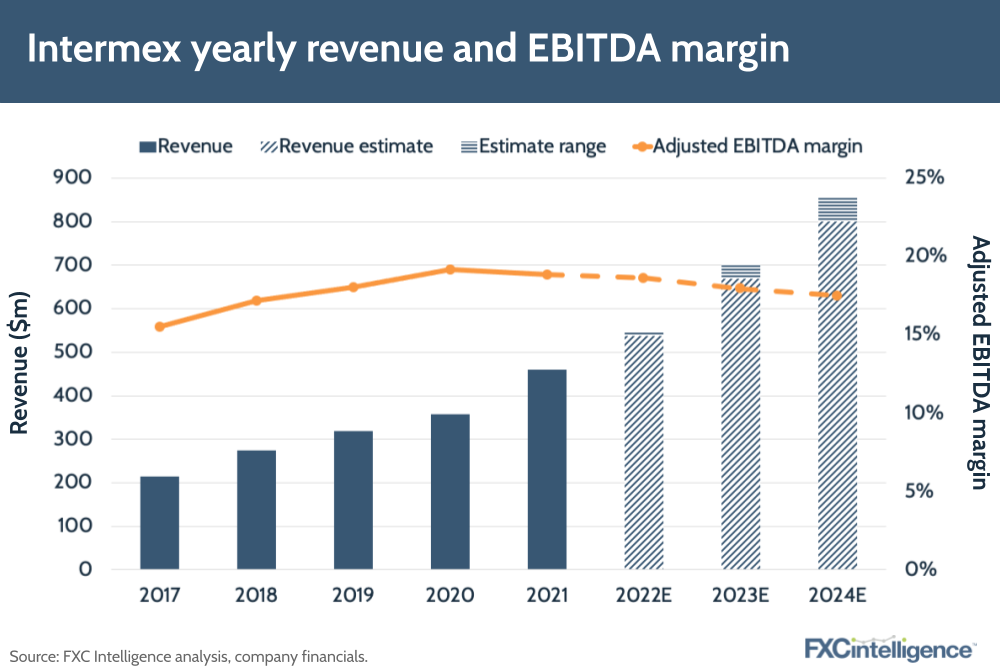

Money transfer provider Intermex reported an impressive set of FY 2021 results with Q4 seeing a year-on-year revenue increase of 28% to $127m while its FY revenue grew 29% YoY to $459m.

