Bank fees for international transfers can vary a lot across different markets, payment methods and providers. We look at how consumer banking fees differ around the world and how they’ve changed over the past year.

Sending money abroad often incurs extra fees and charges, which can vary dramatically depending on the corridor, payment method and provider. Quarterly-updated FXC data in a number of key global markets follows the fees that banks charge customers to send international transfers. With 2023 well underway, let’s have a look into how consumer banking fees differ around the world and how they’ve changed over the past year.

Suppose you’re in X country wanting to send $1,000 to the US*, what would the average fee of that transfer performed online or in-branch amount to? Which countries charge higher fees than others?

Based on data collected for key banks in each country, we have determined the average fee of an identical transfer performed both online and in-branch, as well as a total average fee. This allows us to create a comparative global index that demonstrates both how drastically the fees for an identical transfer vary from country to country, as well as the marked difference in fees between payment methods.

*For the US, a transfer of £1,000 to the UK was simulated. All fees have been converted from the local currency into USD.

How can FXC Intelligence’s pricing and market size data help my business?

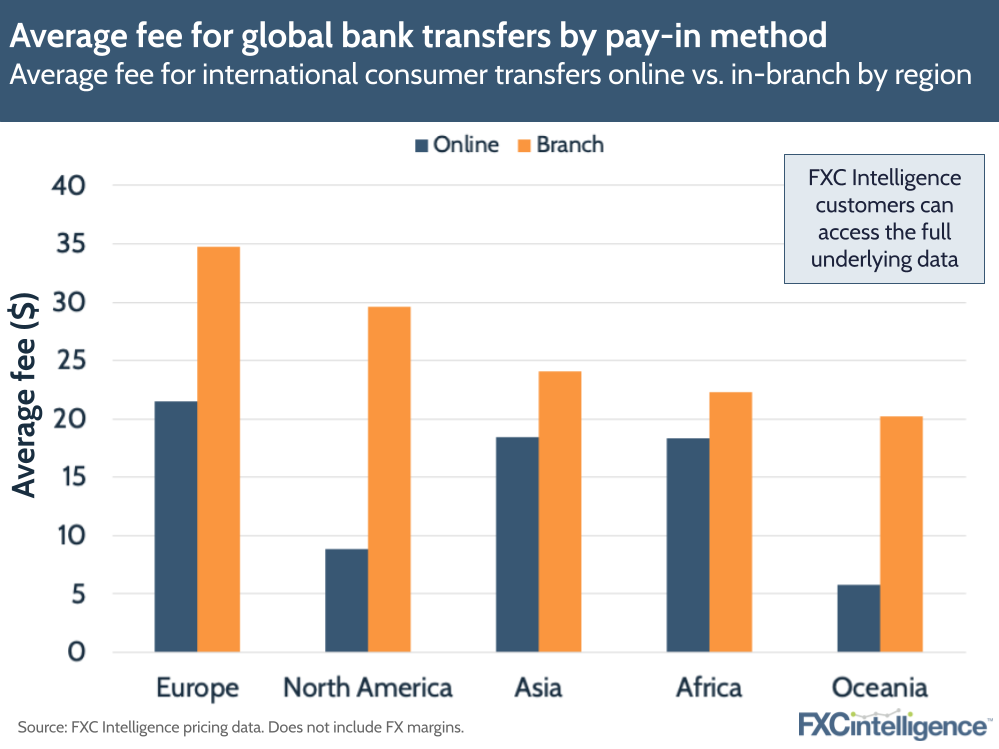

Average bank fees vary significantly by region

Using FXC data, we have mapped the total average fee for each market. These average fees have been split into five ranges, from $0 to $80. As shown, there is noticeable variation in the average fee for this simulated transfer.

Perhaps unsurprisingly, Russia emerged as the most expensive tracked market: the average fee for sending $1,000 to the US doubled during 2023 to $80, with banks in the country raising fees in response to the current severe economic restrictions. Furthermore, Russia’s total average fee was 70% more than the second most expensive market in our dataset, the Czech Republic.

At the other end of the scale, Malaysia, the UAE and India are among the markets that charge the lowest fees for international bank transfers, with the former two markets also charging lower fees compared to 2022 (a 34% reduction in the UAE). Other markets with low average fees – for example Canada, Australia and New Zealand – largely established this positioning thanks to their low online transfer fees, compared to the higher prices charged for traditional in-branch transfers.

Markets in the Asia-Pacific region saw relatively staggered average fees. However, fees in the region were generally more affordable than those offered by European banks; the Asia-Pacific regional average was $19, compared to $27 for European banks (excluding Russia).

A possible explanation for cheaper foreign transfer fees charged by banks in Asia-Pacific is the region’s lack of a common currency, compounded with large numbers of foreign workers in the region, meaning banks in Asia-Pacific would charge less for international transactions.

On a global scale, the median average transfer fee was $19; this is largely unchanged from a global average of $17 in 2022, despite increases and decreases in costs in certain markets.

Online fees are often notably lower than in-branch payment

Average fees by payment method provide further insight into current international transfer fees. Markets where clear data for both in-branch and online transfers was available demonstrate that online transfers primarily remain more affordable than traditional in-branch transfers. This reflects a ubiquitous push from banks to migrate services online where possible.

Although markets saw varying levels of fee differentiation between the two payment methods, in 40% of markets the average online fee was more than 50% lower than the average in-branch fee. Most dramatically, the average online fee in Canada was 90% lower than its in-branch counterpart. For numerous banks in certain markets, notably in the US, Australia and New Zealand, the fee for online international transfers was even waived entirely. In fact, the Philippines was the only market studied where the fee for the simulated transfer was higher when performed online compared to in-branch.