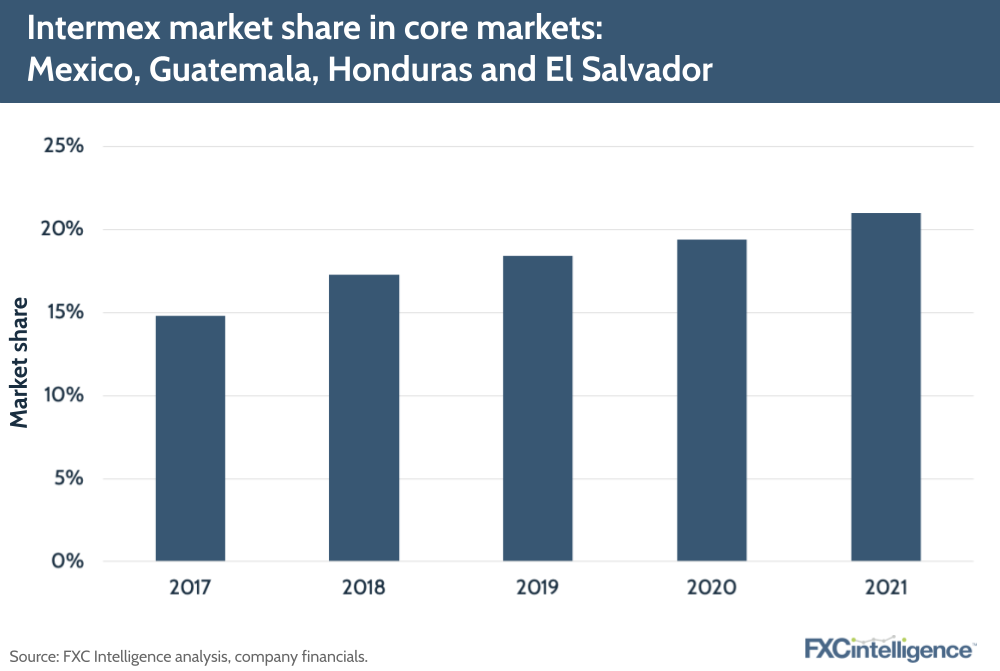

The retail-led remittances player, which focuses on payments from the US to Latin America and the Caribbean, saw its market share in its core markets grow to 21%, while in Q4 it also saw a 32% increase across its emerging markets business.

At its Investor Day conference on 7 March, Intermex presented its ambitious three-year growth plan, which includes growing revenue to $800m – $855m and adjusted EBITDA to $140m – $150m in FY 2024. It plans to achieve this by furthering its omnichannel focus, including through additional development of its app, as well as adding strategically located agents and furthering its international expansion in Canada and Africa. It also intends to boost operational efficiency and roll out additional value-added services.

Daniel Webber spoke to Intermex CEO Bob Lisy, with additional input from CFO Andras Bende, to gain more insight into what’s driving Intermex’s success and how it plans to outperform its competitors in years to come.

Intermex’s key growth drivers in FY 2021

Daniel Webber: You’ve had a strong year and a record Q4. Talk us through what’s behind those numbers.

Bob Lisy:

It’s a combination of a really strong market and the fact that retail is growing faster than people think it is. It’s not shrinking, it’s growing. And we’re better at retail than anybody else.

When you track the growth, this notion that retail is a melting ice cube is really inaccurate. In 2013, $47bn was sent to Latin America. Last year, $103bn was sent. That $56bn increase is not all in digital – most of it is in retail. Retail’s probably gone up to $80bn today from $47bn in 2013, so it continues to be much stronger than people think. People think it’s weaker because Western Union and MoneyGram have shrunk, but all the small guys are probably doing really well, and we’re doing exceedingly well. That’s one factor.

The second factor is that the market was even stronger than normal with higher principle amounts, which drives up the profitability per wire and the EBITDA. Even though we’re a big market shareholder currently, we continue to take market share because we’re continuing to grow faster than the market due to all of these factors – our execution in retail, high-production agents, a pricing model that is value-added and the way we go about things.

This industry thinks ubiquity’s everything. It thinks “it’s a commodity, you’ve got to be the cheapest”. We do the opposite of that in both cases. We get the best, most productive agents in the right places and we have a value-added service. As a result, our margins have had very little degradation over the last five years.

We’re also a rifle-shot adder of agents in the right places, and we’re combining that strategy with our superior technology, which is only going to get better. We’re rolling out new software right now that’s better than it’s ever been, and the best new hardware with it, which will give these retail agents the best memory and the highest processing speeds.

We’ve had strong numbers in all of our countries. We continue to take share with Mexico and Guatemala, Honduras and El Salvador. And we’ve had good growth in what we call our developing countries.

Figure 1

Growth drivers for the US-Mexico corridor

Daniel Webber: The US to Mexico corridor has been particularly strong over the last year – what’s driving this?

Bob Lisy:

There’s been very few times where it wasn’t a strong corridor. Part of the strength in the Mexico market is because there’s been a lot of work being done in a good economy. Also, all of these distributions of money to Americans has been really good for the Mexican worker because it means that less Americans feel compelled to work. There’s more work for Mexicans here. They might even look to work two or three jobs because there’s so many openings.

We look at the marketplace and everybody’s trying to hire, whether it’s people in our warehouse that are loading up supplies to ship out to agents or it’s at the highest levels in the company. The job market is basically a seller’s market: if you’re selling your services, you’re in a better spot.

There’s also a bigger disparity between the economy in Mexico today and the economy in the US. Covid-19 is much more in control here and it has lingered in some other countries.

But there’s been very few times where the Mexican market hasn’t been strong. When you look at all of Latin America, from 2013 to 2021 the market more than doubled in size. That’s a nine-year period, so you had to have compounded growth of 7-8% a year in the total market of funds being sent. There’s some up years and down years, but there’s a misconception that the market is slowing and an even bigger misconception that the retail market is slowing.

For instance, that $103bn, we think (from talking to our payers) at most 20% of that is what we would call online digital. That means $83bn is still at retail. In 2013, there was only $47bn total. Now, there’s $83bn probably just in retail. So we think that it’s just been a really vibrant market.

International expansion challenges

Daniel Webber: What’s different about your approach to your emerging markets, such as Canada or Africa?

Bob Lisy:

I wouldn’t get too hung up on Canada outbound or African inbound. They’re a tiny fraction of our business. Our business is still driven by Latin America. Mexico’s a $50bn market now, while every country in Africa combined is not even close to that. Canada’s not even close to that, despite sending to every country it sends to. So if you’re in the US and you’re not dominant in Mexico and Guatemala, you’re never going to have a successful business.

Canada’s a very challenging market. There’s a lot of regulations that have gone in that affected us and had an even bigger impact on people from places like the UK and Italy that are really dependent upon money going to Africa, because it’s kind of their Mexico. But those are not big pieces of the business for us. They’re always going to be add-ons and you want to service more countries if you can do it profitably. Our business is going to be driven by Latin America, which is driven by Mexico and Guatemala because of the size and margins of those markets.

Figure 2

Intermex’s operational competitiveness

Daniel Webber: You’ve talked about core growth operation efficiencies at your Investor Day. What makes you better than your competitors on the operational side?

Bob Lisy:

Nobody really spends the time in any business on these things anymore. It’s a lost art. People are shuffling around and trying to please Wall Street with growth numbers and a lot of hype. We really look at everything we do from a unit economics perspective.

Online businesses have convinced Wall Street that by disintermediating the agent, you can make more money. But at the end of the day, these prices they’re charging are sometimes as low as $4.99 at the top line. We make $4.28 at the gross margin line after we pay the agent and the retailer. So it’s all about those business efficiencies and the way we look at everything from a unit economics perspective. We look at a return on investment in everything we do.

I guarantee it’s not the case with the Remitlys of the world. Even when you get past that really difficult customer acquisition cost, if they’re going to continue with these discounted prices and you have processing that can cost you $4 to $5 on the credit or debit card, all blended, with fraud costs that can be a buck-and-a-half per wire, you’re just not going to make any money. And that’s the challenge.

For a company like Ria, there’s a lot of waste. They’ve got agents – and agents not producing – all over the place. They’ve got CapEx and bank accounts in all those places. I’ll bet you that Euronet has three times as many retailers in the US as we do. And we probably do a little less business than they do, far more to Latin America, but they’ve got other quarters. They might be a little bigger in the US than us, but they’re so inefficient because they are like the big guys: very much a shotgun approach versus a rifle-shot approach to the best retailers.

With us, pricing is not only down to the agent level, but down to the agent level related to each payer, so our margins are protected. We see companies like Western Union with their Vigo product that has ridiculous FXs at retail. So everything we do has real financial thought put into it because we want to give a high rate of return to the company and shareholders.

Daniel Webber: Which parts of your unit economics are much stronger than the competitors?

Bob Lisy:

We get a better fee, but in addition to that, remember what they’ve talked about forever is disintermediating the agent. The cost of processing the wire with either a credit card or debit card replaces the agent fee – it costs just as much. So they start out with less revenue, now they’re going to charge just as much as the agent fee to process it.

With agent theft (or bad debt), it costs us about 4 cents in retail, per transaction. Online for what is considered fraud, it’s about $1.50. So now you’re even-Steven in terms of the cost, the agent versus processing, but it costs you about $1.46 more for fraud online than it does for bad debted retail. And you’ve got a lower fee.

Let’s say that Remitly’s revenue share of the principal is 2%. (I don’t think it’s 2% in a lot of cases. It could be in some, in some it could be higher.) For a $400 payment, that’s an $8 fee. It costs you about $5 on average to process that wire. So you’re down to $3, you have $1.50 in bad debt (in fraud), so you’re down to a buck and a half. And now,you’ve got to pay the payer about two and a quarter, so you’re -75 cents at the gross margin line.

Now in ours, we’ve got $13 in revenue. We pay the agent $5, we pay the payer $2. So that’s $6 and we’ve got $4. You want to take the bad debt in there, we’ve got 4 cents, so we’re at about more than $5 in gross margin with a Mexico wire. So there’s your difference.

We see a blend of countries like El Salvador, which have very low gross margins, relatively speaking, because it’s dollarized. Or Honduras with a strictly regulated local currency so that there’s no exchange. But when you put all that together, our average gross margin is $4.23. I would say Remitly’s average gross margin is close to negative or zero.

It’s hard to make that up when it costs you $80 to get the customer in, when it costs us very little. We get a payback in retail. It costs us about $2,500 to get a new retailer. That retailer typically produces enough wires for us to get a payback in about six months. So, it’s hard to get a payback when you don’t make any money on that consumer online, no matter how little it costs you to get it. But then on top of it, it cost you $80 to get that customer.

It’s a bad model, but they convinced Wall Street, “We’re going to disintermediate that agent, and we’ve got this technology.” But sometimes technology’s a bad thing, right? If I wanted to get to downtown Miami from here, eight miles away, a Concorde is technological, but it wouldn’t be the best way. I’d be better off on a bicycle. Sometimes, the old blimp is the good blimp.

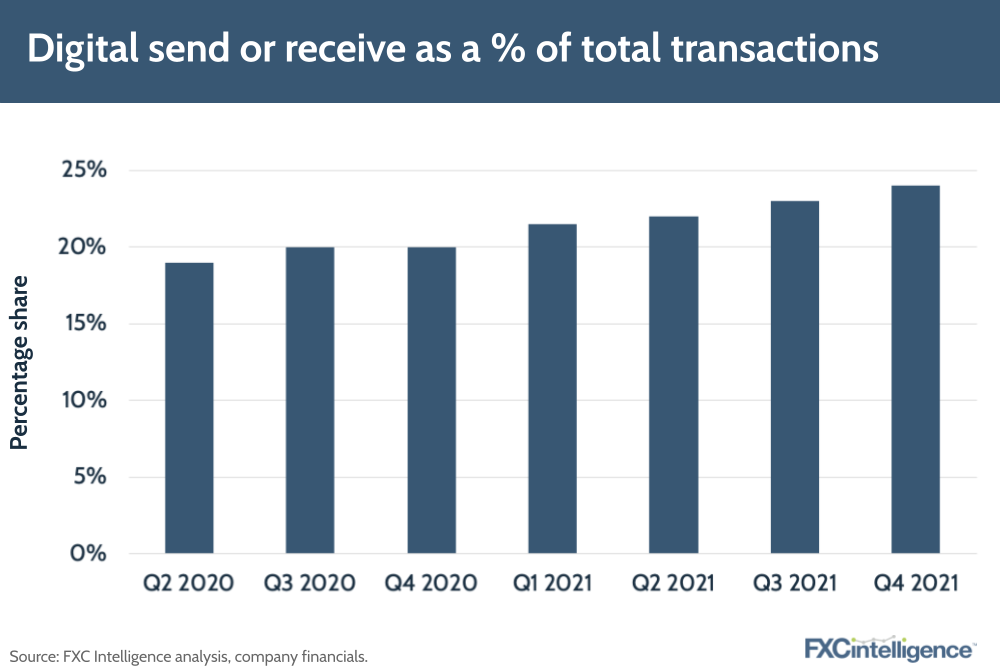

Figure 3

Building relationships with banks

Daniel Webber: Talk us through your treasury function and liquidity in comparison to other players from a unit economics perspective.

Bob Lisy:

For us to bank a wire costs us about 60 cents. You’d have to compare it against the retail guys. We have great technology that allows you to process cheques so we can use them as a method of payment. We don’t accept cheques for a wire, but if you owe us $10,000 today and you have $8,000 in cheques, you can process those and then give us $2,000 in cash to deposit in the account.

That processing brings our costs way down, because it’s really inexpensive for us to take cheques as a method of payment. So we have better banking relationships with more banks versus other companies that are at retail.

Andras Bende:

I’d also say that the growth in volume that we’re able to provide the banks, just by having success out there, makes us a very attractive partner, even in those banks that typically don’t deal with money service businesses. So that’s something we can lean into when we’re doing fee negotiations.

Daniel Webber: I’m assuming the cost to buy pesos for you is in the small number of basis points, given the flow that you have?

Andras Bende:

Sure. And across the $17bn worth of transactions that we do, we can also move where we’re buying that FX around to a lot of different partners too. That’s very attractive because that’s free money for them. It’s easy for them to exchange pesos and garner the spread.

We use that very strategically in terms of other fees that you may be incurring with the bank. It allows us to say, “look, we can move a couple billion more of volume over your way, but you’ve got to keep your bank fees in line.” So those are the types of negotiations we can have as a growing business.

Launching new products

Daniel Webber: A lot of remittance players are thinking about adding or have already added new products. What new products or services are you offering for your customers?

Bob Lisy:

There’s two different card products. One is the payroll card that we think is going to be really useful: not only for putting people into bank status who aren’t currently, but also, those same people would be able to transition to online if they choose to, because now they’ll be banked. Not being banked is the biggest obstacle for most immigrants from Latin America.

With the payroll card, we’re going to employers, farms, processing plants – all the places where people are getting cheques today – and offering them a service where they can do their payroll on one of our cards. That gives us a very easy entry to those consumers to then use our online product if they choose.

The second one is a general-purpose card which is sold at retail. It begins like a prepaid card, but then we send you a card in the mail with your name on it that can also be used to get a download of your payroll if you choose, but can be loaded up for retail. So it’s a multipurpose card. We haven’t put out the GPR card yet, that’ll go out through our retail network.

We’re already selling the payroll card and we have a number of employers already signed up and thousands of consumers that are on it. It’s still in early stages and we’re still building out that sales force, but we think both of those are going to be really good products for us as we go forward.

Plans for future growth

Daniel Webber: Looking at your 2021-2024 three-year growth plans that you presented to investors, it’s about evening out east and west for the distribution, and making digital about 10% of the pie. Are you assuming that your margins will be the same in three years time, but they’ll be very slightly lower from an EBITDA side?

Andras Bende:

On the margins, we dialled back from where we finished the year, as we were a little under 19% for the year. Over time, as more of that digital share comes through, that’s going to put a little pressure on the margins. They’re also, from a business development standpoint, things that we know will give us a little bit of downward pressure, but we’ve always said that we’re comfortable in the 17% to 20% range.

We’re not unhappy with that, but we’ll have to look at how the digital margins evolve over time. As we said to investors, the majority of that growth there is organic. We do have some inorganic that’s baked into that as well. But, it’s good that we’ll be able to get a lot of the way with organic.

Regarding the East/West split, we’re going to look much more balanced at the end of 2024. Early last year we hired a bunch of staff that are focused on the west. We’ve got new leadership in California, which is a key state for us, and we’re going to have some new leadership coming in overall from a retail standpoint.

We’re going to use some different tactics than we have in the past for penetrating the west. We have much more of an appetite to open some of our own stores now in the west, for example. So that’s some of what’s going to be happening through 2024.

Acquiring new customers

Daniel Webber: Is it correct to say that you don’t see any need for giant customer acquisition spends?

Bob Lisy:

It’s not that we don’t see a need for it; we see it as destructive to the business. By “big customer acquisitions”, if you’re referring to paying Walmart to have the good graces of them providing really terrible service in bad locations for our consumers and make no money doing it, we’re not interested in that. These places are not where the business exists.

When I was working for Western Union, I discovered that chains like Ralph’s and others were not producing as many transactions in 100 stores as I would have in two or three of the right agents in the right neighborhoods in LA. The way that I turned around Western Union’s business in California – which didn’t last thankfully after I left – was that we went after it ZIP code by ZIP code. That’s where the business is.

The notion of ubiquity started with domestic transactions, and that’s why people went to big box stores and the like. They keep going after these almost from muscle memory when they’re not the right retailers for the retail outbound business that is now dominated by international.

With domestic, it’s an emergency-driven business, meaning that somebody has an emergency and we don’t really know where they’re going to need the money. Therefore we need to be everywhere. But the international business is predictable. I have this bodega next to the apartment building I live in where I go and pay my money. It’s not so much a matter of how many locations you have, but having the right locations accessible to the consumer.

If we were being a little bit tight-wad and not paying for those, you wouldn’t see the fact that our average retailer does 400 transactions a month. Whereas the guys that are buying these big box stores, their average transactions per month are closer to 100-150. So it’s much more productive to do what we do. It just takes a little bit more work, discipline and analysis, but it’s the way to actually conquer the market.

Intermex and cryptocurrency

Daniel Webber: What are your thoughts on crypto? Is it relevant for your business?

Bob Lisy:

Crypto has no effect on us at all. Let’s imagine one of our consumers that isn’t banked. They have to get banked so they can buy crypto. They buy it, and then it could have a big swing in value so they end up with a lot less or with a lot more, but it’s very volatile. When they are depending on paying the rent and buying the groceries, there’s just no reason. Why would anybody want crypto in this case?

Today, crypto only has value if you want to do things on the dark web and you don’t want your wife or husband to know, or if you’re speculating on it. But there really isn’t a lot of value in crypto that isn’t with a regular currency. What value is it really bringing? And our consumers are not banked. To be able to buy crypto, you’ve got to be banked.

Then you’ve got to buy something and now you’ve got to send it, but it’s not accepted everywhere there, so you have to make two or three additional turns of the money.

I can’t envision a time when the foreman at the orange factory, or the farm, or the grapefruit farm in Fresno, California is going to be standing at the gate handing out pieces of bitcoin instead of cheques. It just doesn’t make sense. It’s another piece of technology that all the smart people are chasing because they’re so damn smart. But they haven’t taken a minute to understand who the consumer is in this area and why it would be so inconvenient.

Not only inconvenient, but possibly even destructive. A good example is Odell Beckham Jr. He had a million-dollar bonus with the Rams and he took it in bitcoin. By the time he got paid, the bitcoin was worth $450,000. But he wanted to be cool because he’s in LA, and so he got bitcoin. So he got half the value.

With crypto, you stand in front of a board with all these formulas on it that nobody understands, including yourself. Get out into the real world and see what our consumer looks like in retail – the guy coming in dirty from painting a house, or dusty from building the deck, or covered in blood from chopping up chickens all day – and then come back and tell me if that person’s going to be on bitcoin anytime soon.

Daniel Webber: Anything else you’d like to share?

Bob Lisy:

This model, digital, has got to change. It’s got a future: it’s probably a fifth of the market today and it’s going to be a growing percentage of the market. I still think retail will be strong and continue to grow. Digital will grow stronger faster, but because the baseline is so much bigger in retail, it’s a long time before digital catches up, particularly in Latin America.

But for digital to make progress, you’ve got to make money on unit economics and find the customer more easily. Even in unit economics, it just doesn’t make sense for us with the way we do business, or anybody does in retail.

Everybody believes that it’s just a matter of volume, like Amazon. People keep talking about brick and mortar, but we have about as much brick and mortar as Airbnb does. We’re renting other people’s spaces to do our wires. There’s no fixed cost.

It’s not just about getting more volume in digital. Look at Remitly: they lost $10m this year. They say they’re going to grow at 34% and lose $40m next year, or 2021 versus 2022. So more volume means more loss. That’s a hint for everybody to say, “Wow, something’s wrong with unit economics here”.

Daniel Webber: Bob, thank you.

Bob Lisy:

Thank you. Good talking to you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.